The post 2 cryptocurrencies to reach $100 billion market cap by 2026 appeared com. With market dynamics shifting, several major cryptocurrencies are now within a realistic range of hitting the $100 billion market-cap milestone over the next year. Strengthening fundamentals, rising adoption, and major protocol upgrades are positioning some digital assets for significant valuation growth as the broader ecosystem evolves. To this end, Finbold has identified two assets with the potential to reach the $100 billion mark. Solana (SOL) Solana (SOL), currently valued at roughly $72. 6 billion, would need to grow by about 38% to hit the $100 billion threshold. That trajectory appears increasingly plausible given the chain’s improving fundamentals. Notably, Solana is preparing for the Alpenglow upgrade, the most significant consensus overhaul in its history. The new architecture promises near-instant finality of around 150 milliseconds and far greater resilience through components such as Votor and Rotor, reforms that have already received overwhelming validator approval. Combined with the upcoming Firedancer validator client, which has demonstrated massive throughput capacity in testing, Solana is building the infrastructure required to support institutional-scale usage and high-frequency decentralized applications. Its expanding footprint in real-world asset tokenization, growing DApp revenues, and deepening staking activity further reinforce the bullish outlook. Meanwhile, following the recent market downturn, SOL is seeing short-term price relief, having rallied over 3% in the past 24 hours to trade at $129 as of press time. Over the past week, however, the asset has plunged more than 9%. SOL seven-day price chart. While the growth requirement is significantly larger than Solana’s, Tron’s fundamentals continue to strengthen, especially in stablecoin settlement. The network has evolved into the dominant global infrastructure for USDT transactions, handling the majority.

Salsanis Analytics

In Hawaii, caring for our home is not a task government can carry alone it’s a shared kuleana held in the hands and hearts of its people. Throughout the islands, community stewards rise early to tend the lo‘i or other food crops, watch the tides and clear forest trails. They are often the first to notice change, on the frontlines of problem-solving, their work carried out quietly and with deep aloha, which has sustained Hawaii for generations.

The post What happened after Cardano was ‘taken down by a kid?’ Mapping investor confidence appeared com. Journalist Posted: November 23, 2025 Key Takeaways What triggered Cardano’s recent sell-off? A rare partition event exposed vulnerabilities in Cardano’s network, disrupting DeFi activity, stake pool operators, and damaging stakeholder confidence. How weak is ADA, fundamentally? ADA has already shed 50% in Q4 and is technically fragile. Analysts suggest another 5× drop could align fundamentals with network strength. Cardano has been among the worst Q4 performers among large-cap cryptocurrencies so far, shedding 50% of its value. However, looking back, ADA has been bearish since peaking in mid-August above $1. This means that Cardano [ADA] was already in a technically weak spot before the October crash, with bulls failing to defend key support zones. That crash further eroded stakeholder confidence, pushing ADA back to pre-election levels. In such a fragile environment, even a small trigger could spark a major sell-off. Recently, Cardano experienced a rare partition event. The incident was later addressed by founder Charles Hoskinson.” For context, the partition event was caused by a glitch, creating a split in Cardano’s blockchain history. Hoskinson highlighted the impact of the incident, explaining how the “accidental” action by a user disrupted the network, affecting DeFi activity, stake pool operators (SPOs), and damaging Cardano’s overall reputation. However, the market reaction largely contradicted this perspective. Many viewed the event as a “much-needed” catalyst that exposed vulnerabilities in the network and sparked debates about Cardano’s resilience. Community questions Cardano’s technical strength This partition event has once again put Cardano’s resilience under scrutiny. Price-wise, ADA has already shaken stakeholder confidence, emerging as one of the weakest top-cap assets. The recent network issue has worsened the situation, further dampening market sentiment. On-chain data reflects this.

A recent cyberattack on New York-based real estate services firm SitusAMC may have compromised sensitive client and internal data of major banks, including JPMorgan Chase, Citigroup, and Morgan Stanley, raising concerns over both personal and non-public banking information.

In the fall of 1963, I was a graduate student and teaching assistant at Texas Christian University. Several of my friends and I were excited about the visit of President John F. Kennedy to Fort Worth and Dallas. Bob Ross, Bob Cowser, and I went downtown at midnight that Thursday night, Nov. 21, 1963, to catch a glimpse of President [.] The post Seeing President Kennedy the morning history changed first appeared.

All Hell Breaks Loose During Georgia High School Football Game As Players Beat Living Crap Out Of Each Other

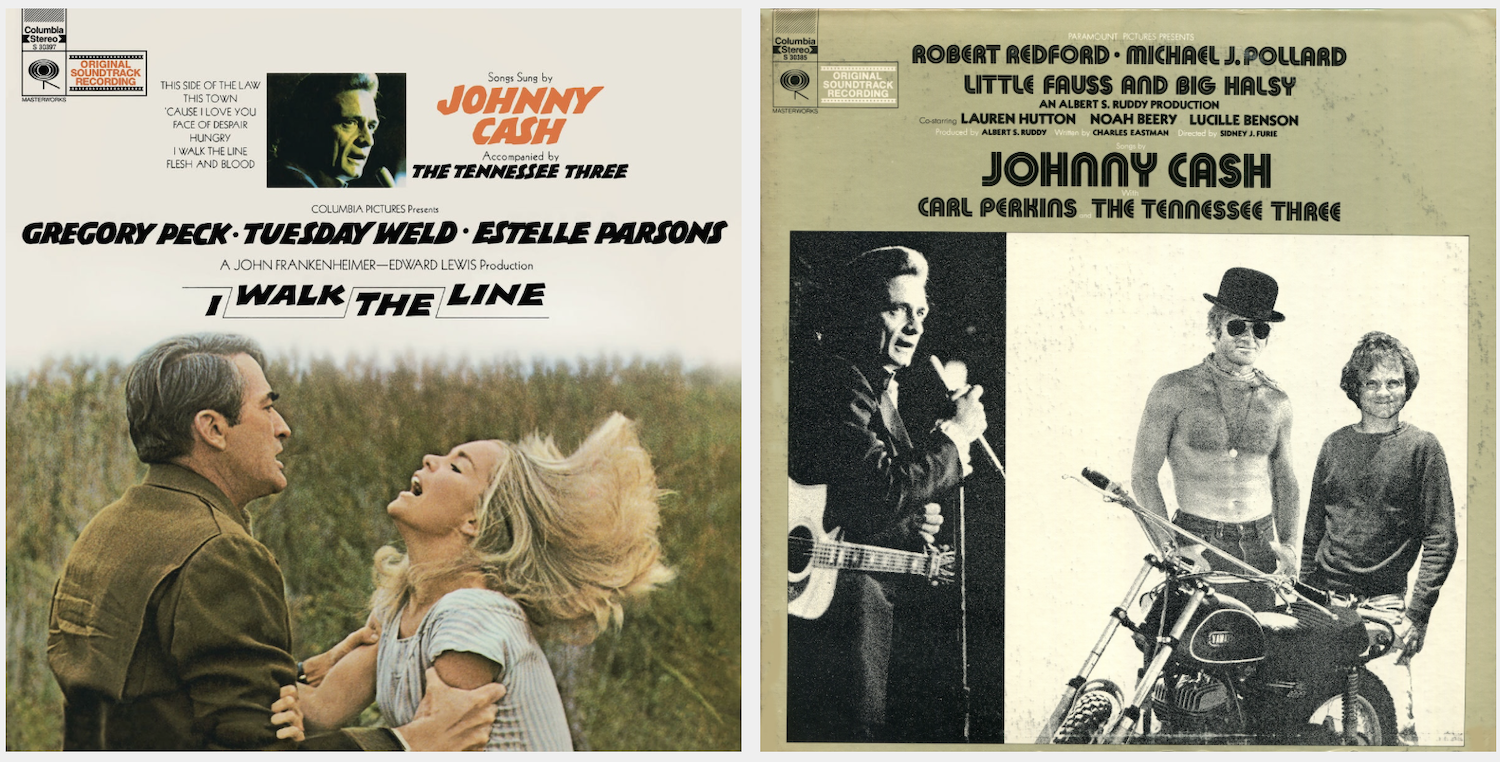

55 years ago today, Johnny Cash released I Walk The Line and Little Fauss And Big Halsy. Sound tracks. Read our review of Cash’s essential Unearthed collection: The post Johnny Cash Released “I Walk The Line” And “Little Fauss And Big Halsy” 55 Years Ago Today appeared first on Magnet Magazine.

VICTORIA Patsy Ruth Cope, age 92, of Victoria, Texas, passed away peacefully on November 14, 2025. She was a devoted wife, mother, sister, and grandmother whose love for life and family touched everyone around her. Patsy is survived by her loving husband, Richard Cope; daughter Ronna Olivarez (Rick); step-sons Michael Cope (Shelagh) and Richard [.].

WESTFORD The entire freshman class at Nashoba Valley Technical High School took part in a Day of Service, volunteering across the region to give back to the community.

TYLER TYLER, TX A man of integrity who loved Jesus and being with other people, William Wilson Newton, Jr., was born on August 9, 1937, and grew up in Dallas. After graduating from the University of Oklahoma College of Architecture (1963), Bill returned to Dallas and married. Bill was a member of the [.].