The post ‘Chaos is coming for Bitcoin in the next few months,’ claims CEO appeared com. Key Takeaways What happens when mining becomes unprofitable? Miners may shut down rigs and sell their Bitcoin reserves to cover costs, adding sell pressure and risking a market downturn. Does a drop in miners weaken the network? Yes. Fewer miners mean reduced hashrate, lower security, and slower block processing. Bitcoin mining has entered a worrying phase, raising fresh concerns across the crypto market. According to the latest data from MacroMicro, the average cost to mine a single Bitcoin has dropped to $112,025. This has sparked questions about the industry’s profitability and long-term sustainability. This sharp decline comes at a time when market sentiment is uncertain, fueling fears that miners may soon face financial pressure if prices continue to fall. All about mining costs Highlighting the same, Jacob King, CEO of SwanDesk, noted, “People don’t realize how much chaos is coming for Bitcoin in the next few months. Bitcoin mining has entered its most unprofitable stretch in a decade.” He added, “It currently costs a whopping $112K to mine a single Bitcoin, that’s now only worth $86K and falling fast. It’s only a matter of time before miners shut down, the network shrinks, and a cascading crash follows.” Needless to say, a decline in miner profitability doesn’t just affect operations. In fact, it can trigger a chain reaction across the market. When mining costs outweigh returns, companies are forced to liquidate their Bitcoin [BTC] reserves to stay afloat. This could increase the sell pressure, potentially dragging prices lower. Thus, if this trend intensifies, the market could see miner capitulation. This is where large numbers of miners shut down, weakening network security and reducing overall hashrate. Together, these factors could heighten the risk of a deeper market downturn. Especially if Bitcoin continues to trade below its production cost. Analysts are not worried.

Tag: profitability

TLDR CoreWeave stock fell nearly 30% over five trading days after cutting 2025 revenue guidance from $5. 25 billion to $5. 1 billion The company reported a backlog of $55. 6 billion in Q3, up 85% from the prior quarter, including major contracts with OpenAI and Meta Despite the pullback, shares remain up over 108% year-to-date on strong [.] The post CoreWeave (CRWV) Stock Drops 30% Despite Winning Major Contracts From OpenAI and Meta appeared first on CoinCentral.

Nebius: The Hype Overwhelms Sobriety (Upgrade)

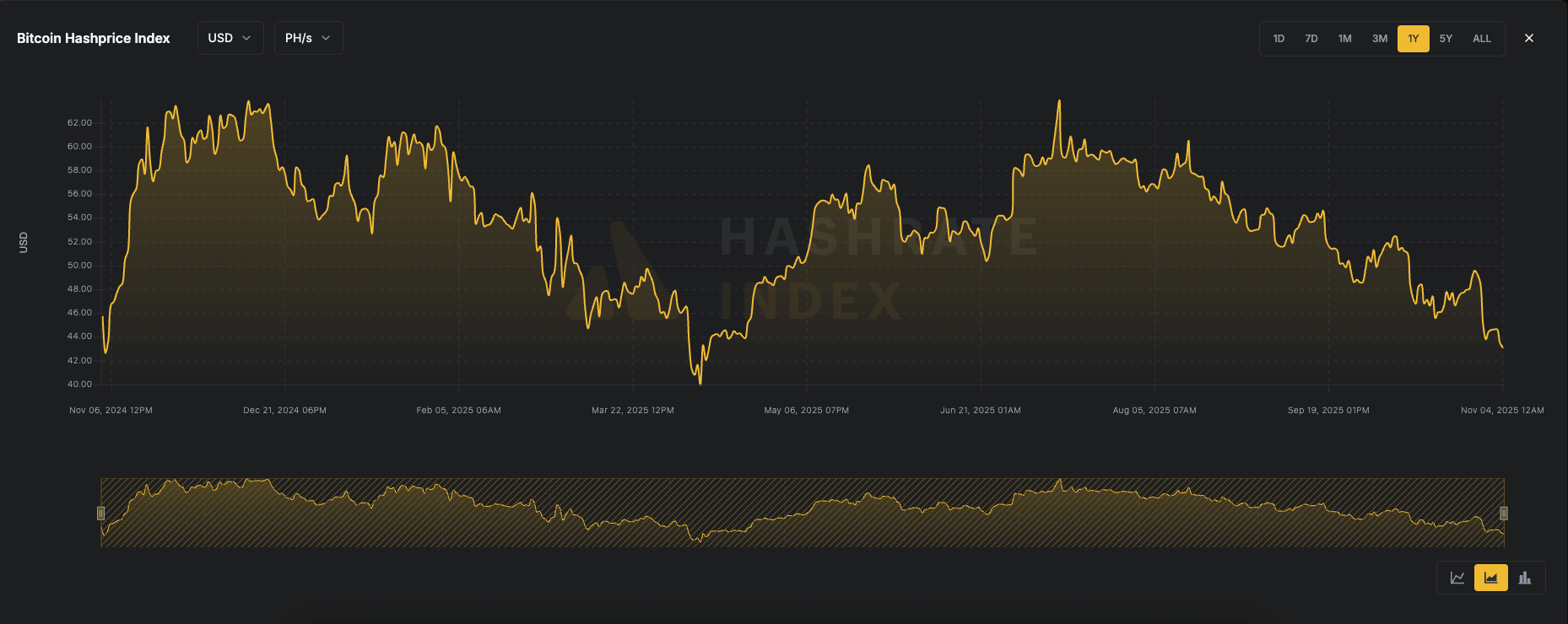

The post BTC Mining Profitability Slumps as Hashprice Falls to Multi-Month Low appeared com. Hashprice has plunged to its lowest level since April, when bitcoin was trading around $76,000, now sitting at $43. 1 per petahash/second (PH/s). Hashprice, a term coined by Luxor, refers to the expected value of one terahash per second (TH/s) of hashing power per day, representing how much a miner can earn from a specific amount of hashrate. It is influenced by bitcoin’s price, network difficulty, block subsidy and transaction fees. As bitcoin has corrected roughly 20% from its October all-time high to $104,000, and transaction fees remain at bear market levels, miner revenues have come under increasing pressure. According to mempool. space, processing a high-priority transaction currently costs about 4 sat/vB ($0. 58), while average transaction fees on an annual basis are at their lowest levels in years. Hash rate, the total computational power used by miners to secure the bitcoin network, remains just below all-time highs at over 1. 1 zettahashes per second (ZH/s). This has coincided with a recent difficulty adjustment reaching an all-time high of 156 trillion (T), up 6. 3%. The difficulty adjustment recalibrates roughly every two weeks to ensure that new blocks are mined approximately every ten minutes, maintaining network stability as mining power fluctuates. Declining bitcoin prices, low transaction fees and record-difficulty are all weighing on bitcoin mining profitability. As a result, bitcoin miners have pivoted to AI and high-performance computing (HPC) data center operations to secure more reliable revenue streams. By locking in longer-term contracts with data companies, miners can stabilize cash flow and reduce reliance on volatile bitcoin market conditions. Source:.

GLENDALE, Calif. (AP) GLENDALE, Calif. (AP) Public Storage (PSA) on Wednesday reported a key measure of profitability in.

Precision components maker Aequs Ltd is planning to raise up to 144 crore through a pre-IPO placement.