This 1955 Porsche 356 Speedster is powered by a replacement 1. 6-liter SC flat-four paired with a four-speed manual transaxle and is finished in ivory over black leather. Equipment includes a black canvas soft top, 15″ steel wheels, body-color bumpers, and fixed-back bucket seats. The car was purchased by the current owner in 2021 and was previously listed on BaT in August 2025. Work has since involved replacing the fender badge and hubcaps as well as repairing the seat bases. This Speedster is now offered on dealer consignment by the selling dealer, a Local Partner, with a spare engine, manufacturer’s literature, a Reutter Certificate of Production, a tool kit, black California license plates, side curtains, and a clean California title.

Tag: approximately

Black Friday is quickly approaching, offering a valuable opportunity to connect with customers in meaningful ways. As you begin planning your holiday marketing, taking a look at last year’s trends and performance can spark stronger ideas and help you shape campaigns that truly resonate this season. What you’ll learn: • Key shopping and spending trends [.].

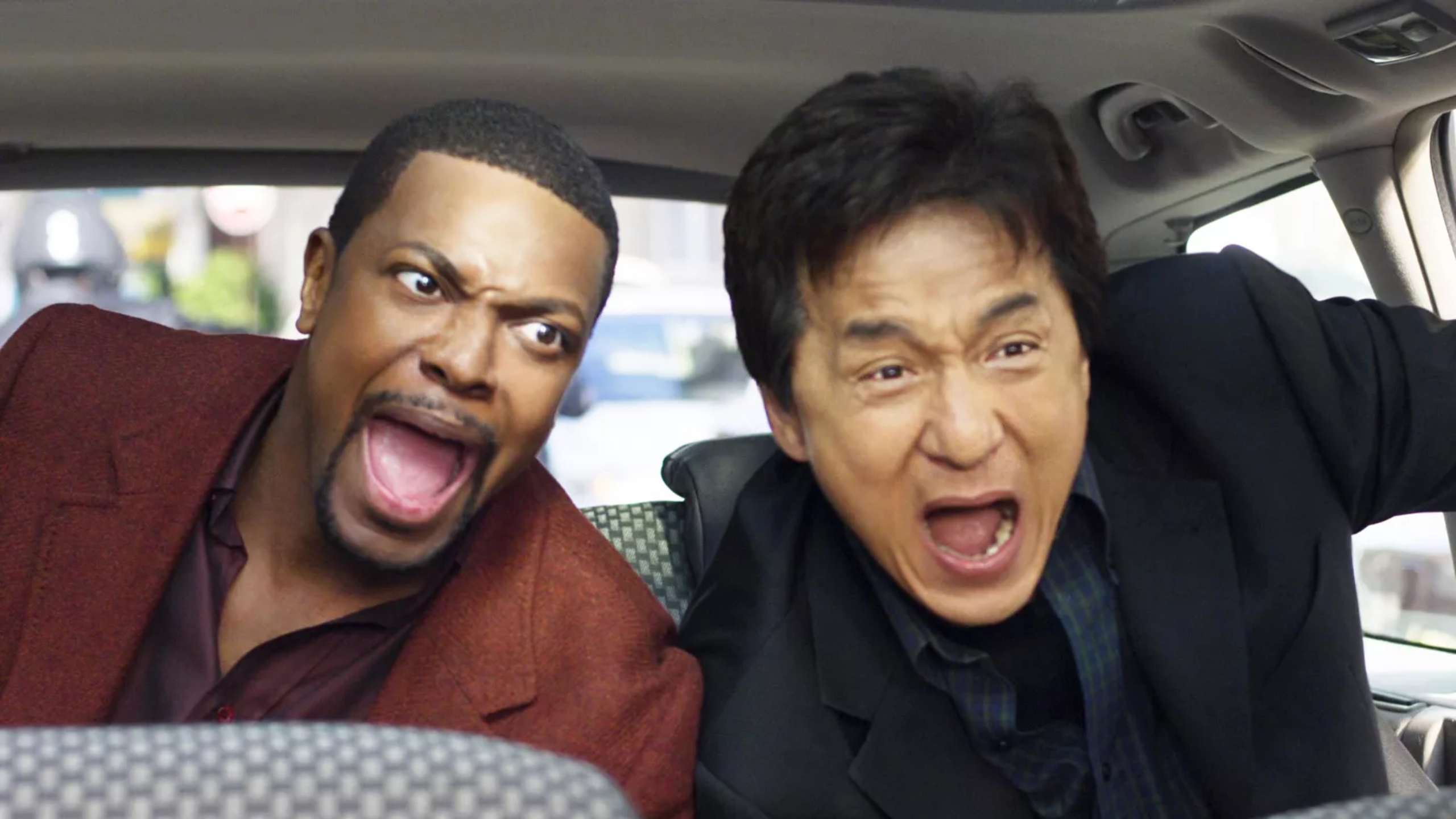

Paramount picks up Rush Hour 4 after Donald Trump reportedly urged its return, reuniting Jackie Chan, Chris Tucker and director Brett Ratner.

The Prince of Wales is in North Wales, highlighting the help available for young people in coastal areas.

The post Ethereum News: 2- Ethereum’s Fate Hangs com. The future of Ethereum lies in the support zone since the whales are piling up. Recent treasury purchases, price risk, and estimates within. Ethereum is currently balancing on one very important support level as retail and institutional traders rush to unravel the short-term destiny of the asset. The market crash of the recent past created shockwaves throughout the crypto universe. A few industry observers are of the opinion that a fall below the current support might increase the declines. Others regard big players as preparing a dramatic turnaround. Treasury Whales Move Aggressively What’s the Endgame? Bitmine, the largest Ethereum treasury, has not been scared of price volatility. A post by CoinBureau on X argues that a wallet most likely associated with Bitmine recently purchased 21, 537 ETH at approximately $59. 17 million at approximately 2, 750 per ETH, indicating a firm belief in buying the dip. Source -CoinBureau on X This is part of the continuous scaling up of Ethereum investments, despite its volatile prices, by Bitmine. Bitmine is still actively accumulating, with data on blockchain showing that it currently owns approximately 3. 5 million ETH, worth approximately 10 billion. These institutional plays have been recorded by on-chain analytics and reputable X sources, indicating that there was a significant departure from retail panic. Bitmine is on an acquisition spree despite billions of unrealized losses made over the recent past. You might also like: ETH Price Prediction: Ethereum Leverage Hits All-Time High at $3,000 Amid $74M ETF Outflows One Critical Support Why It Matters for Ethereum’s Price The focal interest now is the price support of Ethereum in the 2750-2900 range. Price analysts are alerting that falling below this shelf may lead to cascading liquidation, and Ethereum will suffer the risk of falling further, with worst-case scenario targets at as low as 2, 400.

City of Hope and UCI Health-Irvine will open their doors in early December, with Hoag following suit next year. What does it take to staff such a hospital boom?.

Uniswap trades at $6. 48 following whale’s $11. 7M loss liquidation, testing technical support after 35% surge from fee burn proposal momentum fades. (Read More).

TLDR: Owen Gunden liquidates 11, 000 BTC, totaling $1. 3B, after 14-year holding period. Final 2, 499 BTC worth $228M transferred to Kraken, completing the historic sell-off. Bitcoin drops below $86K, marking a 32% fall from its October $126K peak. BTC 24-hour trading volume exceeds $101B, with a weekly decline of over 12%. Bitcoin has fallen below $86, 000 [.] The post OG Bitcoin Whale Exits $1. 3B Holdings as BTC Drops Below $86K appeared first on Blockonomi.

Illegal Alien Released by Biden, Charged in Hammer Attack on Texas Jogger [WATCH]