The Arizona Cardinals enter Week 9 uncertain about the status of quarterback Kyler Murray, who was limited in practice for the second straight day, per ESPN’s Adam Schefter, ahead of Monday night’s matchup against the Dallas Cowboys at AT&T Stadium. Dealing with a toe and foot injury suffered in Week 5, Murray has missed the [.] The post Cardinals QB Kyler Murray limited in practice once again ahead of Cowboys game appeared first on ClutchPoints.

Category: business

That should be all the information you need to solve for the Results of writer’s carelessness, as revealed in slips crossword clue! Be sure to check more clues on our Crossword Answers. The post Results of writer’s carelessness, as revealed in slips Crossword Clue appeared first on Try Hard Guides.

Animal Crossing: New Horizons Nintendo Switch 2 Edition announced for January

Two-time NASCAR Cup Series champion Kyle Busch and his wife, Samantha, have filed a lawsuit against Pacific Life Insurance Company.

Teradyne surges after Q3, outlook beat estimates driven by AI-related demand

The latest upswing follows growing market enthusiasm after reports confirmed that Pi Network has joined the ISO 20022 group, aligning [.] The post Pi Coin Surges Over 30% as Bulls React to Major Network Milestone appeared first on Coindoo.

When AI malware meets DDoS: a new challenge for online resilience

Louisiana approved Meta’s $10 billion project in August, saying it would bring “hope” for economic growth, but some experts say the center’s power demands will raise customers’ power bills statewide.

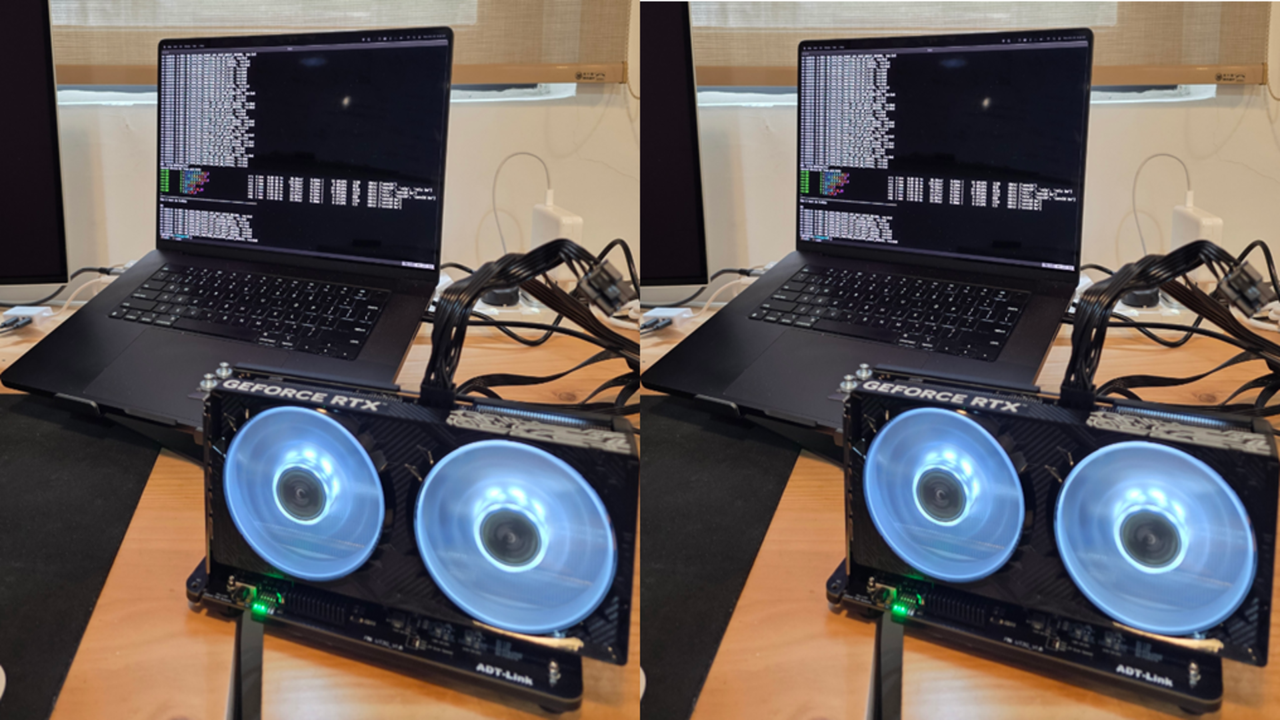

TinyCorp has achieved a remarkable breakthrough by enabling Nvidia GPUs to run on Apple’s M-series MacBooks using USB4 and Thunderbolt 4.