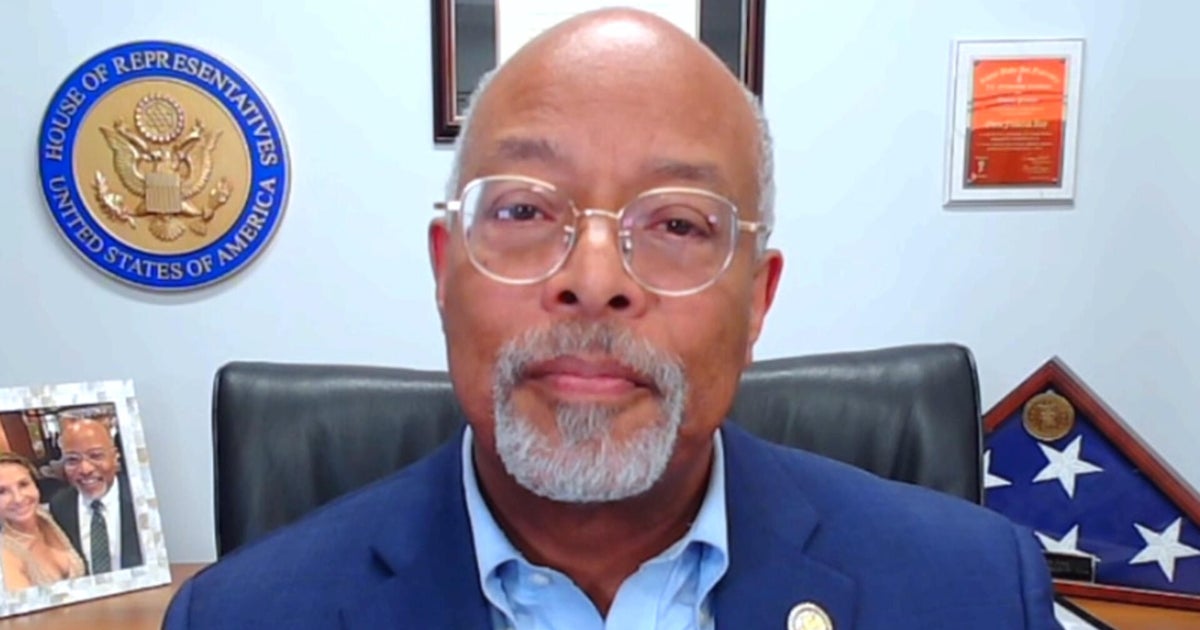

Despite being in the longest government shutdown in U. S. history, the House of Representatives has still not reconvened and is not expected to anytime soon. Democratic Rep. Glenn Ivey of Maryland joins “The Takeout” with his reaction.

Salsanis Analytics

Nina Hoss enters a conversation about “Hedda” the way her character Eileen Lövborg enters that fateful party: She commands the space, is unapologetically present and utterly impossible to overlook. The German actress, who spent six years performing “Hedda Gabler” on stage in Berlin’s demanding repertoire system, now takes on Nia DaCosta’s bold reimagining of the [.].

The post Citibank Explains Reason for Bitcoin’s Continuing Declines, Warns! “The Declines Are a Serious Warning for the Giant Stock Exchange!” appeared com. October and November, known as the historically bullish months for Bitcoin (BTC) and altcoins, are not going as desired in 2025. A major collapse occurred in October following US President Donald Trump’s announcement of tariffs on China. While the collapse on October 11 was recorded as the largest liquidation event in history, the downward trend continued in the first week of November. While wondering whether the declines will continue, Citibank evaluated the declines in Bitcoin. Why Did Bitcoin Fall? Citi analysts said Bitcoin’s decline was due to a liquidity shortage, according to Coindesk. They also noted that Bitcoin’s decline and continued weakness are a warning for the Nasdaq. Citi cited the US Treasury Department’s liquidity-reducing measures and the decline in bank reserves as the reasons for Bitcoin’s weakness. However, it also predicted that Bitcoin and the Nasdaq would experience a combined recovery if liquidity recovered by the end of the year. Bitcoin’s Decline Is a Warning for Nasdaq! Citibank stated that Bitcoin fell due to a liquidity crunch and decoupled from the Nasdaq. Citi analysts noted that Bitcoin’s trading patterns have historically moved in close correlation with the Nasdaq 100 index. Nasdaq’s earnings, in particular, showed a marked improvement as BTC’s price moved above its 55-day moving average. However, Bitcoin has recently fallen below its 55-day moving average. With Bitcoin now trading below its 55-day moving average, the situation for the stock market is also worsening. Citi noted that while the Nasdaq remains relatively strong thanks to the AI craze, it faces a risk of decline due to weakness in Bitcoin, which is more sensitive to liquidity changes. However, Citibank added that there remains upside potential for both Bitcoin and stocks as liquidity shows signs of improvement. In this context, Citi analysts stated that the year-end Christmas Rally is not.

Danielle Poli, Assistant Portfolio Manager for Global Credit Strategy at Oaktree Capital Management, says investors are seeing systematic, rather systemic, problems in credit and there is a place in portfolios for both public and private credit. She speaks to Bloomberg’s Matt Miller on “Bloomberg Real Yield.” (Source: Bloomberg)

Veterans Day 2025 in South Florida: Ceremonies, patriotic music & a parade to honor military service

Communities across South Florida will gather at events that provide the opportunity to pause, reflect and say thanks to veterans while celebrating their courage and commitment.

Thank you, veterans By Rep. Dusty Johnson November 7, 2025 This coming Tuesday is an opportunity to thank the brave men and women who have served our country. South Dakota is home to more than 60, 000 veterans who served from World War II through today. Veterans Day is an important reminder to take time to [.].

India will take on Australia at The Gabba in Brisbane on Saturday, November 8 in the fifth and final T20I of the series.

The Recording Academy announced today the nominees for the upcoming 68th Annual Grammy Awards, and Apple scored a total of four nominations. Here are the details. more.

The post Phase 2 Almost Full Why IPO Genie Is Selling Out Fast appeared com. Crypto Presales The IPO Genie presale is almost full. Discover why 300K investors are joining this AI-powered, audited crypto presale before Phase 2 closes. Inside the Frenzy: How IPO Genie’s Phase 2 Is Selling Out Fast The crypto world never sleeps, but investors have learned one thing: not every presale is worth the chase. In 2025, the ones filling up fastest are those that mix innovation with proof. And right now, IPO Genie (PO) is leading that pack. Its presale is moving faster than most predicted with Phase 2 almost full and new participants joining every hour. The reason? Transparency, structure, and real AI-driven utility. Unlike typical hype launches, IPO Genie’s rise has been steady, verified, and community-backed. It’s not chasing investors, it’s earning them. Let’s see why this Top Crypto Presale is capturing global attention and how it’s setting new standards for early-stage crypto investing. Why IPO Genie Is Selling Out So Fast Momentum is no mystery, it’s math, structure, and trust. Here’s why IPO Genie is accelerating while others fade: AI-Powered Dealflow: Each PO token connects users to vetted private-market deals powered by AI insights. Audited Infrastructure: CertiK-audited smart contracts and Fireblocks custody ensure full transparency. Tiered Access: Early participants get better rates, staking rewards, and priority deal entry. Community Confidence: Nearly 300, 000 verified users have joined the presale and airdrop. That’s not hype. That’s traction. PO Presale Pricing Structure Transparent and Verified Here’s how IPO Genie built its growth model slow, steady, and transparent: Stage Token Price (USD) Tokens per $1 USD Price Increase Stage 1 $0. 0001 per PO 10, 000 PO Stage 2 $0. 0001002 per PO 9, 980 PO (approx.) 0. 20% from Stage 1 Stage 1: Investors could grab 10, 000 PO tokens for just $1 USD. Stage 2: The price slightly increased to $0. 0001002 still extremely early, but already.