The post BitMine Increases Ethereum Holdings Amid Market Volatility appeared com. Key Points: BitMine expands Ethereum holdings by 34% during market downturn. Chairman Tom Lee sees Wall Street’s interest in blockchain building. CEO Chi Tsang aims to bridge Ethereum with capital markets. This acquisition, central to BitMine’s strategy, aims to bolster Ethereum’s role in institutional finance despite mixed market reactions and potential liquidation risks. BitMine’s 34% Ethereum Acquisition During Downturn BitMine, under the leadership of Tom Lee and new CEO Chi Tsang, recently increased its Ethereum holdings to position itself at the forefront of the financial industry’s interest in blockchain developments. With institutional backing and an ambitious target of owning 5% of the total Ethereum supply, BitMine aims to cement its influence in the market. This expansion comes during a period of volatility in the cryptocurrency market, where retail investors have seen significant fluctuations in ETH valuations. The company has acquired a total of 3. 5 million ETH, representing 2. 9% of the current circulating supply. This acquisition signals aggression in consolidating Ethereum, despite recent 13. 4% price declines. BitMine’s strategy mirrors past accumulation tactics seen in the crypto sphere, similar to MicroStrategy’s Bitcoin buildup. Tom Lee, Chairman, BitMine Immersion Technologies, “The recent dip in ETH prices presented an attractive opportunity and BitMine increased its ETH purchases this week. We are now more than halfway towards our initial pursuit of the ‘alchemy of 5%’ of ETH.” (source) Ethereum Market Performance and Institutional Interest Did you know? Ethereum has seen significant adoption in institutional finance, reflecting its growing importance in the blockchain ecosystem. Ethereum’s current market dynamics reveal fluctuating performance metrics. According to CoinMarketCap, Ethereum (ETH) is valued at $3,196. 09, holding a market cap of approximately $385. 76 billion and a market.

Tag: microstrategy

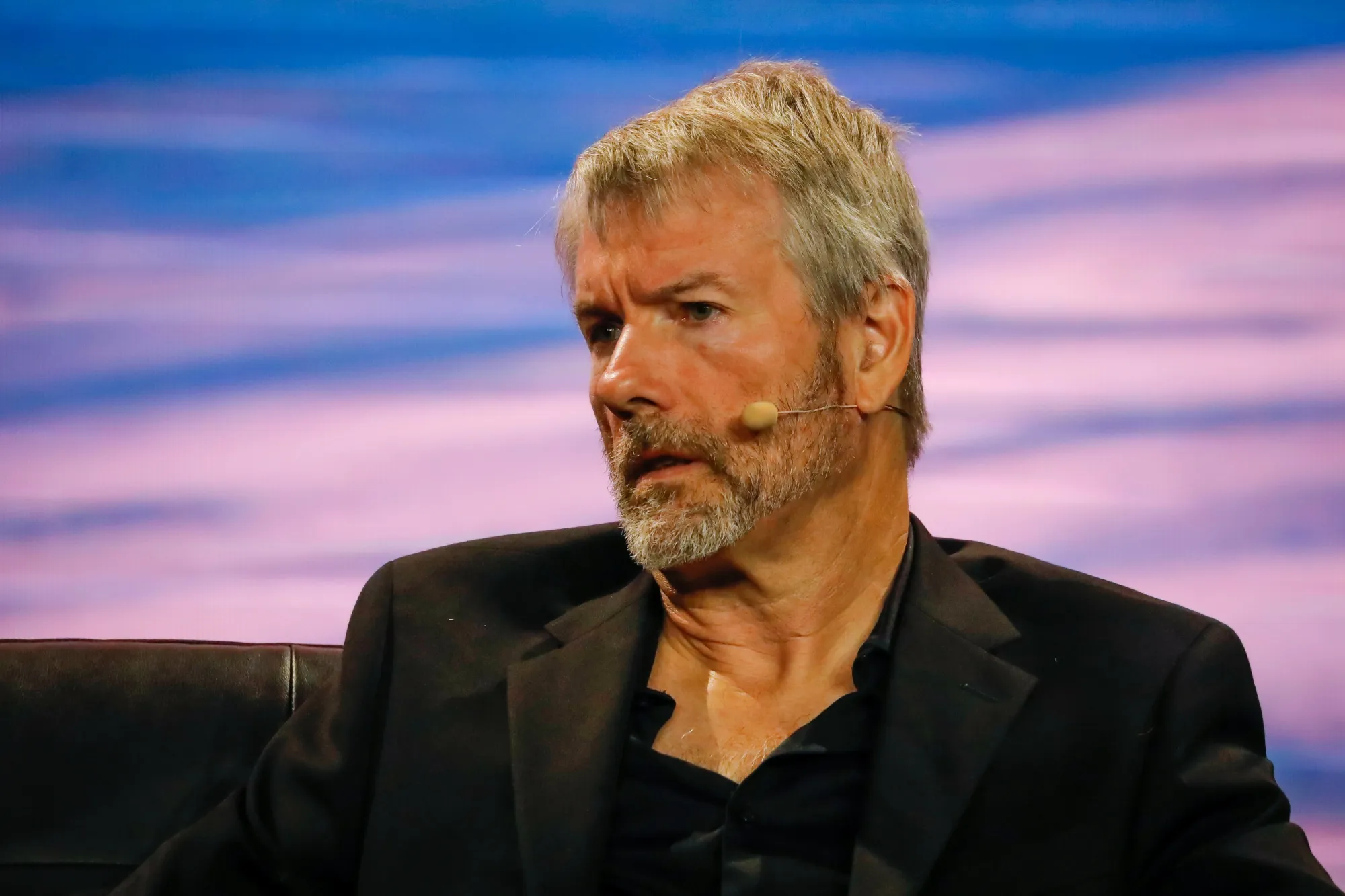

The post Strategy Founder Michael Saylor Says Bitcoin Will Overtake Gold by 2035! Here Are the Details appeared com. Michael Saylor, founder and chairman of Strategy, said in an interview that Bitcoin will replace gold in the financial world within the next decade. Michael Saylor: “Bitcoin Will Overtake Gold by 2035” “I have no doubt that Bitcoin will become a larger asset class than gold by 2035,” Saylor said. Saylor emphasized that he believes Bitcoin will become the reserve asset of the digital age in the long term, thanks to its limited supply, increasing global adoption, and interest from institutional investors. He also noted that central banks and large corporations around the world are inclined to include digital assets in their balance sheets, which will permanently increase the demand for Bitcoin. MicroStrategy has been known for its large-scale investments in Bitcoin since 2020. As of November 2025, the company holds over 214, 000 Bitcoins, with a total value of over $20 billion. Saylor has previously described Bitcoin as “digital gold” and argued that it is the strongest hedge against inflation. His new statement reflects growing institutional confidence in Bitcoin’s long-term potential. Experts say that if Saylor’s prediction comes true, Bitcoin’s market value could exceed $10 trillion. It is not investment advice. account now for exclusive news, analytics and on-chain data! Source:.

The MicroStrategy co-founder, who first revealed his personal Bitcoin holdings back in 2020, is now seeing his bet pay off [.] The post Here’s How Much Bitcoin Michael Saylor Still Holds in 2025 appeared first on Coindoo.