The post China’s CPI Rises 0. 2% in October, Signaling Potential Consumer Recovery appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → China’s October CPI rose 0. 2% year-on-year, signaling a slight uptick in consumer inflation that could influence global cryptocurrency markets by stabilizing investor sentiment in Asia, the world’s largest crypto trading hub. Consumer Price Index (CPI) increased 0. 2% year-on-year, the first positive reading since June, breaking deflationary trends. Monthly CPI also climbed 0. 2%, driven by holiday spending on travel and goods, exceeding analyst forecasts. Producer prices fell 2. 1% annually, with manufacturing activity contracting to a six-month low, per National Bureau of Statistics data. China’s October inflation data shows a modest CPI rise, impacting crypto markets amid trade truces. Explore how this shift affects Bitcoin and altcoins-stay informed on global economic influences today. What is the Impact of China’s October Inflation Data on Cryptocurrency Markets? China’s October inflation data revealed a consumer price index (CPI) increase of 0. 2% year-on-year, marking the first positive reading since June and the strongest since January, according to the National Bureau of Statistics. This slight uptick ends months of deflationary pressures and could bolster confidence in Asian markets, where cryptocurrency trading volumes remain significant despite regulatory.

Tag: bitcoin

21Shares Sparks 20-Day Countdown with New Filing for Spot XRP ETF

The post Crypto News: Expert Targets $16 in ICP Price Prediction Amidst 214% Breakout appeared com. Internet Computer coin just delivered its biggest move in years, jumping 214% in a single week and snapping a long, painful downtrend. After spending nearly four years grinding lower, the token finally broke out of a massive descending wedge a move that often signals the start of a lasting reversal. Right now, ICP is trading around $9. 64, up from the $2-$3 range where it lingered for most of 2023 and early 2024. That breakout has shattered the bearish pattern that’s dominated the chart since the token’s $700 peak back in 2021. With momentum building and trading volume spiking, the market’s next focus is clear: $16, a key Fibonacci level that marks the first serious resistance on the way up. A clean break above that zone could open the path toward $24.

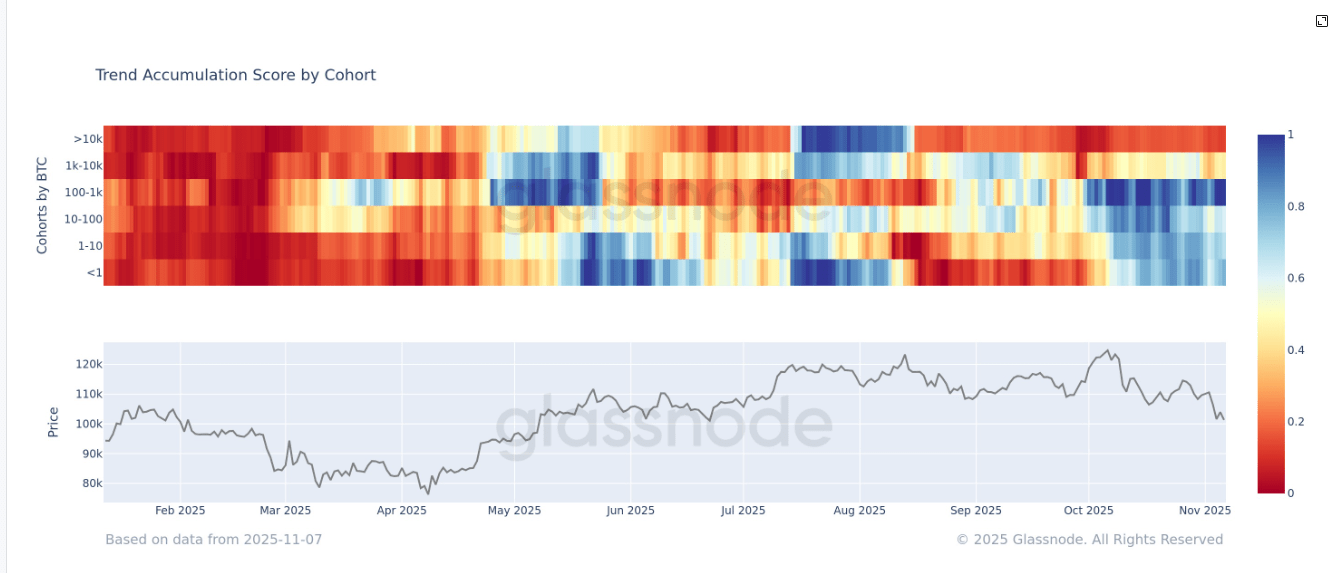

The post Whales Dump While the Rest Accumulate appeared com. Bitcoin BTC$102,272. 80 remains only marginally positive year-to-date, suggesting 2025 has been a period of consolidation as the asset stabilizes around the $100,000 level. Much of the recent price weakness appears linked to previously dormant coins re-entering circulation, per onchain data. Large holders, commonly known as whales, have been the primary distributors, driving the current downward pressure on price, according to The Accumulation Trend Score (ATS) by Glassnode. ATS measures the relative accumulation or distribution behavior across different wallet cohorts, accounting for both the size of entities and the volume of coins they have acquired over the past 15 days. A value near 1 suggests that participants in that cohort are actively accumulating. A value near 0 indicates that they are distributing holdings. Exchanges, miners, and certain other entities are excluded from the calculation. Whales holding over 10, 000 BTC have been consistent sellers since August, marking three months of sustained distribution. Meanwhile, wallets in the 1, 000-10, 000 BTC range remain neutral around a score of 0. 5, while all smaller cohorts (below 1, 000 BTC) are firmly in accumulation mode, according to Glassnode data. While in the first four months of the year, all cohorts were in deep distribution, which contributed to bitcoin’s 30% decline to $76,000 in April during the so-called tariff tantrum. This data highlights a clear divide between whales and the rest of the market participants and for now, it appears the whales are still steering the price action. Source:.

The post VCs pour $5. 1B into crypto firms while Bitcoin’s ‘Uptober’ whiffed appeared com. October closed roughly 4% down for Bitcoin, yet venture funding hit $5. 1 billion in the same month, the second-strongest month since 2022. According to CryptoRank data, three mega-deals account for most of it, as October defied its own seasonal mythology. Bitcoin fell 3. 7% during a month traders have nicknamed “Uptober” for its historical winning streak, breaking a pattern that had held since 2019. Yet venture capitalists deployed $5. 1 billion into crypto startups during the same 31 days, marking the second-strongest monthly total since 2022 and the best VC performance of 2025 aside from March. The divergence between spot market weakness and venture market strength creates a puzzle, where either builders see something that traders have missed, or a handful of enormous checks have distorted the signal. The concentration tells most of the story. Three transactions account for roughly $2. 8 billion of October’s total of $5. 1 billion: Intercontinental Exchange’s (ICE) strategic investment of up to $2 billion in Polymarket, Tempo’s $500 million Series A round led by Stripe and Paradigm, and Kalshi’s $300 million Series D round. CryptoRank’s monthly data shows 180 disclosed funding rounds in October, indicating that the top three transactions account for 54% of the total capital deployed across fewer than 2% of deals. The median round size is likely in the single-digit millions. Removing Polymarket, Tempo, and Kalshi from the calculation would shift the narrative from “best month in years” to “steady but unspectacular continuation of 2024’s modest pace.” The “venture rebound” narrative depends heavily on whether people count a strategic acquisition play by the New York Stock Exchange’s parent company and two infrastructure bets as representative of broader builder confidence or as outliers that happened to close in the same reporting window. October 2025’s $5. 1 billion in crypto venture funding marked the second-highest monthly total since 2022, surpassing.

Quick Facts: ➡️ Bitcoin is trading at $104K after it broke the critical support at $106K, with the next support at $100K. ➡️ Weakening tech stocks have further aggravated today’s bloodbath, with top stocks seen as no longer reflecting fundamentals. ➡️ Despite the news, there are still buying opportunities, especially among the best crypto presales [.].

The post Is the Bitcoin price heading for its worst Q4 since 2022? appeared com. Can the Bitcoin price recover its momentum after October’s reversal, or will Q4 extend its weakest run since 2022? Summary Bitcoin price has tumbled nearly 15% after hitting $126,000 in early October, breaking its winning streak and setting a weak tone for Q4. Trade tensions between the U. S. and China, a stronger dollar, and slower Fed easing weighed on markets, pulling Bitcoin back near $108,000. Central banks added liquidity and eased tariffs to calm markets, but the impact was short-lived as investors stayed cautious through early November. Analysts now see $107,000 as Bitcoin’s key support, warning that a break below could trigger deeper losses in an already fragile Q4. Bitcoin price breaks the Uptober streak Bitcoin entered October with confidence, extending a powerful rally that lifted prices to a record high above $126,000 on Oct. 6. What followed was a sharp and sudden pullback. Within days, prices dropped more than 17 %, reaching about $104,500 between Oct. 10 and 11. The month closed with Bitcoin (BTC) down roughly 3. 6 %, marking its first negative October since 2018. As of Nov. 3, it trades near $108,000, around 14. 5 % below its monthly peak. news The decline stemmed from several connected global developments. The U. S.-China trade confrontation intensified after Washington imposed 100 % tariffs and introduced new restrictions on software exports. The move sparked heavy liquidations across crypto markets and dampened investor risk appetite. At the same time, the Federal Reserve signaled that it may slow the pace of interest rate cuts. That stance strengthened the dollar and increased the appeal of yield-bearing assets, putting additional pressure on Bitcoin, which produces neither interest nor dividends. Another factor is Bitcoin’s deeper integration with traditional finance. In past cycles, Bitcoin often moved independently of global markets. Today, institutional trading, ETF flows, and broader.

The post Why Is the Crypto Market Down Today, On Nov 3? appeared com. The post Why Is the Crypto Market Down Today, On Nov 3? appeared first Bitcoin, Ethereum, and major altcoins experienced over 10% declines, resulting in more than $400 million in liquidations within 24 hours. But what’s really driving this sudden downturn? Fed Official Hints at No Further Rate Cut One of the main reasons behind today’s drop is renewed caution from the U. S. Federal Reserve. After cutting rates by 25 basis points in October, Powell said another cut in December isn’t “a foregone conclusion,” boosting the U. S. dollar and cooling investor sentiment. Even Treasury Secretary Scott Bessent also warned that tight policies have already slowed parts of the economy, leaving limited room for more cuts ahead. Even the FedWatch Tool now shows the probability of another rate cut has fallen to 69. 3%, reflecting growing doubts about further policy easing. Bitcoin ETFs See Billions in Outflows Adding to the pressure, Bitcoin ETFs continue to see heavy outflows. Recent data from Fairside shows that U. S. spot Bitcoin ETFs recorded $1. 15 billion in withdrawals last week alone. The largest outflows came from funds managed by BlackRock, ARK Invest, and Fidelity, suggesting investors are pulling back from Bitcoin-linked financial products. Long Liquidations Deepen the Sell-Off The fall of Bitcoin below $107, 500 triggered a chain reaction of long liquidations worth nearly $400 million, with over 162, 000 traders wiped out in a day. Bitcoin alone saw $74. 6 million in long positions liquidated, while Ethereum accounted for $85. 6 million. This rapid liquidation has intensified the downward momentum, and now analysts warn that if BTC breaks below $106, 000, another wave of $6 billion in liquidations could follow. Altcoins Hit Harder Than.