In a major reform aimed at enhancing the ease of living for over 70 million account holders, the Employees’ Provident Fund Organisation (EPFO) has approved liberalised partial withdrawal rules. According to PTI reports, these changes now allow up to 100 per cent withdrawal of the eligible provident fund balance.

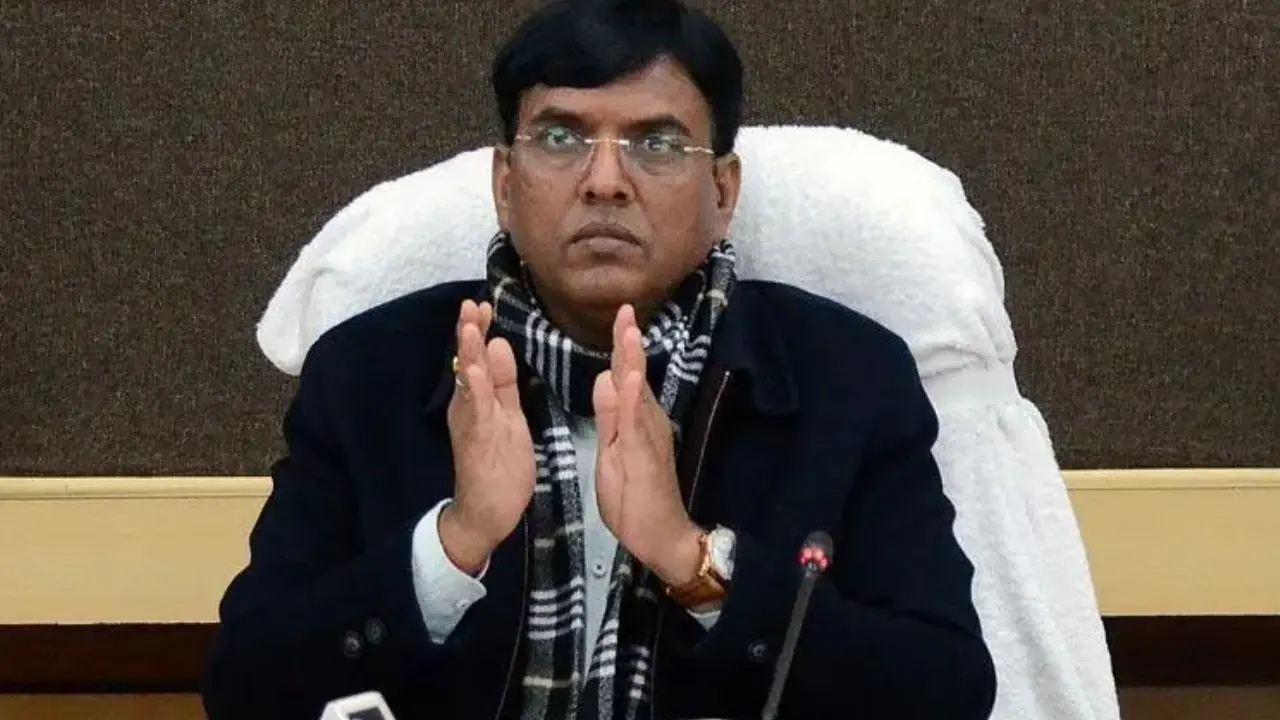

During the recent meeting of the Central Board of Trustees (CBT), chaired by Union Minister Mansukh Mandaviya, a key decision was made to simplify the existing 13 complex withdrawal rules into just three clear categories: Essential Needs (such as illness, education, and marriage), Housing Needs, and Special Circumstances.

### Key Highlights of the New Withdrawal Rules

– **Full Withdrawal Allowed:** Members can now withdraw 100 per cent of both employee and employer contributions.

– **Increased Withdrawal Limits:** Education withdrawals can be made up to 10 times the earlier limit, and marriage withdrawals up to 5 times, up from a previously combined limit of 3.

– **Reduced Service Requirement:** The minimum service period to qualify for partial withdrawals has been reduced to 12 months.

– **Special Circumstances Simplified:** Under this category, members no longer need to specify reasons for withdrawal, significantly reducing claim rejections.

– **Minimum Balance Requirement:** A minimum balance of 25 per cent of the fund must be retained to ensure long-term retirement savings.

– **Documentation-free Process:** The EPFO aims for 100 per cent auto-settlement of claims with minimal paperwork.

### Revised Final Settlement Rules

The CBT also revised the final settlement rules to expedite withdrawals:

– The waiting period for full EPF withdrawal has been reduced to 12 months from the earlier 2 months.

– For final pension withdrawal, the waiting period has been extended to 36 months.

### Vishwas Scheme for Penalty Cases

To ease litigation related to delayed contributions, EPFO has introduced the ‘Vishwas Scheme’ for pending penalty cases under Section 14B. The scheme offers a flat 1 per cent monthly penalty, with lower rates for shorter defaults. It covers both pending and ongoing litigations and will remain operational for six months, with a possible extension of another six months.

### Doorstep Digital Life Certificate Services

In collaboration with India Post Payments Bank (IPPB), the board approved a Memorandum of Understanding (MoU) to provide doorstep Digital Life Certificate (DLC) services to EPS 1995 pensioners free of charge. This initiative aims to assist elderly pensioners, especially in rural areas, in continuing to receive their pensions smoothly.

### EPFO 3.0 Digital Revamp

As part of the EPFO 3.0 digital transformation, a new member-centric digital framework was approved. This framework integrates core banking solutions, cloud-native technology, and an API-first architecture to offer several benefits: faster and automated claims processing, payroll-linked contributions, and self-service options in multiple languages.

### New Fund Managers for EPFO Debt Portfolio

Four fund managers have been selected to manage EPFO’s debt investment portfolio for a five-year term. This move is geared towards ensuring safe and effective investment of retirement savings.

### Conclusion

Minister Mansukh Mandaviya also launched several digital initiatives designed to make EPFO more efficient and user-friendly. These reforms mark a significant step towards simplifying the provident fund experience and empowering members with greater control over their retirement savings.

*(With PTI inputs)*

https://www.mid-day.com/news/india-news/article/epfo-simplifies-13-complex-claim-rules-allows-100-per-cent-partial-withdrawal-check-complete-details-here-23598521

Be First to Comment