The post BlackRock Launches Expansion Of $2. 5 Billicom. BlackRock Launches Expansion Of $2. 5 Billion BUIDL Fund Into Binance And BNB Chain | Bitcoinist. com Sign Up for Our Newsletter! For updates and exclusive offers enter your email. Ronaldo is a seasoned crypto enthusiast with over four years of experience in the field. He is passionate about exploring the vast and dynamic world of decentralized finance (DeFi) and its practical applications for achieving economic sovereignty. Ronaldo is constantly seeking to expand his knowledge and expertise in the DeFi space, as he believes it holds tremendous potential for transforming the traditional financial landscape. This website uses cookies. By continuing to use this website you are giving consent to cookies being used. Visit our Privacy Center or Cookie Policy. I Agree Source:.

Tag: applications

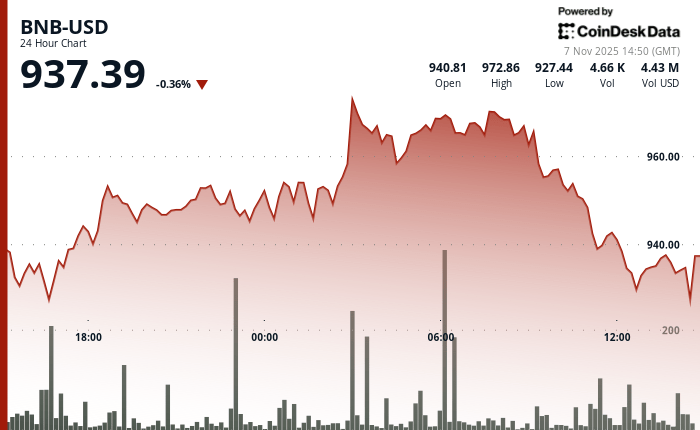

The post BNB Drops to Key Support Level Above $930 as Markets React to Liquidity Pressures appeared com. The native token of the BNB Chain, BNB, slipped slightly over the last 24-hour period, moving to $933 after briefly surging to $974, as broader crypto markets showed signs of stress tied to tightening financial conditions. The token’s price action played out in a narrow $46 range. Volume rose sharply during the morning’s move higher, 71% above the 24-hour average, but cooled into the close according to CoinDesk Research’s technical analysis data model. The rejection near $975 marked a technical ceiling, while BNB found support once again near $930. “BNB’s ability to hold support mirrors the broader strength we’re seeing on-chain,” Johnny B., the founder of BNBPad. ai, told CoinDesk in an emailed statement. “Despite the market headwinds, BNB Chain saw 82 million active addresses in October, a new all-time high, while DEX volumes neared $120 billion based on DeFiLlama.” BNB’s muted performance came along a wider market drawdown. 9% in the last 24 hours while bitcoin is struggling to remain above $100,000. A U. S. Treasury cash rebuild and falling bank reserves, down an estimated $500 billion since July, have drained capital from markets and made risk assets less attractive, according to a recent report from Citi. That has seen stocks fall as well, with the tech-heavy Nasdaq 100 seeing a 4. 7% decline this week, and the S&P 500 dropping by 2. 7%. In this environment, BNB’s ability to stay above its key $930 support level may reflect confidence in the network’s adoption and the performance of newer decentralized applications like Asper, even as the broader outlook dims. A break above $975 could reopen the path toward recent highs, but further downside in major assets could test buyers’ resolve. BNB remains tied to technical setups for now, but broader.

Photo credits: European Union EU governments want to change Horizon Europe eligibility rules to limit the countries that can participate in dual-use and defence projects. The suggestion adds guard rails to the European Commission’s plan to allow dual-use start-ups to receive grant funding and equity.