Nintendo has just started distribution of a new update for Donkey Kong Bananza, which is version 3. 0. 0. There are a couple of main additions. First, Thai is supported as an additional language. Also, “Camera’s automatic tracking” is now in the options. The full rundown of the update is as follows: Donkey Kong Bananza version 3. 0. 0 update patch notes Added Thai. The post Donkey Kong Bananza 3. 0. 0 update out now, patch notes appeared first on Nintendo Everything.

Tag: distribution

The post One Bitcocom. The Bitcoin price has dropped sharply this month. Since early November, it has fallen almost 15%, turning one of the strongest assets of the year into one of the weakest in the current pullback. The drop has pushed the market into two camps again. Some believe this is the start of a deeper correction. Others believe the cycle is still unfolding, and this is merely an oversized dip. The next move depends on one level. If Bitcoin reclaims it, the rebound setup activates. If it fails there, the downside can widen fast. Sponsored Sponsored Bitcoin Momentum Softens the Fall, but One Level Must Validate It There are early signs that sellers may be losing strength. The Relative Strength Index entered the oversold zone this week and has since reversed. That usually shows that selling pressure is easing. A longer-term pattern also supports that view. Between April 30 and November 14, Bitcoin price formed a higher low, which means the broader trend is not fully broken. However, over the same period, the RSI also made a lower low. This is a hidden bullish divergence, a signal that often appears when a strong trend is attempting to resume after a significant correction. For the RSI sign to play out, the Bitcoin price must cross above $100,300 ( a key support since late April), which might now act as a psychological resistance. Bitcoin Sellers Might Be Getting Weaker: TradingView . Supply data points to the same area on the chart. The UTXO Realized Price Distribution shows a large band of long-term Bitcoins created near the $100,900 zone. Sponsored Sponsored When a cluster like this forms, it often becomes a significant decision point because a large portion of the supply is.

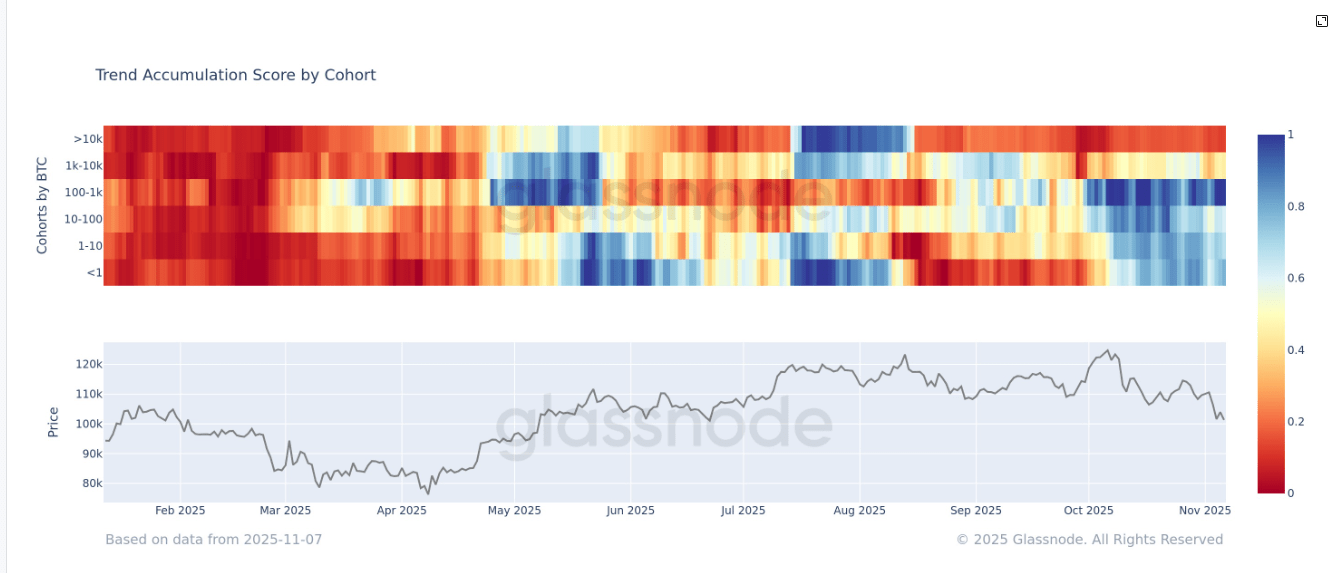

The post Whales Dump While the Rest Accumulate appeared com. Bitcoin BTC$102,272. 80 remains only marginally positive year-to-date, suggesting 2025 has been a period of consolidation as the asset stabilizes around the $100,000 level. Much of the recent price weakness appears linked to previously dormant coins re-entering circulation, per onchain data. Large holders, commonly known as whales, have been the primary distributors, driving the current downward pressure on price, according to The Accumulation Trend Score (ATS) by Glassnode. ATS measures the relative accumulation or distribution behavior across different wallet cohorts, accounting for both the size of entities and the volume of coins they have acquired over the past 15 days. A value near 1 suggests that participants in that cohort are actively accumulating. A value near 0 indicates that they are distributing holdings. Exchanges, miners, and certain other entities are excluded from the calculation. Whales holding over 10, 000 BTC have been consistent sellers since August, marking three months of sustained distribution. Meanwhile, wallets in the 1, 000-10, 000 BTC range remain neutral around a score of 0. 5, while all smaller cohorts (below 1, 000 BTC) are firmly in accumulation mode, according to Glassnode data. While in the first four months of the year, all cohorts were in deep distribution, which contributed to bitcoin’s 30% decline to $76,000 in April during the so-called tariff tantrum. This data highlights a clear divide between whales and the rest of the market participants and for now, it appears the whales are still steering the price action. Source:.

It’s the first time since 2014 that Halloween has fell on a Friday in what is expected to be horrific for the weekend box office. For the most part, the audience is expected to shrink greatly on Friday due to festivities, though a scary movie like Black Phone 2 might be able to find some [.].

The Cat Distribution System is a truly interesting thing. It tends to strike when we least expect it and when it does, it does so in a way that makes all life around it stop. Frozen in time as our attention is devoted to the cute catto that has been brought forth to be our fur baby until the end of time. Which is pretty much what happened to one woman as she was trying to make her way to work. A rather ironic way for the CDS to operate seeing as it is rather well-known that cats encourage their pawrents to go to work and to work hard so that they can provide them with the fanciest treats in the land, making this story quite the standout. So we invite you to sit back, relax and thank your lucky stars that you were not the one who had to explain to their boss that they could not come in on account of a cat that had suddenly come to command their life. Is your inbox feline too professional? Add some cats falling off counters. Subscribe here!.