XRP’s new spot ETF is drawing institutional attention, while retail investors are turning to LeanHash for daily XRP earnings during market volatility. #partnercontent.

Tag: high-performance

[PRESS RELEASE Zug, Switzerland, November 19th, 2025] Supra, the vertically integrated Layer 1 powering MultiVM smart contract execution with native oracles, dVRF, automation, and cross-chain communication, announced today the opening of applications for its MultiVM testnet during today’s keynote at Devconnect Buenos Aires, held as part of Multichain Day. The announcement was delivered by [.].

Are Cloud-based platforms combined with AI and machine-learning the answer to scientists’ big data problems?.

The post Building a Crypto Portfolio for 2026: Where IPO Genie Fits In appeared com. Why Allocation Matters More Than Individual Token Picks In serious portfolio construction, one principle is non-negotiable: allocation is more important than selection. In crypto, where volatility is extreme and narratives evolve quickly, this truth is even more pronounced. Two investors can hold similar assets yet experience radically different outcomes simply because one structured their exposure intelligently, while the other chased momentum. As the market evolves toward 2026-with AI-enhanced research, tokenized private markets, audited presales, and institutional-grade infrastructure-investors seeking the best crypto allocation must think in terms of risk layers, not isolated bets. Core Requirements of the Best Crypto Allocation in 2026 A robust allocation today must: Distribute risk across blue-chip, growth, and emerging assets Incorporate AI-driven discovery tools Include exposure to tokenized private and pre-IPO markets Allow limited, controlled participation in frontier innovation Be structured enough to survive drawdowns, but flexible enough to capture upside At the same time, sophisticated investors increasingly use tracking methods like UTM-tagged links to understand how interest, research, and engagement flow over time. For example, visiting the official IPO Genie portal allows performance and engagement to be measured in a structured way. The 40/30/20/10 Allocation Blueprint A professional, risk-aware model for the best crypto allocation in 2026 can be summarized as: 40% Blue-Chip Foundational Assets 30% Mid-Cap Growth Assets 20% Emerging High-Conviction Assets 10% Frontier Innovation Assets This model is designed to balance stability, scalability, and asymmetric upside. 40% Blue-Chip Layer: Structural Stability The blue-chip layer underpins the entire portfolio. It typically includes: Bitcoin Ethereum Leading layer-1 networks with strong liquidity and adoption Institutional-grade infrastructure assets These assets provide: Deep liquidity Long-term demand drivers Lower relative downside during market stress Allocating ~40% of capital here establishes a resilient core that can absorb volatility from higher-risk segments. 30% Mid-Cap Growth.

Zug, Switzerland, 14th November 2025, Chainwire The post Coinbase Ventures-Backed Supra Offers $1M Bounty to Beat Its Parallel EVM Execution Engine appeared first on Chainwire.

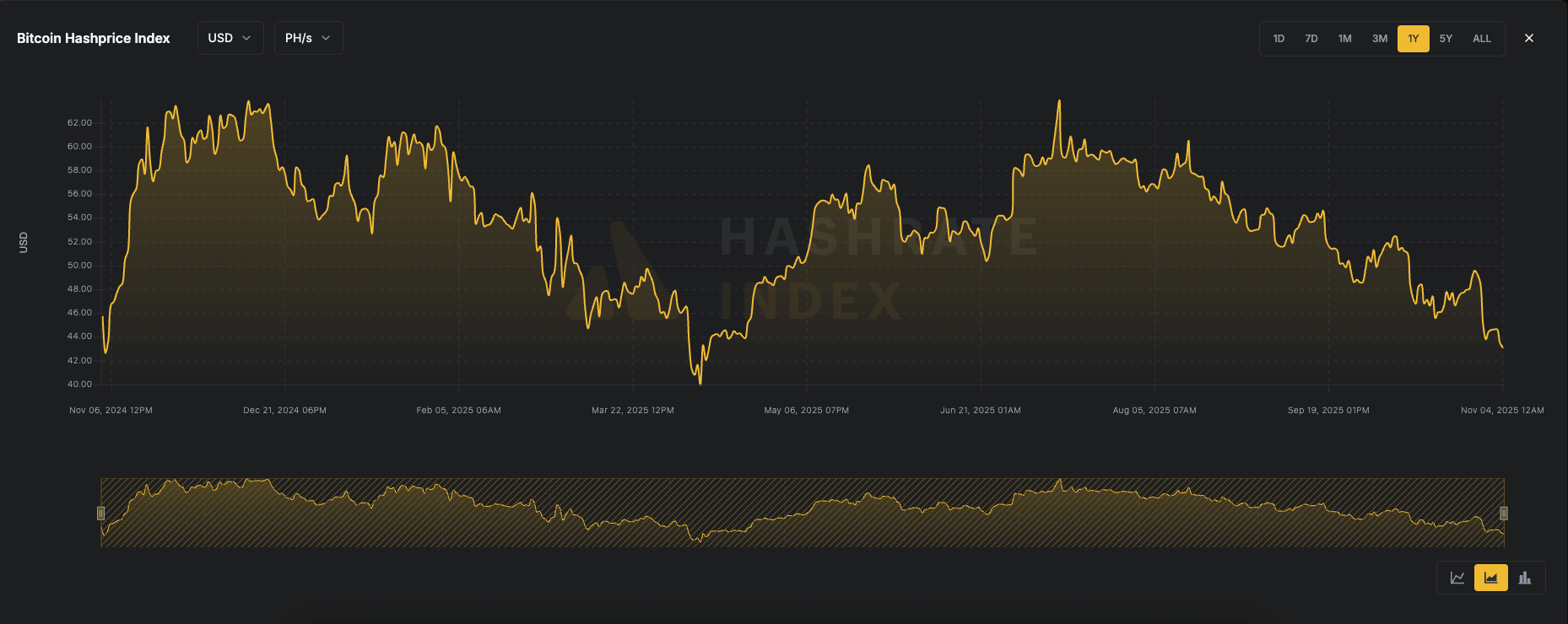

The post BTC Mining Profitability Slumps as Hashprice Falls to Multi-Month Low appeared com. Hashprice has plunged to its lowest level since April, when bitcoin was trading around $76,000, now sitting at $43. 1 per petahash/second (PH/s). Hashprice, a term coined by Luxor, refers to the expected value of one terahash per second (TH/s) of hashing power per day, representing how much a miner can earn from a specific amount of hashrate. It is influenced by bitcoin’s price, network difficulty, block subsidy and transaction fees. As bitcoin has corrected roughly 20% from its October all-time high to $104,000, and transaction fees remain at bear market levels, miner revenues have come under increasing pressure. According to mempool. space, processing a high-priority transaction currently costs about 4 sat/vB ($0. 58), while average transaction fees on an annual basis are at their lowest levels in years. Hash rate, the total computational power used by miners to secure the bitcoin network, remains just below all-time highs at over 1. 1 zettahashes per second (ZH/s). This has coincided with a recent difficulty adjustment reaching an all-time high of 156 trillion (T), up 6. 3%. The difficulty adjustment recalibrates roughly every two weeks to ensure that new blocks are mined approximately every ten minutes, maintaining network stability as mining power fluctuates. Declining bitcoin prices, low transaction fees and record-difficulty are all weighing on bitcoin mining profitability. As a result, bitcoin miners have pivoted to AI and high-performance computing (HPC) data center operations to secure more reliable revenue streams. By locking in longer-term contracts with data companies, miners can stabilize cash flow and reduce reliance on volatile bitcoin market conditions. Source:.

The post IREN Signs $9. 7B AI Cloud Deal With Microsoft appeared com. Bitcoin mining company IREN (IREN) signed a multi-year GPU cloud services contract with Microsoft, highlighting the integration of traditional mining infrastructure with the demands of Big Tech for AI computing power. The five-year agreement, valued at $9. 7 billion, will provide Microsoft with access to Nvidia GB300 GPUs hosted within IREN’s data centers. In a related move, IREN also announced a $5. 8 billion deal with Dell Technologies to acquire GPUs and related equipment. The company plans to fund its capital expenditures through a combination of cash reserves, customer prepayments, operational cash flow, and additional financing. IREN said the agreement reinforces its position as a major provider of AI cloud services, following its pivot into the sector in early 2024. Beyond AI, the company remains one of the largest Bitcoin (BTC) miners by realized hashrate. IREN shares traded sharply higher after Monday’s market open, reflecting investor enthusiasm following the Microsoft announcement. IREN stock surged more than 10% after Monday’s open. HIVE Digital was one of the first to shift strategy, beginning its transition in mid-2023 and now generating meaningful revenue from AI and high-performance computing services. MARA Holdings unveiled an immersion cooling system in 2024 designed to support dense compute workloads such as AI. Earlier this year, Riot Platforms also began laying the groundwork for a potential expansion into AI and high-performance computing. In one of the sector’s largest deals to date, TeraWulf announced a $3. 7 billion hosting agreement in August with AI cloud platform Fluidstack,.

The post CORZ Has Major Upside Following Failed CRWV Takeover appeared com. Investment bank Macquarie upgraded Core Scientific (CORZ) to outperform from neutral and hiked its price target on the stock nearly 90% to $34 from $18 following the collapse of the CoreWeave (CRWV) deal. The failed merger between Core Scientific and CoreWeave came as no surprise after reports and proxy recommendations pointed to shareholder opposition, analysts Paul Golding and Marni Lysaght wrote in the report on Thursday. The bank’s analysts viewed the outcome as a positive, giving Core Scientific more flexibility to lease its near-term power capacity to AI tenants. Core Scientific shares were 4. 5% higher in early trading, around $21. 70. The analysts noted that the bitcoin miner’s 1. 5 gigawatt (GW) portfolio includes 590 megawatts (MW) leased to CoreWeave and another 1 GW gross, roughly 700 MW billable, under load study. Management expects to sign at least one new colocation customer by fourth-quarter earnings, a move Macquarie said could accelerate revenue diversification and highlight the company’s advantage in high-performance computing buildouts. Jefferies said Core Scientific is moving forward with renewed focus after shareholders voted down its proposed merger with CoreWeave. The bank noted that Core Scientific exits the process with 1. 5 GW of existing and planned billable power capacity and little capital expenditure tied to the now-defunct deal. Throughout the merger talks, the miner continued expanding its data center business and is now positioned to sign new tenants and power contracts by the end of the year, analysts led by Jonathan Petersen wrote in the Thursday report. The signing of a new tenant would be a key milestone for diversifying revenue and reducing dependence on CoreWeave, the report said. Jefferies has a buy rating on Core Scientific shares with a $28 price target. Read more: Core Scientific Holders Poised to Reject CoreWeave Merger, Jefferies Says Source:.

120,000 Bitcoin (BTC) Wallets at Risk With This Vulnerability