BNM’s tokenization roadmap aims to focus on real-world use cases such as SME supply chain financing, Shariah-compliant Islamic products, green finance and 24/7 cross-border payments. Bank Negara Malaysia (BNM), the country’s central bank, has unveiled a three-year roadmap to explore and test asset tokenization across the financial sector. Under the initiative, BNM will launch proof-of-concept (POC) projects and live pilots through its Digital Asset Innovation Hub (DAIH), established earlier this year, the central bank announced on Friday. A key part of this roadmap is the creation of an Asset Tokenization Industry Working Group (IWG), which will coordinate industry-wide exploration, share knowledge and identify regulatory and legal challenges. Read more.

Tag: cryptocurrencies

TLDR Robert Kiyosaki has warned that a massive global financial crash could wipe out millions of investors. The financial author urges people to protect their wealth by investing in gold, silver, Bitcoin, and Ethereum. Kiyosaki issued a similar warning in October after U. S. tariffs caused Bitcoin to plunge from $122,000. Bitcoin currently trades at $110,079 [.] The post Robert Kiyosaki Warns ‘Massive Crash’ Could Wipe Out Millions Soon appeared first on CoinCentral.

Banks may soon take a softer stance on crypto as the Basel Committee prepares to revise its 2022 guidance on banks’ exposure to digital assets, according to Bloomberg. Global banks may soon take a more favorable view of cryptocurrencies as the Basel Committee on Banking Supervision (BCBS) prepares to revise its landmark guidance on crypto exposure, according to a Bloomberg report published Friday. According to Bloomberg, citing sources familiar with the matter, the Basel Committee’s 2022 guidance on banks’ treatment of crypto will be updated next year to be more favorable. This follows the issuance of previous standards in 2022, with most banks interpreting them as a signal to avoid crypto altogether. Bloomberg’s sources claim the Basel Committee recently held talks about the appropriateness of the previous rules, which the United States, United Kingdom and the European Union have yet to fully implement. Read more.

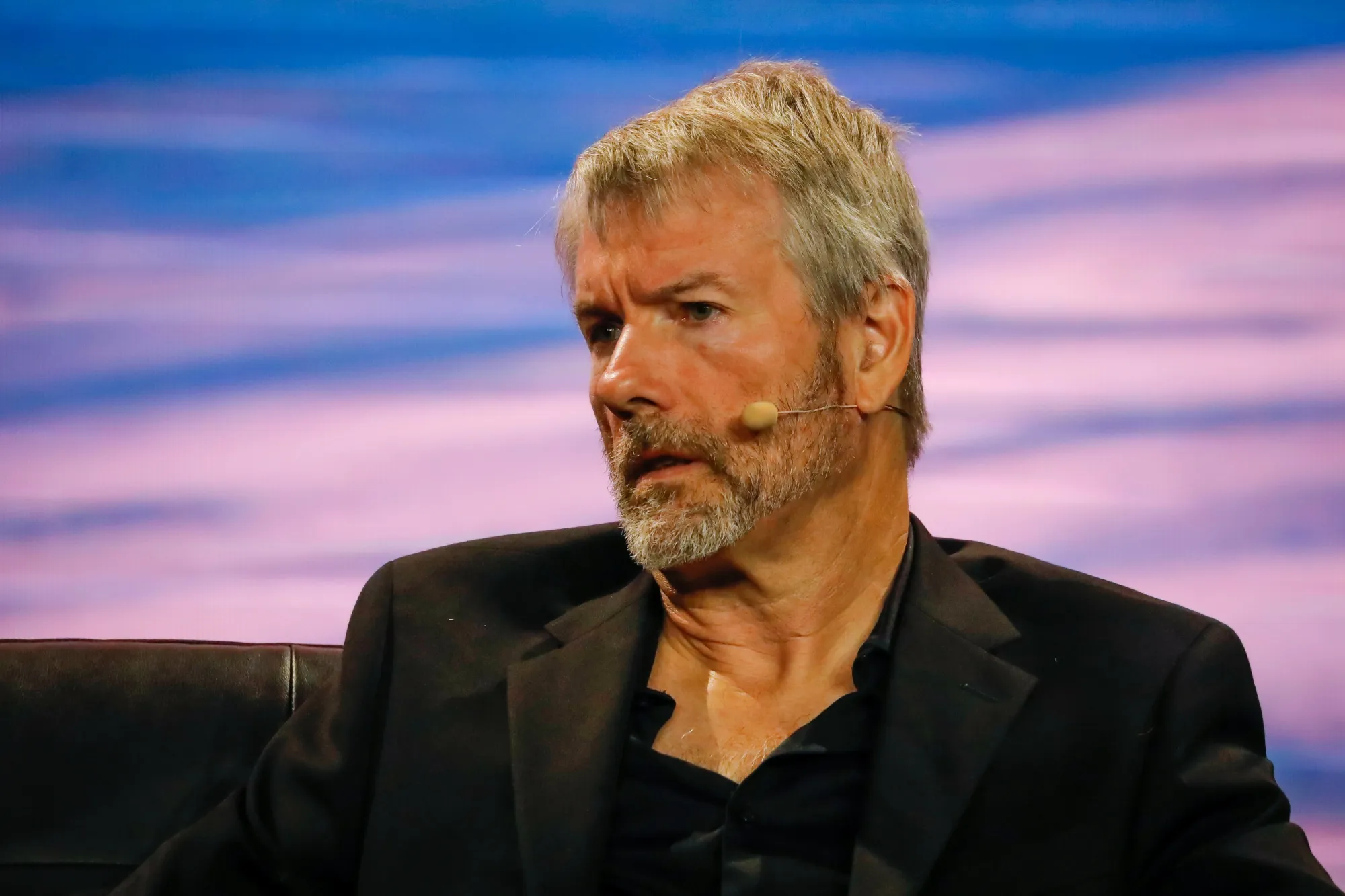

The MicroStrategy co-founder, who first revealed his personal Bitcoin holdings back in 2020, is now seeing his bet pay off [.] The post Here’s How Much Bitcoin Michael Saylor Still Holds in 2025 appeared first on Coindoo.

The latest upswing follows growing market enthusiasm after reports confirmed that Pi Network has joined the ISO 20022 group, aligning [.] The post Pi Coin Surges Over 30% as Bulls React to Major Network Milestone appeared first on Coindoo.

The post Trump Criticizes Fed Chair Powell Over Interest Rate Policy appeared com. Key Points: Trump criticizes Fed at APEC, jokes about Powell’s slow rate action. Possible future inflation, 4% growth for U. S., Trump says. Cryptocurrencies may react to potential Fed rate changes. On October 29, 2025, President Trump criticized Federal Reserve Chair Jerome Powell at the Asia-Pacific Economic Cooperation summit in South Korea, ridiculing the Fed’s interest rate policies. Trump’s remarks highlight ongoing tensions with the Fed, potentially influencing U. S. economic policies and affecting market confidence, particularly in interest-sensitive assets like cryptocurrencies. Trump Mocks Powell: Calls for Faster Rate Cuts President Trump, speaking at the Asia-Pacific Economic Cooperation summit, labeled Federal Reserve Chair Jerome Powell as “Jerome ‘Too Late’ Powell,” criticizing his handling of interest rate cuts. Trump’s comments drew laughter from the audience and indicated frustrations with the pace of monetary policy adjustments. Trump highlighted his insistence that the Federal Reserve keep interest rates low, notwithstanding inflation risks. He predicted that the U. S. economy will achieve 4% growth in early 2026, a rate significantly higher than the median economist forecasts. “Jerome ‘Too Late’ Powell” and ridiculing the Fed’s pace on interest rate cuts, reinforcing, “We will not let the Fed raise interest rates because they are worried about inflation three years from now.” Donald Trump, Former U. S. President Crypto Markets Watch Fed Moves on Rate Debate Did you know? In past instances, President Trump’s criticisms of the Federal Reserve have led to short-term market volatility and debates over the stability of the US dollar, indirectly fueling interest in cryptocurrencies as a store of value. Bitcoin (BTC) is currently priced at $113,069. 26, according to CoinMarketCap. The cryptocurrency has a market cap of 2. 25 trillion dollars, maintaining a market dominance of 59. 22%. With a max supply of 21 million and a circulating supply of 19. 94 million, BTC experienced a 0. 51% decrease in.

The post Trump Nominates Michael Selig as New CFTC Chair appeared first S. President Donald Trump has chosen Michael Selig as the chair of the Commodity Futures Trading Commission (CFTC), according to Bloomberg reports on Friday. This replaces his previous nominee, Brian Quintez, after pressure from Tyler and Cameron Winklevoss, founders of Gemini. Selig As the New CFTC Chair Selig currently serves as chief counsel for the.

Fintech Giant Robinhood Embraces Binance Coin (BNB) and Hyperliquid (HYPE)

The Sentinel Global founder has raised alarms about what he calls “central business digital currency” a new form of [.] The post Are Stablecoins Just Corporate Versions of CBDCs? appeared first on Coindoo.

BCH price drops to $467. 40 amid broader crypto selloff triggered by Bitcoin’s decline below key support and Fed’s unexpected rate cut resumption signaling economic concerns. (Read More).