SDI Limited (SDLDF) Shareholder/Analyst Call Transcript

Tag: consolidation

Uniswap trades at $6. 48 following whale’s $11. 7M loss liquidation, testing technical support after 35% surge from fee burn proposal momentum fades. (Read More).

TLDR Coinbase has ended acquisition talks with UK-based stablecoin startup BVNK after reaching an exclusivity agreement in October. The deal was valued between $1. 5 billion and $2. 5 billion, which would have been one of the largest in digital payments history. Coinbase was reportedly leading the bidding ahead of Mastercard before talks were called off. Both [.] The post Coinbase (COIN) Stock: Exchange Ends $2 Billion BVNK Acquisition Talks appeared first on CoinCentral.

The post PEPE Price Prediction: Technical Analysis Points to $0. 0000048-$0. 0000061 Range Through December 2025 appeared com. Lawrence Jengar Nov 08, 2025 09: 20 PEPE price prediction shows mixed signals with analyst targets ranging $0. 0000048-$0. 0000061. RSI at 40. 49 suggests potential upside despite recent bearish momentum. The meme coin sector continues to capture trader attention, with Pepe (PEPE) showing intriguing technical patterns that warrant detailed analysis. Based on current market dynamics and recent analyst predictions, PEPE appears positioned for a period of consolidation with defined upside and downside targets. PEPE Price Prediction Summary • PEPE short-term target (1 week): $0. 0000053-$0. 0000057 (±8-12% from current levels) • Pepe medium-term forecast (1 month): $0. 0000048-$0. 0000061 trading range • Key level to break for bullish continuation: $0. 0000061 • Critical support if bearish: $0. 0000048 Recent Pepe Price Predictions from Analysts The latest PEPE price prediction landscape reveals a notably divided analyst community. Changelly has maintained a consistently bearish stance over the past week, progressively lowering their price targets from $0. 00000597 on November 4th to $0. 00000487 by November 8th. This represents a systematic downward revision of approximately 18% across their forecasting period. In contrast, AMB Crypto has demonstrated remarkable consistency in their Pepe forecast, maintaining an average target of $0. 0000057 with a tight trading range between $0. 0000053-$0. 0000061. This stability in their predictions suggests confidence in their technical framework and indicates they view current price levels as fair value. The divergence between these analytical approaches creates an interesting dynamic. While Changelly’s progressive bearishness reflects momentum-based technical analysis pointing to continued weakness, AMB Crypto’s range-bound Pepe forecast suggests the token has found equilibrium within established technical boundaries. PEPE Technical Analysis: Setting Up for Range-Bound Consolidation The current Pepe technical analysis reveals several compelling indicators that support a consolidation scenario rather than a strong directional breakout. The RSI reading of 40. 49 positions PEPE in neutral territory, neither oversold nor overbought, which.

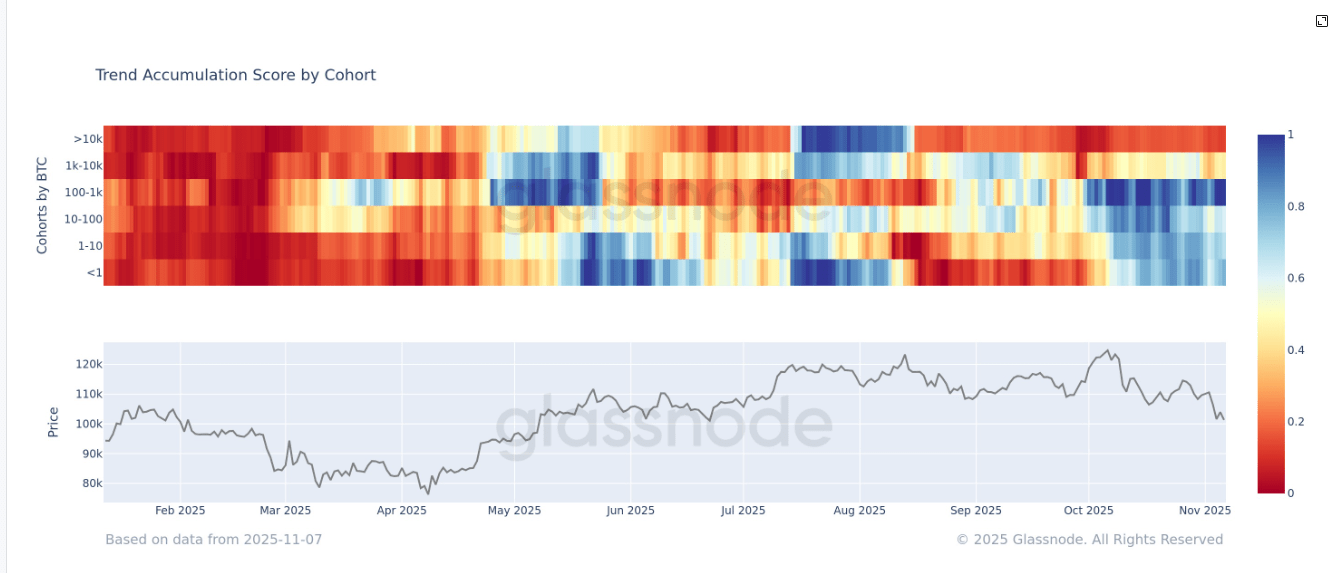

The post Whales Dump While the Rest Accumulate appeared com. Bitcoin BTC$102,272. 80 remains only marginally positive year-to-date, suggesting 2025 has been a period of consolidation as the asset stabilizes around the $100,000 level. Much of the recent price weakness appears linked to previously dormant coins re-entering circulation, per onchain data. Large holders, commonly known as whales, have been the primary distributors, driving the current downward pressure on price, according to The Accumulation Trend Score (ATS) by Glassnode. ATS measures the relative accumulation or distribution behavior across different wallet cohorts, accounting for both the size of entities and the volume of coins they have acquired over the past 15 days. A value near 1 suggests that participants in that cohort are actively accumulating. A value near 0 indicates that they are distributing holdings. Exchanges, miners, and certain other entities are excluded from the calculation. Whales holding over 10, 000 BTC have been consistent sellers since August, marking three months of sustained distribution. Meanwhile, wallets in the 1, 000-10, 000 BTC range remain neutral around a score of 0. 5, while all smaller cohorts (below 1, 000 BTC) are firmly in accumulation mode, according to Glassnode data. While in the first four months of the year, all cohorts were in deep distribution, which contributed to bitcoin’s 30% decline to $76,000 in April during the so-called tariff tantrum. This data highlights a clear divide between whales and the rest of the market participants and for now, it appears the whales are still steering the price action. Source:.

The post BNB Price Prediction: Targeting $1,150-$1,200 Rally Within 2 Weeks Despite Mixed Signals appeared com. Alvin Lang Nov 02, 2025 07: 10 BNB price prediction points to $1,150-$1,200 targets over the next two weeks, with current technical analysis showing bullish potential above $1,100 support level. BNB Price Prediction Summary • BNB short-term target (1 week): $1,150 (+5. 4% from current levels) • Binance Coin medium-term forecast (1 month): $1,100-$1,250 range with bias toward upper end • Key level to break for bullish continuation: $1,180 (Bollinger Band upper resistance) • Critical support if bearish: $1,041 (Bollinger Band lower support) Recent Binance Coin Price Predictions from Analysts The latest BNB price prediction consensus from major analysts shows remarkable alignment around the $1,070-$1,157 range for short-term targets. CoinLore’s forecasts have consistently targeted the $1,058-$1,072 range over the past three days, while AMB Crypto maintains a more bullish Binance Coin forecast with targets between $1,145-$1,157. This convergence around the $1,150 level is particularly significant given that it aligns with key technical resistance zones. The medium confidence ratings from analysts suggest cautious optimism, likely reflecting the mixed technical signals currently present in BNB’s chart structure. What stands out in these predictions is the consistent upward bias despite current bearish momentum indicators, suggesting analysts are positioning for a technical bounce from current support levels. BNB Technical Analysis: Setting Up for Consolidation Breakout The current Binance Coin technical analysis reveals a cryptocurrency caught between competing forces. Trading at $1,091. 25, BNB sits strategically positioned within its Bollinger Bands at the 0. 36 position, indicating room for upward movement toward the upper band at $1,179. 68. The moving average structure tells a compelling story for medium-term bulls. While BNB trades below the 7-day SMA ($1,100. 54) and 20-day SMA ($1,110. 64), it maintains crucial support above the 50-day SMA ($1,090. 89). Most importantly, the massive 34. 9% gap above the 200-day SMA ($809. 85) confirms.

The post Solana, Cardano and XRP Slide as Remittix Extends Its Winning Streak appeared com. Solana, Cardano, and XRP are once again under serious pressure this week, as investors brace for more swings in the market. While these major altcoins are trying to find their footing, Remittix keeps stealing the spotlight. This PayFi token continues improving with new listings strong growth, and a real-world use case that is already turning some heads. In a sea of uncertainty, Remittix (RTX) is trying to prove that real utility still beats temporary hype. Solana Price Outlook Shows Consolidation Phase Ahead The price of SOL has dropped to around $186, charting a loss of around 3. 6% amid a weak broader market. Even with over $117 million in ETF inflows from Grayscale and Bitwise, SOL’s price today remains well below the $200 level, suggesting that traders are cautious. The rally that followed the news of the ETF has apparently cooled down as institutions are seemingly taking profits. Technical indicators are also relatively mixed, with the RSI sitting at 47 and MACD currently in negative territory. Data also shows reduced holding among long-term investors, which also suggests some mild profit-taking. For now, SOL’s price action remains rather neutral, according to the popular analyst Ali Martinez. Traders are closely watching the $192-$206 range. Any move beyond that would open the door to $237, whereas any fall would direct the prices to $182. Cardano Price Struggles To Hold Key Support Amid Market Downturn The Cardano (ADA) price is trading near $0. 61. So far, it the buyers have been able to defend the crucial support of $0. 58 successfully. Analysts believe that a break below it may result in the ADA price falling to as low as $0. 54 or even less. Most of the analysts remain cautious, even as the project rolls out governance upgrades under the Voltaire model. The current price action points to.

TLDR Dogecoin traded between $0. 176 and $0. 189 amid a 7% intraday swing. Whales sold about 360M DOGE worth $74M during the tariff-led drop. Strong buying near $0. 18 created a key support zone through the session. Resistance remains near $0. 19 as traders await signals for the next move. Dogecoin steadied on Friday after a sharp morning [.] The post Dogecoin Finds Support Near 0. 18 After Tariff-Led Selloff and Price Swing appeared first on CoinCentral.

The post Crypto Market Correction Deepens: On-Chain Data Points to Capitulation-What’s Next? appeared first 8 trillion, down nearly 5% in 24 hours. Bitcoin price dropped below the $110,000 barrier, while Ethereum price dropped below $4000. This correction follows a wave of global macro uncertainty-including renewed U. S.-China trade tensions, stronger dollar momentum, and rising bond.