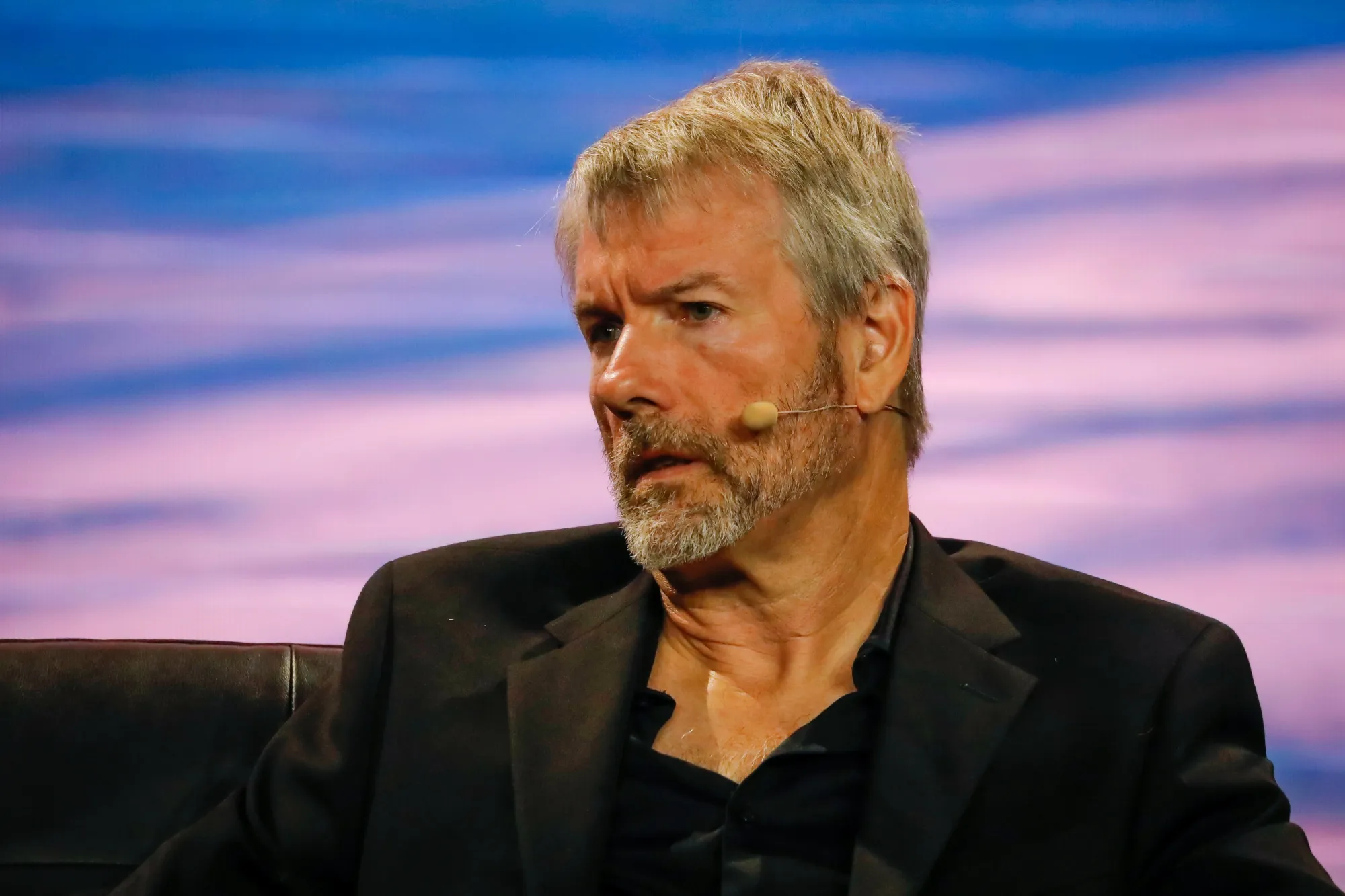

Michael Saylor’s early conviction in Bitcoin has evolved into one of the most remarkable personal investment stories in modern financial history. The MicroStrategy co-founder, who first revealed his personal Bitcoin holdings back in 2020, is now seeing his bet pay off in extraordinary fashion as the leading cryptocurrency hovers around the $110,000 mark.

In an X post dated October 28, 2020, Saylor disclosed that he owned 17,732 BTC, purchased at an average price of $9,882 per coin. At the time, Bitcoin was trading below $14,000, and many institutional investors were still skeptical about adopting digital assets. Saylor’s personal investment totaled roughly $175 million.

Today, at around $110,000 per BTC, that same stash is worth nearly $1.95 billion—representing a gain of more than 1,000% in just five years.

### From Skeptic to Bitcoin’s Loudest Advocate

Before his public embrace of Bitcoin, Saylor was known for running one of the largest business intelligence companies in the world. In the early 2010s, he was openly skeptical about cryptocurrencies. But by 2020, faced with the accelerating devaluation of fiat currencies and the rising appeal of digital scarcity, he began to reassess his stance.

His personal accumulation of Bitcoin preceded MicroStrategy’s historic move to convert a portion of its corporate treasury into BTC. Saylor informed the company’s board of his own holdings before the firm made its first purchase, ensuring full transparency.

This step marked the beginning of what would become one of the largest and most influential Bitcoin accumulation strategies ever executed by a public company.

### MicroStrategy’s Strategy Becomes a Blueprint

MicroStrategy’s entry into Bitcoin not only reshaped its own identity but also influenced broader corporate treasury policies across the tech and finance sectors. The company now holds 640,808 BTC, valued at nearly $70.6 billion based on current market prices.

Saylor’s steadfast advocacy and consistent accumulation have positioned MicroStrategy as a de facto Bitcoin proxy stock. Shares of the company have closely mirrored Bitcoin’s performance, often serving as a leveraged play for institutional investors seeking exposure to the crypto market without directly purchasing BTC.

Despite periods of volatility and market downturns, Saylor has maintained his long-term thesis: that Bitcoin is a superior form of money designed to outlast inflationary pressures, currency debasement, and political uncertainty. His frequent appearances on financial media and social platforms have made him one of the most visible ambassadors of the Bitcoin movement.

### Bitcoin Consolidates Above $110K

Recent data from TradingView shows Bitcoin continuing to hold above the $110,000 level, with moderate volatility but consistent support near the six-figure zone. After a strong performance throughout the year, BTC has shown resilience even amid tightening monetary conditions and shifting macroeconomic signals.

The current trend highlights investor confidence returning to the market as expectations build around the next wave of institutional inflows, fueled by ETF approvals, sovereign fund interest, and renewed adoption from major payment networks.

At this price, Saylor’s personal holdings alone account for nearly $2 billion, and MicroStrategy’s total BTC position is among the most valuable single-asset corporate treasuries in the world. Together, they represent a combined exposure exceeding $26 billion to Bitcoin—a figure unmatched by any other institution.

### A Long-Term Vision Still Unfolding

Five years after Saylor’s disclosure, his conviction remains unchanged. He continues to advocate for dollar-cost averaging into Bitcoin and has often referred to the asset as “digital energy” or “digital property.”

While skeptics continue to question Bitcoin’s volatility and long-term scalability, Saylor’s persistence has solidified his status as one of the asset’s most influential champions.

As Bitcoin flirts with new highs, both Saylor’s personal fortune and MicroStrategy’s market valuation remain tightly bound to the cryptocurrency’s performance. With growing institutional interest and an increasingly mature digital asset market, his early faith in Bitcoin appears far from misplaced, and the story of his 17,732 BTC purchase has become part of crypto legend.

—

**Author:** Reporter at Coindoo

Alex is an experienced financial journalist and cryptocurrency enthusiast. With over 8 years of experience covering the crypto, blockchain, and fintech industries, he is well-versed in the complex and ever-evolving world of digital assets. His insightful and thought-provoking articles provide readers with a clear picture of the latest developments and trends in the market. His approach allows him to break down complex ideas into accessible and in-depth content. Follow his publications to stay up to date with the most important trends and topics.

https://coindoo.com/heres-how-much-bitcoin-michael-saylor-still-holds-in-2025/

Be First to Comment