The post One Bitcocom. The Bitcoin price has dropped sharply this month. Since early November, it has fallen almost 15%, turning one of the strongest assets of the year into one of the weakest in the current pullback. The drop has pushed the market into two camps again. Some believe this is the start of a deeper correction. Others believe the cycle is still unfolding, and this is merely an oversized dip. The next move depends on one level. If Bitcoin reclaims it, the rebound setup activates. If it fails there, the downside can widen fast. Sponsored Sponsored Bitcoin Momentum Softens the Fall, but One Level Must Validate It There are early signs that sellers may be losing strength. The Relative Strength Index entered the oversold zone this week and has since reversed. That usually shows that selling pressure is easing. A longer-term pattern also supports that view. Between April 30 and November 14, Bitcoin price formed a higher low, which means the broader trend is not fully broken. However, over the same period, the RSI also made a lower low. This is a hidden bullish divergence, a signal that often appears when a strong trend is attempting to resume after a significant correction. For the RSI sign to play out, the Bitcoin price must cross above $100,300 ( a key support since late April), which might now act as a psychological resistance. Bitcoin Sellers Might Be Getting Weaker: TradingView . Supply data points to the same area on the chart. The UTXO Realized Price Distribution shows a large band of long-term Bitcoins created near the $100,900 zone. Sponsored Sponsored When a cluster like this forms, it often becomes a significant decision point because a large portion of the supply is.

Tag: psychological

Ethereum price has remained on edge in the past few months, moving from the year-to-date high of $4,945 in August to the current $3,412. Ethereum (ETH) token has pulled back as sentiment in the industry has waned, with the Crypto.

The post Crypto Market Prediction: Ethereum at about $3,600 has now turned into resistance. Previously, this level served as a basis for a recovery. The daily chart’s declining structure, which is indicated by a series of lower highs and waning buying interest, validates the overall bearish sentiment shift. Red candle volume spikes raise additional concerns because they imply that sellers are still in charge. On a market that is not exhibiting any indications of significant accumulation, the RSI hovering around 31 suggests that ETH is approaching oversold territory. Even though there may be a brief respite, the current downward trend is unlikely to be reversed unless general market conditions improve. Technically speaking, $3,000 is the next significant support, and $2,800 is a more psychological barrier. If Ethereum is unable to maintain those levels, it is more likely that it will drop to $2,500, which would eliminate most of the gains from the midyear rally. In summary, the price movement.

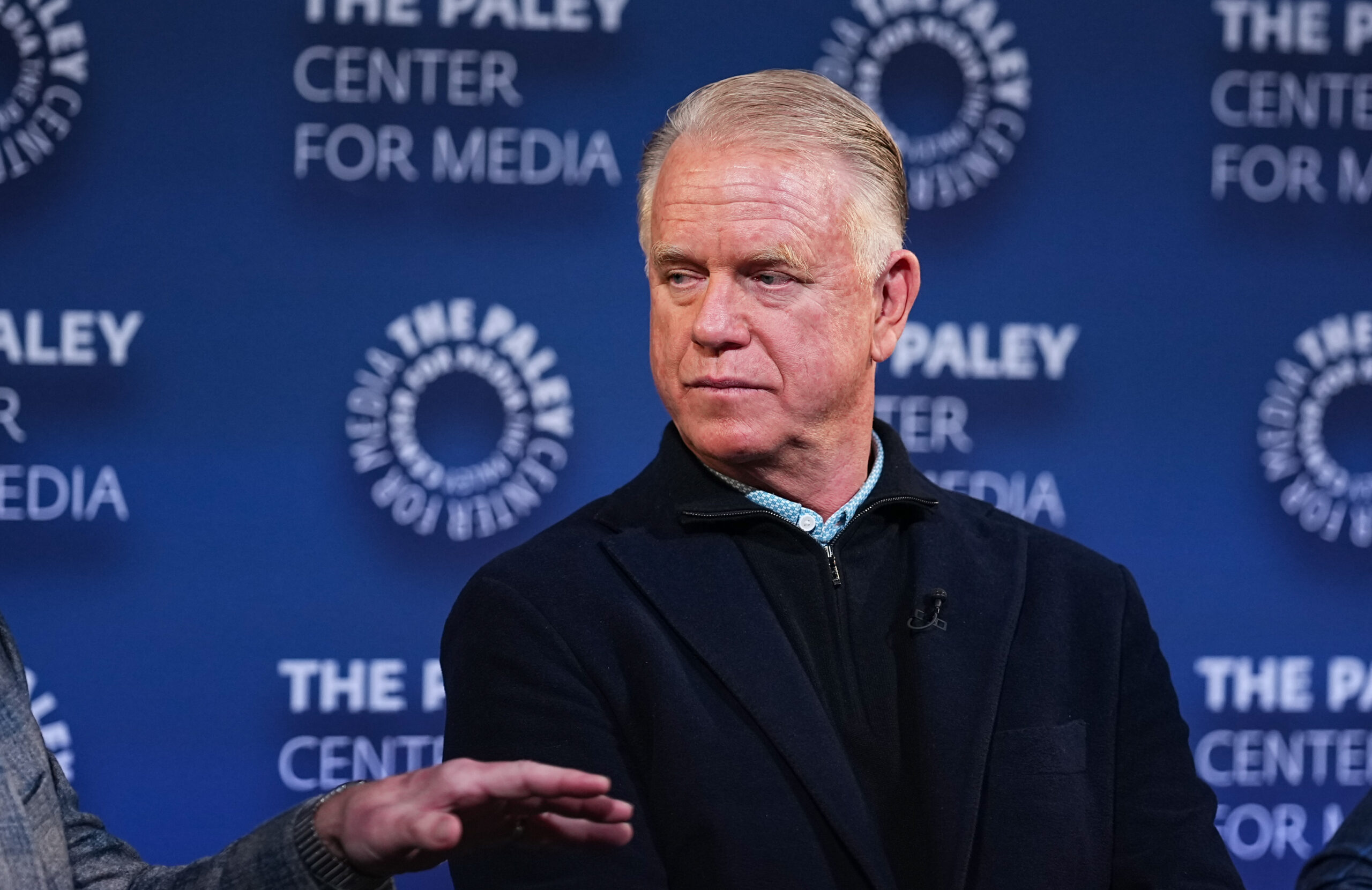

Boomer Esiason offers Giants’ Graham Gano advice as he faces ugly ‘sewer pit’ of hate

The post Eyes fresh six-month highs near 1. 4150 within overbought zone appeared com. USD/CAD continues its winning streak for the seventh consecutive day, trading around 1. 4120 during the European hours on Friday. The technical analysis of the daily chart indicates a prevailing bullish bias, with the pair remaining within the ascending channel pattern. The short-term price momentum is stronger as the pair rises above the nine-day Exponential Moving Average (EMA). However, the 14-day Relative Strength Index (RSI) is positioned at the 70 level, suggesting a stronger bullish bias but lies within the overbought territory and a potential near-term downward correction. The USD/CAD pair may test the fresh seven-month high of 1. 4140, reached on November 5. A break above this level would support the pair to explore the area around the upper boundary of the ascending channel at 1. 4230. On the downside, the primary support lies at the psychological level of 1. 4100, followed by the nine-day EMA of 1. 4067. Further declines below this level would dampen the short-term price momentum and prompt the USD/CAD pair to test the 50-day EMA at 1. 3954, followed by the ascending channel’s lower boundary around 1. 3940. USD/CAD: Daily Chart Canadian Dollar Price Today The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Australian Dollar. USD EUR GBP JPY CAD AUD NZD CHF USD 0. 13% 0. 12% 0. 29% 0. 03% -0. 07% 0. 30% 0. 19% EUR -0. 13% -0. 01% 0. 16% -0. 10% -0. 20% 0. 17% 0. 06% GBP -0. 12% 0. 00% 0. 16% -0. 12% -0. 19% 0. 18% 0. 07% JPY -0. 29% -0. 16% -0. 16% -0. 24% -0. 33% 0. 01% -0. 08% CAD -0. 03% 0. 10% 0. 12% 0. 24% -0. 10% 0. 25% 0. 17% AUD 0. 07% 0. 20% 0. 19% 0. 33% 0. 10% 0. 38% 0. 27% NZD -0. 30% -0. 17% -0. 18% -0. 01% -0. 25% -0. 38% -0. 11% CHF -0. 19% -0. 06% -0. 07% 0. 08% -0. 17% -0. 27% 0. 11% The heat map shows percentage changes of major currencies against each other. The base currency is picked from the.

The post Bitwise’s NYSE Listing Update Hints XRP ETF Approval Could Arrive Within 20 Days appeared com. The post Bitwise’s NYSE Listing Update Hints XRP ETF Approval Could Arrive Within 20 Days appeared first 34%. Eric Balchunas, senior ETF analyst at Bloomberg, believes Bitwise’s latest filing marks a major step forward for XRP’s entry into traditional finance. “Adding the NYSE and fee means Bitwise has checked nearly all boxes.” Bitwise just updated their XRP ETF filing to include exchange (NYSE) and fee of 0. 34%, which are typically the last boxes to check. Amendment #4. pic. twitter. com/BUnkasSQY5 Eric Balchunas (@EricBalchunas) October 31, 2025 Historically, once issuers include exchange and fee details in their S-1 forms, it usually means they’re just waiting for the final green light from the SEC. XRP ETF Could Launch in 20 Days Following the update news, ETF expert James Seyffart of Bloomberg Intelligence added more context to it, noting that Bitwise’s latest filing contains “shorter language” that could allow the product to go live within just 20 days, pending SEC clearance. Seyffart noted that Bitwise isn’t alone, major players like VanEck, Fidelity, and Canary Funds have also updated their filings,.

BCH price drops to $467. 40 amid broader crypto selloff triggered by Bitcoin’s decline below key support and Fed’s unexpected rate cut resumption signaling economic concerns. (Read More).