The post Bitcoin Price Prediction for the End of 2025 Slightly Improves as Gold Sets Record, but It Is DeepSnitch AI the Crypto That Is Shining the Most appeared com. A few Bitcoin price predictions for the end of 2025 were rather bleak, seeing a recovery of the $90k mark as an optimistic scenario, and a spike towards $100k as very unlikely. But as the last full week of the year began, bullish winds seemed to be carrying the moment. Regardless of whether bulls or bears will prevail at the end of the year, DeepSnitch AI continues to capture investors’ attention. Its unique combination of AI tech with a massive market has catalysed its presale, with more than $875k already raised. Many consider it a far better investment than BTC or even gold for 2026. BTC recovers $90k as Gold sets new record What some Bitcoin price predictions projected to happen at the end of the year took place on December 22. Bitcoin recovered the $90k mark, which it had lost for more than a week. On that same day, the so-called “digital gold” saw its physical counterpart rise to a new all-time high above $4,400. As some analysts observed, capitals are still hedging macro uncertainty rather than leaning aggressively into risk, limiting enthusiasm for crypto. The trend is adding a fitting end to a year where gold has massively outperformed almost any other investment class. The next section presents a Bitcoin price forecast 2026, in comparison with DeepSnitch AI and a gold-pegged coin. DeepSnitch vs. BTC. vs. PAXG for 2026 DeepSnitch AI (DSNT) Bitcoin and gold’s appeal for financial markets has to do with their potential as hedging instruments against inflation, diversification assets, safe-haven mechanisms, etc. In simpler terms, they are purely investment instruments (even if gold has certain practical utilities). In contrast, DeepSnitch AI is an actual product with a concrete and practical utility. A system of AI agents that transforms crypto data into business intelligence. These agents.

Tag: bitcoin

The post Bitcoin’s Bearish 200-Day Trend Fuels Debate com. Bitcoin’s 200-day trend has shifted bearish, signaling potential end of the bull market, though analysts remain divided on whether a full downturn has begun. This key indicator, combined with a death cross in moving averages, points to increased volatility and possible declines through 2026, but short-term upside momentum offers some relief for bulls. Persistent trend shift: Bitcoin’s price has spent extended time below the 200-day trend, confirming bearish momentum. Volume spikes and above-average volatility highlight market uncertainty. Analysts predict 2026 as a decline year, with the 200-day moving average dipping below the 50-day in mid-November 2025. Discover how Bitcoin’s 200-day trend turning bearish impacts the bull market. Expert insights reveal mixed signals-explore key indicators and analyst views for informed crypto decisions today. What Does Bitcoin’s 200-Day Trend Turning Bearish Mean for the Market? Bitcoin’s 200-day trend turning bearish indicates a potential reversal from the ongoing bull phase, as this long-term technical indicator has shifted downward, suggesting weakened momentum and possible extended declines. Analysts use the 200-day trend to connect price points and assess overall strength, and its bearish turn, confirmed by factors like prolonged time below the line and heightened volatility, raises concerns about the sustainability of recent gains. While this doesn’t guarantee an immediate crash, it serves as a critical warning for investors monitoring long-term support levels. How Are Moving Averages Influencing Bitcoin’s Current Outlook? The 200-day moving average, which calculates the average price over the past 200 days, crossed below the 50-day moving average in mid-November 2025, forming a “death cross”-a widely recognized bearish signal in technical analysis. This event, tracked closely by traders, often precedes broader market corrections and is viewed as a shift toward bearish territory. According to data from market charts, Bitcoin’s price has shown persistent weakness since this crossover, with volume spikes indicating selling.

The post Bitcoin Price Soars, Crosses $90,000 LTH Still a Threat appeared com. Bitcoin is beginning to recover from its recent decline, crossing above $90,000 for the first time in a week as market conditions slowly improve. However, despite the renewed optimism, one key group of investors continues to fuel concerns around liquidity. This lingering pressure is preventing Bitcoin from reestablishing a fully stable upward trend. Sponsored Sponsored Bitcoin Holders Could Present A Threat Liquidity trends measured through realized profit and loss provide important insight into longer-term market health. The Long-Term Holder (LTH) Realized Profit/Loss Ratio remains above 100x, indicating that long-term holders are still realizing profits rather than losses. This suggests liquidity remains healthier than during major bottom formations or the stressed market conditions of Q1 2022. As long as LTHs continue to realize profits, Bitcoin retains a layer of structural support. However, the picture could shift quickly. If liquidity fades and the ratio compresses toward 10x or lower, the risk of entering a deeper bear market becomes difficult to dismiss. Historically, that threshold has aligned with moments of severe stress across long-term holders. Should LTHs begin realizing losses, it would signal a deterioration in market confidence and a potential reversal in price momentum. . Recent patterns reflect clear mean reversion, suggesting that volatility sellers are returning. Even so, implied volatility remains elevated relative to actual market performance. Sponsored Sponsored Glassnode data shows that one-month implied volatility has fallen-dropping roughly 20 vol points from last week’s peak and about 10 points from recent levels-indicating that some of the stress premium is now unwinding. The decline in implied volatility, combined with easing put skew, signals reduced demand for immediate downside protection.

Strategy is reassuring investors that its towering Bitcoin stash still dwarfs its debt-even as its stock price keeps falling faster than a hardware wallet dropped off a balcony. Michael Saylor’s company said its Bitcoin holdings would be worth nearly six.

The post Bitcoin Dead Cat Bounce: Analyst Reveals What To Expect As Price Recovers appeared com. Bitcoin’s (BTC) latest upward move arrives at a time when confidence in the market remains uncertain, with many traders unsure whether the slight price recovery marks early strength or another temporary bounce. With last week’s pullback still fresh, a crypto analyst argues that most traders may label the recent recovery a dead cat bounce. However, he believes the narrative is misleading and predicts that Bitcoin’s rebound this week may be setting the stage for a stronger rally. Why The Bitcoin Price Recovery Is Not A Dead Cat Bounce Market analyst and founder of The House of Crypto, Peter Anthony, has released a new technical analysis of Bitcoin that challenges the prevailing bearish sentiment among traders. In his post on X, Anthony stated that the repeated claims of a dead cat bounce are part of a recurring pattern that has appeared at multiple stages of previous Bitcoin price recoveries. He explained that market sentiments have swung so far into fear that many traders may have already locked in their worst losses just as the market began to recover. According to his analysis, last week’s BTC sell-off and price crash prompted many participants to exit their positions near the bottom. Now that the cryptocurrency is recovering, the analyst believes those same traders will hesitate to re-enter the market, convinced that the recent rebound is nothing more than a dead cat bounce. In his chart, Anthony highlighted several instances in the past when similar skepticism emerged after Bitcoin continued trending higher following a downturn. The analyst expects this pessimistic behavior to persist, stating that traders may continue labeling every upward push a dead cat bounce until BTC reaches $100,000 and beyond. This suggests that investors might interpret each step higher as a warning sign that the price rally is only temporary and bound.

The post Bitcoin Options Market Turns Bearish in Q4 as Whales Roll Positions Amid Heightened Volatility appeared com. Market observers say the Bitcoin options market was upbeat in Q3 about year-end highs, with the so‑called Q4 market or “holiday rally” terms circulating even as Bitcoin slid. However, the late‑summer pullback and the ongoing November softness have eroded that structure, leaving bearish sentiment as the prevailing consensus and undermining the case for a decisive late‑year rally. From the data lens, declines in realized volatility (RV), implied volatility (IV), and 25‑day Skew have not quelled fear. Medium‑ to long‑term option readings point to a continued bearish bias into year‑end and early next year, with whales pushing to roll positions as price swings intensify near monthly expirations. Analysts see a tentative short-term bottom forming, yet appetite for fresh downside has faded and price action is expected to oscillate. The near‑term outlook remains precarious, with persistent volatility expectations and elevated risk premia suggesting traders should stay cautious into the final trading weeks. Source:.

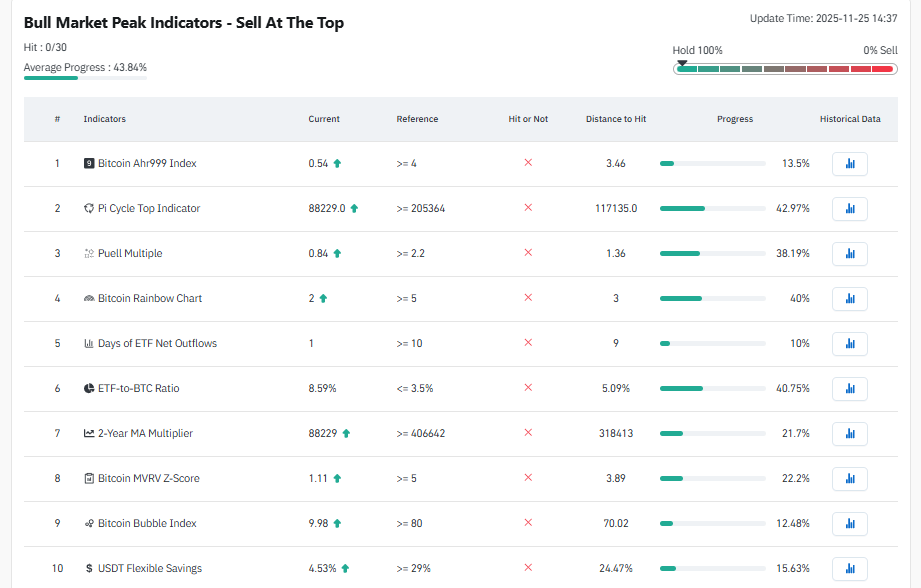

The post None of Bitcoin’s bull market peak indicators have been triggered yet, Coinglass appeared com. Bitcoin has yet to flash a single confirmed market-top warning signal even after dwindling down 30. 7% from its all-time high in early October, according to data from analytics platform Coinglass reviewed on Tuesday. None of the 30 monitored bull-market peak indicators have reached their activation thresholds, leaving the composite dashboard at “0/30” as of the latest update. At least 15 triggers are needed before Coinglass confirms the market has peaked. The absence of signals suggests the market has not entered the type of extreme euphoria, with an average progress level of 43. 84% toward peak conditions, far below danger territory. Price trend, supply, dominance indicators nearing activation Although none of the indicators have reached their thresholds, four of them are approaching critical levels. The closest among them is the Bitcoin Short-Term Holder Supply, which registered 29. 37% against a target of 30%, reaching 97. 9% of the level associated with prior tops. Bull market peak indicators chart. 09 million BTC recorded versus a bull-market peak threshold of 13. 5 million. Supply held by long-term investors mostly declines during topping phases as holders distribute into rising prices, and this metric reached 95. 82%, the second-highest reading on the dashboard. The third is Bitcoin Dominance, which rose to 58. 16%, several percentage points below the 65% reference level associated with past market peaks. The Bitcoin Trend Indicator printed 6. 14 against a required 7 with a progress of 87. 72%. At the other end of the scale, the Bitcoin AHR999 Top Escape Indicator sits at 5. 64, far above the ≤0. 45 level expected during overheated conditions. With just 7. 98% progress, it is the furthest from confirmation among all 30 metrics. The Bitcoin Ah999 Index, another valuation-based top detector, prints 0. 54 against a required ≥4 and a 13. 5% progress, suggesting the.

The post Bitcoin Surges 8% as Powell Eyes December Fed Rate Cut Push appeared com. Bitcoin surges 8% from $81K low as Fed rate cut odds jump to 67% for December meeting. Chair Powell may override divided Fed officials to push through 25 basis point rate reduction. With the market speculating a Fed rate cut in December, Bitcoin has rallied by more than 8% since it went down below $81, 000 on Friday. According to Barclays Research, there is disagreement among Fed officials about the future of monetary policy. Moreover, Chair Jerome Powell might signal another 25 basis point cut. Powell Could Tip the Scales Toward Rate Reduction It looks like, Federal officials are quite divided on the issue of monetary policy direction. It has been reported that governors Stephen Miran, Michelle Bowman, and Christopher Waller are in favor of loosening rates at the meeting in December. On the other hand, President of the St. Louis Fed, Alberto Musalem and President of the Kansas City Fed, Jeffrey Schmid are inclined to keep the current range of 3. 75-4% without any further changes. Vice Chair Michael Barr, Philip Jefferson, Austan Goolsbee of Chicago, and Susan Collins of Boston are all quite uncertain about the matter and are slightly inclined to suggest holding the rates at their current level. In the meantime, Lisa Cook and John Williams are waiting for the economic data to come in and seem to be agreeable to another rate cut if the situation requires it. The CME FedWatch tool is currently indicating a 67% chance of a rate cut in December, which is a significant reversal from the 33% probability that was estimated right after Fed Williams’ remarks. According to Nick Timiraos, a reporter for the Wall Street Journal, if there is a rate reduction, Powell will have to be very vocal about it and persuade the rest of the committee to go along with.

The post Bitcoin Price Today: BTC Price Reclaims Strength at $87K, but Bulls Must Overcome the $100K Block appeared com. Bitcoin is showing renewed strength this weekend as bulls attempt to reclaim momentum, pushing the price closer to key resistance levels that could trigger Bitcoin’s next major breakout. After briefly dipping earlier in the week, Bitcoin has stabilized above crucial demand zones, attracting fresh trader interest. Market sentiment is shifting as buyers eye a potential surge toward the highly anticipated $90K-$100K range. Weekend Momentum Accelerates, but Analysts Urge Caution Market commentator Ted (@TedPillows)-known for tracking Bitcoin liquidity flows and weekend volatility patterns-highlighted the recurring nature of weekend-driven rallies, noting that they often fade once institutional trading volume returns. “TC weekend pump is here. And we know what will happen next,” he wrote, suggesting that Bitcoin frequently loses momentum without strong weekday follow-through from institutional desks. Bitcoin’s weekend pump returns, but traders warn real momentum must show up on weekdays. Technical charts referenced by traders show consistent selling pressure around this region, which continues to serve as a major barrier to any attempt at a new Bitcoin all-time high. Some analysts attribute this behavior to thinner weekend order books. According to multiple order-flow tools used by traders, weekend depth can be 10-30% lower than weekday levels, magnifying both upward surges and sudden corrections. Critics refer to these conditions as “low-liquidity weekend traps”, though not all analysts agree on the reliability of this pattern. Large Sell Orders Emerge as Market Approaches Resistance In a separate update, Ted noted that significant sell-side liquidity has been forming between $88,000 and $91,000. “Some big sell orders are emerging. Bitcoin is trading $2,000 above the CME gap, which isn’t a good sign,”.

The post Bitcoin Cycle Peak Still Ahead, According to New Price Projection appeared com. Bitcoin Many investors looking at Bitcoin’s latest pullback are bracing for a dramatic washout. But one crypto analyst argues the opposite: the downturn might already be close to exhausting itself and the next leg higher could begin from a level far above where most bears expect. Key Takeaways: Bitcoin is expected to stabilize higher than many traders fear, with the likeliest floor projected between $70K and $80K. The pullback is viewed as a normal pause within a larger bullish cycle, not the start of a prolonged market collapse. Long-term conviction remains strong, with expectations of significantly higher valuations over the coming years. Instead of warning about a crash into the $50,000s or lower, the analyst believes the market is shaping up for a controlled reset inside the higher price ranges. In his view, the biggest cluster of probabilities sits not in disaster territory but in an area that would still keep Bitcoin deep inside bullish long-term structure. A Statistical Approach to Price Floors His model visualizes the current correction as a probability curve rather than an emotional forecast. The curve peaks around the $70, 000-$80, 000 band, which he identifies as the most realistic zone for Bitcoin to finalize its bottom. Everything below that begins to show smaller and smaller likelihoods. The analyst’s curve continues to taper: a dip to $60,000-$70, 000 sits in the slim-chance category; $50,000-$60,000 drifts into unlikely territory; and anything under $50,000 is labeled borderline impossible statistically speaking. Under that framework, $70, 000 becomes the practical definition of the worst case rather than the catastrophic depths many fear. The Long-Term Mindset Interestingly, his outlook doesn’t come from someone trying to time every fluctuation. He openly states he doesn’t chase short-term entries or exits and considers Bitcoin a multi-year growth story rather than a trading instrument. He said he.