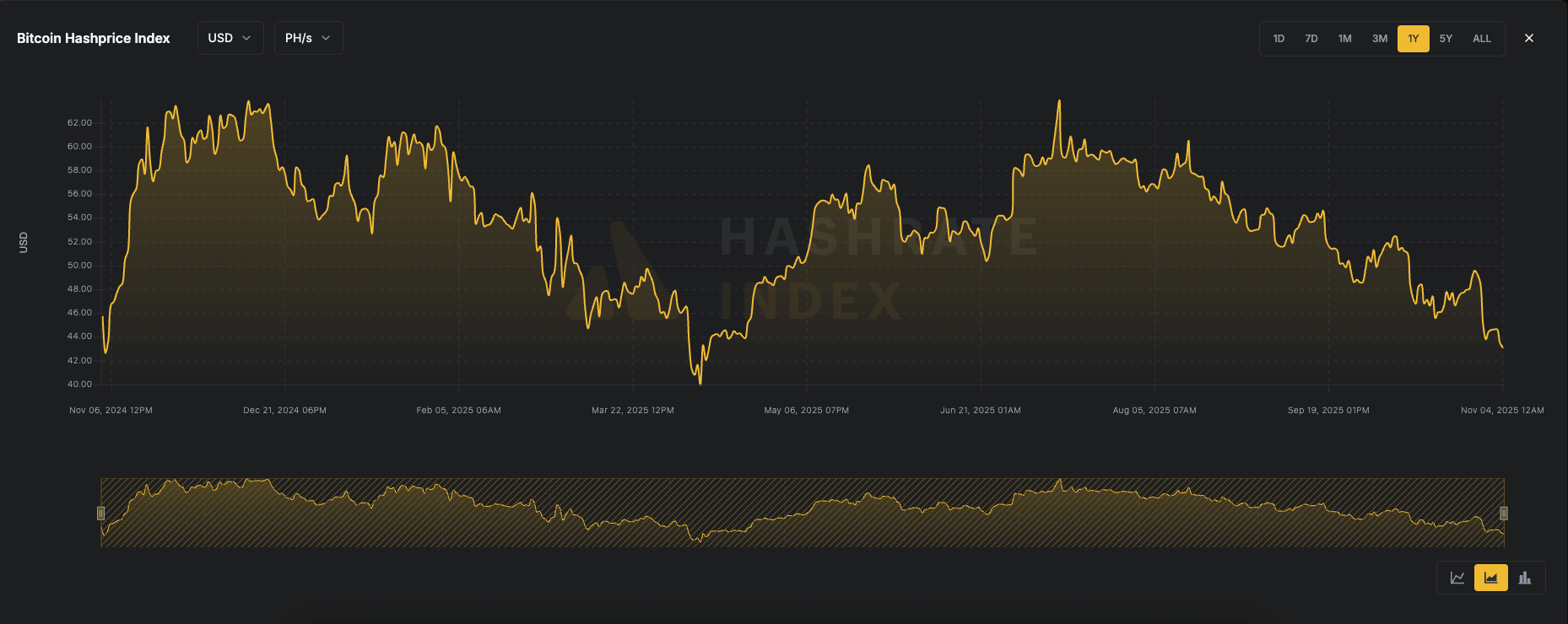

Hashprice has plunged to its lowest level since April, when Bitcoin was trading around $76,000. It now sits at $43.1 per petahash/second (PH/s).

Hashprice, a term coined by Luxor, refers to the expected value of one terahash per second (TH/s) of hashing power per day. It represents how much a miner can earn from a specific amount of hashrate. Hashprice is influenced by several factors, including Bitcoin’s price, network difficulty, block subsidy, and transaction fees.

Since Bitcoin has corrected roughly 20% from its October all-time high of $104,000, and transaction fees remain at bear market levels, miner revenues have come under increasing pressure. According to mempool.space, processing a high-priority transaction currently costs about 4 sat/vB ($0.58). Meanwhile, average transaction fees on an annual basis are at their lowest levels in years.

Hash rate, which is the total computational power used by miners to secure the Bitcoin network, remains just below all-time highs at over 1.1 zettahashes per second (ZH/s). This has coincided with a recent difficulty adjustment reaching an all-time high of 156 trillion (T), up 6.3%. The difficulty adjustment recalibrates roughly every two weeks to ensure that new blocks are mined approximately every ten minutes, maintaining network stability as mining power fluctuates.

Declining Bitcoin prices, low transaction fees, and record-high difficulty are all weighing on Bitcoin mining profitability.

As a result, Bitcoin miners have pivoted to AI and high-performance computing (HPC) data center operations to secure more reliable revenue streams. By locking in longer-term contracts with data companies, miners can stabilize cash flow and reduce reliance on the volatile Bitcoin market conditions.

https://bitcoinethereumnews.com/bitcoin/btc-mining-profitability-slumps-as-hashprice-falls-to-multi-month-low/