The post MATIC Price Prediction: Targeting $0. 45-$0. 58 by December 2025 Despite Current Weakness appeared com. Jessie A Ellis Nov 08, 2025 06: 57 MATIC price prediction shows potential recovery to $0. 45-$0. 58 range within 4-6 weeks, though current bearish momentum suggests caution with $0. 35 support critical. Polygon (MATIC) presents a complex technical picture as we analyze the latest data for our comprehensive MATIC price prediction. Trading at $0. 38, the token sits near its 52-week low of $0. 37, yet several technical indicators suggest a potential recovery scenario could unfold over the coming weeks. MATIC Price Prediction Summary • MATIC short-term target (1 week): $0. 40-$0. 42 (+5-11%) • Polygon medium-term forecast (1 month): $0. 45-$0. 58 range (+18-53%) • Key level to break for bullish continuation: $0. 43 (SMA 20 resistance) • Critical support if bearish: $0. 35 (immediate support) and $0. 33 (strong support) Recent Polygon Price Predictions from Analysts The latest analyst predictions reveal a significant disconnect between short-term forecasts and current market reality. Recent MATIC price prediction models from Changelly suggest modest targets around $0. 19-$0. 194, while CoinArbitrageBot’s AI models project higher targets near $0. 228. However, these predictions appear outdated given MATIC’s current price of $0. 38, suggesting either the models haven’t adjusted to recent price action or there’s potential for significant downside risk. This disparity highlights the challenge in cryptocurrency forecasting, where rapid price movements can quickly invalidate short-term predictions. The consensus among recent forecasts indicates bullish sentiment, but the actual price action tells a different story, with MATIC experiencing a -0. 29% decline in the past 24 hours. MATIC Technical Analysis: Setting Up for Potential Reversal Our Polygon technical analysis reveals several key indicators that shape our MATIC price prediction. The RSI reading of 38. 00 places MATIC in neutral territory, avoiding oversold conditions but indicating selling pressure remains present. This positioning suggests room for downward movement before reaching truly oversold levels that might trigger buying.

Tag: volume

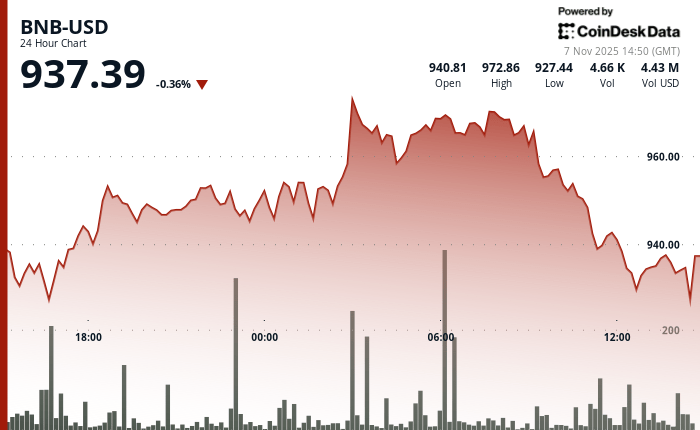

The post BNB Drops to Key Support Level Above $930 as Markets React to Liquidity Pressures appeared com. The native token of the BNB Chain, BNB, slipped slightly over the last 24-hour period, moving to $933 after briefly surging to $974, as broader crypto markets showed signs of stress tied to tightening financial conditions. The token’s price action played out in a narrow $46 range. Volume rose sharply during the morning’s move higher, 71% above the 24-hour average, but cooled into the close according to CoinDesk Research’s technical analysis data model. The rejection near $975 marked a technical ceiling, while BNB found support once again near $930. “BNB’s ability to hold support mirrors the broader strength we’re seeing on-chain,” Johnny B., the founder of BNBPad. ai, told CoinDesk in an emailed statement. “Despite the market headwinds, BNB Chain saw 82 million active addresses in October, a new all-time high, while DEX volumes neared $120 billion based on DeFiLlama.” BNB’s muted performance came along a wider market drawdown. 9% in the last 24 hours while bitcoin is struggling to remain above $100,000. A U. S. Treasury cash rebuild and falling bank reserves, down an estimated $500 billion since July, have drained capital from markets and made risk assets less attractive, according to a recent report from Citi. That has seen stocks fall as well, with the tech-heavy Nasdaq 100 seeing a 4. 7% decline this week, and the S&P 500 dropping by 2. 7%. In this environment, BNB’s ability to stay above its key $930 support level may reflect confidence in the network’s adoption and the performance of newer decentralized applications like Asper, even as the broader outlook dims. A break above $975 could reopen the path toward recent highs, but further downside in major assets could test buyers’ resolve. BNB remains tied to technical setups for now, but broader.