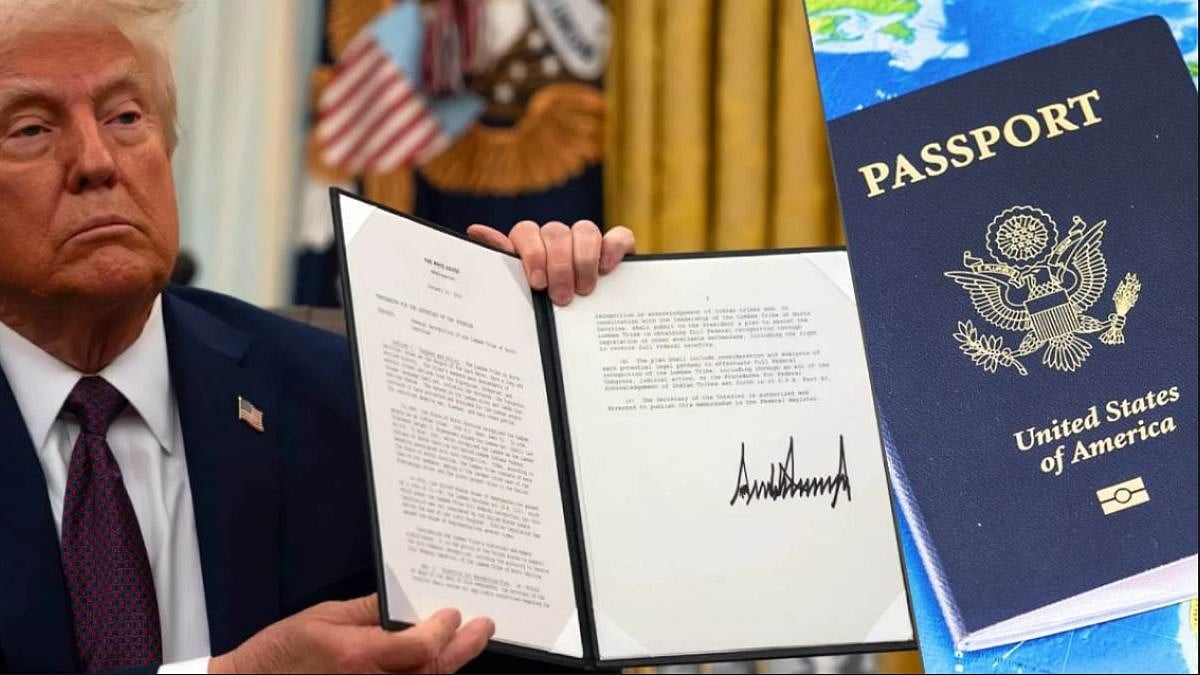

When policy looks like a tantrum, economies pay the price. Last week’s proclamation from the White House slapped a staggering $100,000 charge on H-1B sponsorships — a move rolled out with breathtaking haste and defended as a revenue-and-protection measure by the administration.

Whatever its stated objectives, the practical arithmetic and geopolitical fallout are stark: this is not a narrow reform but a blunt instrument aimed squarely at the talent bridge between India and America.

### The Numbers Speak First

The H-1B system is not small. USCIS approved roughly 399,395 H-1B petitions in FY-2024, of which about 141,205 were approvals for initial employment (new entrants rather than renewals). The statutory annual cap remains 85,000 (65,000 regular slots plus 20,000 for advanced degrees).

Depending on how the new charge is applied, the headline revenue to U.S. coffers could range widely — and not all of it would be net gain once economic second-order effects are accounted for.

– If the $100,000 were charged only to the statutory cap (85,000 new visas), the gross take is $8.5 billion.

– If it were to fall against all initial petitions approved in a year (~141,205), that figure jumps to roughly $14.1 billion.

– If the levy extended to every approved petition in FY-2024 (a broader and legally doubtful reading), the sum would be nearly $40 billion.

(Using today’s rupee-dollar rates, $100,000 is roughly ₹8.8 lakh — small variations in exchange rates explain why some reports quote ₹83 lakh or ₹88 lakh.)

### Beyond Raw Revenue

Raw revenue is not the whole ledger. Indian technocrats are woven through American tech, finance, healthcare, and academia — they are founding entrepreneurs, senior engineers, hospital specialists, and university researchers. Indian nationals accounted for roughly three-quarters of H-1B approvals in recent years, a concentration that means any blunt restriction falls disproportionately on India.

Much of the economic value these professionals create — patents, start-ups, payroll taxes, consumption, and managerial leadership — is not captured by a one-off visa levy. Indiaspora and industry studies show the Indian diaspora’s economic footprint in the U.S. runs into the tens or hundreds of billions when multiplicative effects are counted; students alone contribute over $8 billion a year in tuition and living expenses.

Strip mobility, and the innovation pipeline is damaged in ways a fee cannot repair.

### Who Gets Hit?

In one sense, every company that depends on specialized, mobile labor — from Amazon and Microsoft to giant Indian services exporters such as TCS and Infosys — faces sharply higher costs. Federal filings show Amazon, Cognizant, Ernst & Young, TCS, and others among the biggest sponsors; Amazon alone accounted for thousands of H-1B beneficiaries in 2024.

For Indian services firms that staff client sites across the U.S., the hit is not merely additional fees but the prospect of re-pricing contracts, canceling placements, or shifting delivery back offshore — with attendant margin and reputational damage. Smaller U.S. start-ups, which rely on H-1B hires to scale, would be squeezed even harder.

How many Indian lives and careers are immediately endangered is a question of definitions: reports quote a range from roughly 300,000 to 700,000 Indians affected, depending on whether one counts active H-1Bs, beneficiaries plus dependents, or cumulative approvals.

That variance matters politically: a conservative figure of ~300,000 still represents whole communities clustered in specific Indian ecosystems — Bengaluru, Hyderabad, Chennai, Pune, Mumbai, and the Delhi-NCR corridor — and flows of talent that feed the wider economy through remittances, entrepreneurship, and investments.

States that account for the lion’s share of India’s software exports — Karnataka, Maharashtra, Telangana, and Tamil Nadu — will feel the blow most directly, since they host the headquarters and campus pipelines that feed U.S. placements.

### Americans Will Also Be Hit

So what does the U.S. “gain”? The immediate fiscal headline looks seductive: billions in receipts (depending on the base) and, the administration argues, pressure on employers to hire domestically.

But the counterfactual is costly. Reduced mobility will depress U.S. innovation output, delay product roadmaps, shrink start-up formation by immigrant founders, and raise costs for firms that cannot easily replace experience embodied in transferred teams.

In short, short-term revenue risks becoming a longer-term tax on competitiveness.

### What Should Be India’s Future Strategy?

There is no single lever; this moment calls for a layered response:

**1. Diplomatic Containment and Negotiation**

New Delhi must mount a calibrated diplomatic offensive — not tit-for-tat, but targeted advocacy for carve-outs (healthcare, critical R&D, academic exchanges) and grandfathering of current holders. India should channel industry pressure through U.S. corporate stakeholders who will lose talent and lobby Congress.

**2. Legal and Multilateral Pressure**

The legality of an executive fee of this magnitude will be challenged in U.S. courts; India and affected firms should coordinate legal and administrative reviews while using WTO and international forums to underscore the externalities of unilateral, extra-legislative measures.

**3. Offshore Resilience and Near-Shoring**

Indian firms must accelerate higher-value onshore-offshore models: repatriate roles to Indian delivery centers, deepen centers in neighboring time zones (ASEAN, Middle East), and pivot clients to outcome-based contracts rather than body-shopping models.

**4. Domestic Absorption and Talent Policy**

Invest the shortfall into skilling, start-up financing, and R&D incentives so returning talent seeds domestic product companies rather than becoming unemployed. States such as Karnataka and Telangana must be offered fiscal support to expand global capability centers.

**5. Strategic Economic Diplomacy**

Broaden mobility pipelines with Europe, Japan, South Korea, Australia, and Canada while pressing for reciprocal mobility and technical collaboration.

### Final Thoughts

The administration’s spectacle — a policy unleashed with headline theatrics and inconsistent clarifications about renewals and scope — has already frayed trust.

If the objective was to protect American workers, the tools chosen are blunt and economically perverse: levy first, measure consequences later.

For India, the need is to turn diplomatic shock into strategic opportunity: convert disruption into accelerated domestic capability, diversify partner markets, and make the case — to U.S. firms and to Washington — that talent mobility is not a subsidy but the oxygen of 21st-century innovation.

If New Delhi and Mumbai react only with anger, they will cede the strategic initiative. If they act with speed, foresight, and the hard policy instruments of investment, skills, and international coalition-building, the loss of a visa corridor can become impetus for a stronger, less dependent India.

*— The writer is a strategic affairs columnist and senior political analyst based in Shimla.*

https://www.freepressjournal.in/analysis/trumps-100000-h-1b-gamble-an-erratic-tax-on-talent-that-will-hollow-out-indo-us-trust

Be First to Comment