The post Best Crypto to Buy Now? Mutuum Finance firmly on investors’ radars as one of the top cryptos to buy right now, particularly as it hastens towards an important development phase. With its presale crossing the $19 million mark in no time and Phase 6 almost out, investor interest is pouring in far faster than analysts expected. Tapping at $0. 035, Mutuum Finance (MUTM) is making waves for its cutting-edge DeFi approach to crypto, tackling decentralized lending, borrowing, and interest tokens uniquely crafted to reward its earliest supporters. The hype over its imminent V1 testnet launch on Sepolia is only pouring more fuel on this fire, solidifying its position within the DeFi space as a leading DeFi crypto and the best crypto to buy now for early-stage investors. MUTM Presale Phase 6: Final Window for Strategic Investors Mutuum Finance is quickly emerging as one of the most heavily anticipated token sales that this year has to offer. Stage 6 of presale, priced at $0. 035 per token, is the last stage prior to its price increase to $0. 04 in Stage 7. To ensure simplicity in entry, MUTM has introduced support for Credit and Debit Card payments, making entry into this investment opportunity seamless for both new and veteran investors in cryptocurrencies. As its fundamentals continue to look good and its adoption increases, MUTM is poised to emerge as the top DeFi crypto and the best crypto to buy now for investors seeking exposure before the next phase. Sepolia Testnet: Full DeFi Features Testing One of the most important milestones in the near future is to launch the full lending and borrowing protocol for Mutuum Finance on Sepolia testnet, which is expected to happen in Q4 2025. It will initially support ETH, USDT, mtTokens, debt tokens, and automatic liquidation,.

Tag: decentralized

The post FanHub Revolutionizes Sports Fandom Economy with Avalanche Blockchain appeared com. Felix Pinkston Nov 18, 2025 02: 16 FanHub introduces a decentralized platform using Avalanche blockchain to transform sports fandom into a dynamic economy, providing tangible rewards and opportunities for fans and businesses. FanHub, a pioneering platform in the Fantech space, is set to revolutionize the sports fandom landscape by leveraging decentralized technology. According to Avax. network, this innovative platform aims to create an organic economy where new value flows are established between fans, teams, and brands. The Broken Traditional Model For over a century, the sports business model has seen little evolution, with fans contributing passion and money primarily benefiting broadcasters and social platforms. Traditional sponsorships focus on brand awareness without clear ROI, often excluding smaller businesses. FanHub seeks to disrupt this model by turning fan engagement into a transaction layer that offers tangible rewards, democratizing access for smaller businesses. Addressing Fan Needs Fans often seek recognition and tangible benefits, yet the current system provides little in return. Traditional sponsorships are costly and designed for large brands, leaving small and midsized businesses at a disadvantage. FanHub addresses these issues with a mobile-first, gamified app that generates economic value from fan interactions. Features include match check-ins, lineup predictions, and fan stats, all verified on the Avalanche blockchain. Innovative Offerings FanHub rewards users with LYLTY Points, redeemable for a variety of incentives such as free merchandise, partner discounts, and soon, vouchers with major food delivery apps. Businesses can also join as LYLTY Partners, allowing them to offer loyalty rewards to customers without upfront costs. This infrastructure has been approved by major financial institutions like Visa, Mastercard, and American Express, ensuring a seamless user experience. Expanding Market Reach The platform targets a vast £0. 5 trillion market encompassing sports betting, sponsorship, and fan travel. FanHub has strategically focused.

The post Algorand ’s October 2025 report highlights growth in user engagement and developer activity despite a decline in DeFi metrics, reflecting broader market trends. Algorand (ALGO)’s October 2025 ecosystem insights reveal a month of mixed outcomes, characterized by increased user engagement and developer activity, alongside a notable decline in decentralized finance (DeFi) metrics, according to the Algorand Foundation. Despite broader market challenges, the blockchain network demonstrated resilience and growth. Key Metrics and Growth In October, Algorand saw a 20. 3% rise in monthly active addresses, reaching 909, 000. This uptick was largely driven by new ecosystem initiatives, such as Algoland and participating decentralized applications (dApps). The number of new assets created on the Algorand network surged by 54. 3%, while smart contracts deployed increased by 8. 3%, indicating robust developer engagement. The overall network expansion was marked by a 1. 5% increase in wallets, totaling 47. 8 million, and a near 2% rise in transactions, surpassing 3. 3 billion. Node count remained stable with a slight increase of 0. 7%, reinforcing Algorand’s decentralization and network health. DeFi and Social Metrics Despite these positive developments, Algorand’s total value locked (TVL) in DeFi dropped by 16. 3% to approximately $140 million, reflecting broader market trends. Social media engagement showed consistent growth, with followers on platforms such as X, YouTube, and Instagram increasing modestly. Tokenomics and Staking By the end of October, the circulating supply of Algorand’s native token, ALGO, reached 8. 79 billion, representing 87. 9% of the total maximum supply. This marks a 0. 11% increase from the previous month. During the first ten months of 2025, validators received a total of 56. 20 million ALGO in staking rewards, highlighting the network’s ongoing reward distribution and fee-driven activity. Foundation’s Activities and Governance Algorand Foundation’s CEO, Staci Warden, participated in key industry.

The post BlackRock Launches Expansion Of $2. 5 Billicom. BlackRock Launches Expansion Of $2. 5 Billion BUIDL Fund Into Binance And BNB Chain | Bitcoinist. com Sign Up for Our Newsletter! For updates and exclusive offers enter your email. Ronaldo is a seasoned crypto enthusiast with over four years of experience in the field. He is passionate about exploring the vast and dynamic world of decentralized finance (DeFi) and its practical applications for achieving economic sovereignty. Ronaldo is constantly seeking to expand his knowledge and expertise in the DeFi space, as he believes it holds tremendous potential for transforming the traditional financial landscape. This website uses cookies. By continuing to use this website you are giving consent to cookies being used. Visit our Privacy Center or Cookie Policy. I Agree Source:.

The post Hyperliquid Faces a Staggering $4. 9 Millicom. On Wednesday, Hyperliquid faced an unexpected financial hit amounting to $4. 9 million due to extreme fluctuations in the price of POPCAT. Blockchain analytics platform Lookonchain revealed that these fluctuations involved intentional price manipulation, exposing the vulnerability of liquidity in decentralized derivative markets. Continue Reading: Hyperliquid Faces a Staggering $4. 9 Million Setback Source:.

The post new era for DeFi or ‘a sad day for DAOs’? appeared com. Uniswap founder Hayden Adams yesterday announced his proposal to activate the long-awaited UNI fee-switch on the decentralized finance (DeFi) sector’s leading exchange. Widely expected to pass this time, the move would mark a significant milestone for DeFi. but not everyone is convinced. The proposal The proposal would see a portion of fees, which currently go to liquidity providers (LPs), redirected to the buy-and-burn of UNI. For most pools, this would be a sixth of the total fees, with some of the lower tiers coughing up 25%. One hundred million UNI will be burned to represent the amount that “would have been burned if fees were on from the beginning.” Sequencer fees from Unichain will also go towards the UNI burn, while other features would look to earn fees on external pools and capture MEV on the protocol. The wildly unpopular front-end fees which have, to date, made almost $180 million for Uniswap Labs, will be abolished. > As part of this, Labs will stop collecting fees on its interface, wallet, and API to supercharge distribution and adoption of the Uniswap protocol llama didnt expect this ngl 0xngmi is hiring (@0xngmi) November 10, 2025 Read more: Uniswap’s new trading fee neglects UNI holders Despite multiple fruitless attempts, the UNI fee-switch has yet to make it across the finish line. Legal worries have often been cited as a reason to hold back; Adams refers to this as “a hostile regulatory environment that cost thousands of hours and tens of millions in legal fees.” The Trump Administration’s more permissive regulatory landscape may have eased earlier nerves. Coming this time from founder Adams (who talks as if it’s a done deal), it.

The post Solana News: Rothschild and PNC Financial Disclose SOL ETF Holdings com. Rothschild and PNC disclose holdings in Solana ETF as $336M flows into Solana ETFs, signaling growing institutional interest in SOL. Rothschild Investment and PNC Financial Services have disclosed their holdings in the Solana ETF. This news comes as spot Solana ETFs continue to show strong inflows, despite the volatility in the broader crypto market. These disclosures signal growing interest from traditional financial institutions in Solana, further highlighting the growing adoption of the cryptocurrency. Rothschild Investment’s Move into Solana ETF Rothschild Investment, a major player in traditional finance with $1. 5 billion in assets under management, has revealed its holdings in the Volatility Shares Solana ETF (SOLZ). According to the latest filing with the U. S. Securities and Exchange Commission, Rothschild has acquired 6, 000 shares in the ETF, valued at approximately $132, 720. This marks a strategic move into Solana, which has been gaining traction as a promising blockchain network for decentralized applications. Rothschild’s involvement in the Solana ETF is part of a broader trend of institutional interest in crypto-based investment products. The firm already holds shares in other prominent crypto ETFs, such as the BlackRock iShares Bitcoin ETF (IBIT) and Grayscale Ethereum ETF (ETHE). This latest investment highlights the growing confidence in Solana’s potential as part of diversified crypto portfolios. Increased Interest in Solana as an Investment The interest from Rothschild and PNC Financial Services follows a trend of growing institutional investment in Solana. Investors have been increasingly shifting their attention from Bitcoin ETFs to Solana, drawn by the higher staking rewards offered through Solana ETFs. The Bitwise Solana Staking ETF (BSOL) and Grayscale Solana ETF (GSOL) have seen notable inflows in recent weeks, further reflecting the growing interest in Solana. Reports indicate that the Bitwise Solana Staking ETF has received over $323 million in inflows, with the Grayscale Solana ETF also.

The post Explore Tezos Innovations at TezDev 2026 @ EthCC 9 Cannes appeared com. TezDev 2026 TezDev 2026 @ EthCC 9 Cannes Location: Hôtel Martinez The Unbound Collection by Hyatt, 73 Bd de la Croisette, FranceDate: Mon, Mar 30 Mon, Mar 30, 2026Time: 12: 00 PM 08: 00 PM (UTC+02: 00) Central European Summer TimeEvent Type: Web3 ConferenceOfficial Website: Event Overview Join the Tezos community in Cannes on March 30 for TezDev 2026, a one-day event that dives into all that’s in motion across the ecosystem. The event promises another day of builders, art, and ambitious ideas by the sea. If TezDev 2025 was any indication, expect a packed agenda filled with substance, not spectacle. Kindly note that the dress code at the Hotel Martinez excludes beachwear such as flip-flops. Why Attend? Engage with the vibrant Tezos community and explore cutting-edge innovations. Participate in thought-provoking discussions and art showcases by the sea. Connect with fellow enthusiasts at a side event to the Ethereum Community Conference. Gain insights into the future of Web3 and decentralized technologies. Key Highlights Speakers: TBA Sessions: Focused on innovation, art, and community building in the Tezos ecosystem. Topics Covered: Emerging trends in Web3, blockchain applications, community-driven initiatives. Special Features: Networking opportunities, side events, and rich cultural experiences. FAQs What is TezDev 2026 @ EthCC 9 Cannes? TezDev 2026 is a pivotal Web3 conference that brings together the Tezos community to explore advancements and network within the ecosystem. When and where is it held? Mon, Mar 30 Mon, Mar 30, 2026, 12: 00 PM 08: 00 PM, at Hôtel Martinez The Unbound Collection by Hyatt, 73 Bd de la Croisette, France. Who should attend? The event is ideal for blockchain developers, artists, entrepreneurs, and anyone interested in the future of decentralized technologies. What topics are discussed? The event will cover key topics such as blockchain innovation, the role of art in tech, and.

Key Points 21RP ETF would trade on Cboe [.] The post 21RP ETF Nears Launch as SEC Timer Starts appeared first on Coindoo.

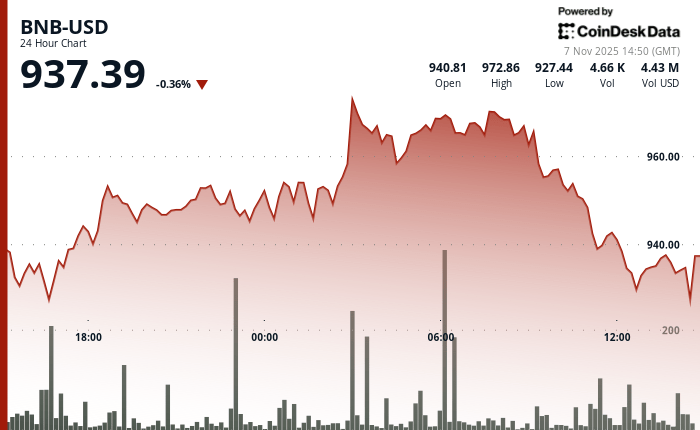

The post BNB Drops to Key Support Level Above $930 as Markets React to Liquidity Pressures appeared com. The native token of the BNB Chain, BNB, slipped slightly over the last 24-hour period, moving to $933 after briefly surging to $974, as broader crypto markets showed signs of stress tied to tightening financial conditions. The token’s price action played out in a narrow $46 range. Volume rose sharply during the morning’s move higher, 71% above the 24-hour average, but cooled into the close according to CoinDesk Research’s technical analysis data model. The rejection near $975 marked a technical ceiling, while BNB found support once again near $930. “BNB’s ability to hold support mirrors the broader strength we’re seeing on-chain,” Johnny B., the founder of BNBPad. ai, told CoinDesk in an emailed statement. “Despite the market headwinds, BNB Chain saw 82 million active addresses in October, a new all-time high, while DEX volumes neared $120 billion based on DeFiLlama.” BNB’s muted performance came along a wider market drawdown. 9% in the last 24 hours while bitcoin is struggling to remain above $100,000. A U. S. Treasury cash rebuild and falling bank reserves, down an estimated $500 billion since July, have drained capital from markets and made risk assets less attractive, according to a recent report from Citi. That has seen stocks fall as well, with the tech-heavy Nasdaq 100 seeing a 4. 7% decline this week, and the S&P 500 dropping by 2. 7%. In this environment, BNB’s ability to stay above its key $930 support level may reflect confidence in the network’s adoption and the performance of newer decentralized applications like Asper, even as the broader outlook dims. A break above $975 could reopen the path toward recent highs, but further downside in major assets could test buyers’ resolve. BNB remains tied to technical setups for now, but broader.