The post Bitcoin Surges 8% as Powell Eyes December Fed Rate Cut Push appeared com. Bitcoin surges 8% from $81K low as Fed rate cut odds jump to 67% for December meeting. Chair Powell may override divided Fed officials to push through 25 basis point rate reduction. With the market speculating a Fed rate cut in December, Bitcoin has rallied by more than 8% since it went down below $81, 000 on Friday. According to Barclays Research, there is disagreement among Fed officials about the future of monetary policy. Moreover, Chair Jerome Powell might signal another 25 basis point cut. Powell Could Tip the Scales Toward Rate Reduction It looks like, Federal officials are quite divided on the issue of monetary policy direction. It has been reported that governors Stephen Miran, Michelle Bowman, and Christopher Waller are in favor of loosening rates at the meeting in December. On the other hand, President of the St. Louis Fed, Alberto Musalem and President of the Kansas City Fed, Jeffrey Schmid are inclined to keep the current range of 3. 75-4% without any further changes. Vice Chair Michael Barr, Philip Jefferson, Austan Goolsbee of Chicago, and Susan Collins of Boston are all quite uncertain about the matter and are slightly inclined to suggest holding the rates at their current level. In the meantime, Lisa Cook and John Williams are waiting for the economic data to come in and seem to be agreeable to another rate cut if the situation requires it. The CME FedWatch tool is currently indicating a 67% chance of a rate cut in December, which is a significant reversal from the 33% probability that was estimated right after Fed Williams’ remarks. According to Nick Timiraos, a reporter for the Wall Street Journal, if there is a rate reduction, Powell will have to be very vocal about it and persuade the rest of the committee to go along with.

Tag: accumulation

The post Shiba Inu Exchanges Losing SHIB: 207, 000, 000, 000 in 24 Hours appeared com. Withdrawals are not enough? Shiba Inu’s lack of momentum With 207 billion SHIB departing exchanges in a 24-hour period, Shiba Inu recently reported yet another significant exchange outflow event. It is one of the biggest withdrawals in a single day in months, so it is not a tiny accumulation wave. Additionally, this type of signal is important in a market where sentiment has been unstable. According to CryptoQuant data, there was a net outflow of 121 billion SHIB in Nov. 15 by itself, and then the same pattern continued until Nov. 16. Withdrawals are not enough? This consistent flow of withdrawals is a reliable sign of long-term strategy. Spot selling pressure dries up, and the likelihood of a deep breakdown sharply declines when exchanges lose supply at this rate. SHIB/USDT Chart by TradingView The chart is brutally honest about the fact that SHIB is still pinned under strong technical resistance, so why isn’t the price blowing up yet? Shiba Inu is still far below all of the major moving averages. As dynamic resistance, all three are convergent and sloping downward. Shiba Inu’s lack of momentum The price is currently trading between $0. 0000090 and $0. 0000093, which is a local support zone that has held several times without breaking the market structure to the upside. Weak momentum but no surrender is indicated by the RSI at about 39. The fact that the volume is steady rather than collapsing suggests that holders are waiting rather than hurrying out. You Might Also Like People are removing tokens from exchanges because they are prepared to endure volatility rather than panic-sell, which is in line with the outflow data. In other words, rather than entering a liquidation phase, SHIB has entered an accumulation phase. The price must recover at least $0. 0000105, the first resistance cluster where.

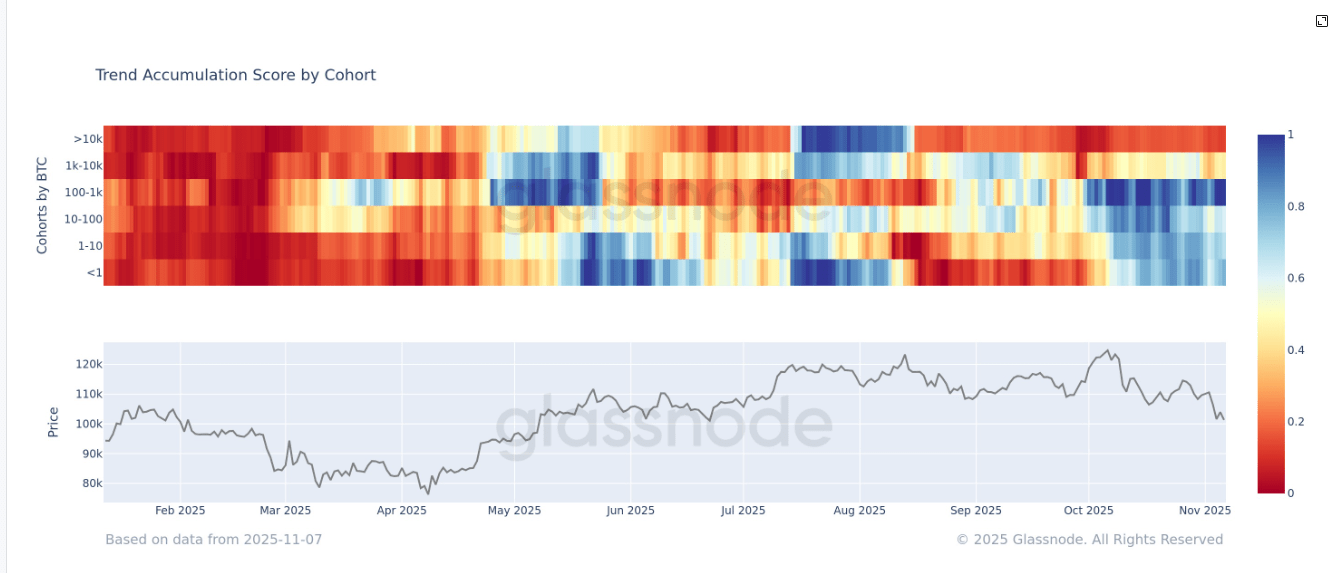

The post Whales Dump While the Rest Accumulate appeared com. Bitcoin BTC$102,272. 80 remains only marginally positive year-to-date, suggesting 2025 has been a period of consolidation as the asset stabilizes around the $100,000 level. Much of the recent price weakness appears linked to previously dormant coins re-entering circulation, per onchain data. Large holders, commonly known as whales, have been the primary distributors, driving the current downward pressure on price, according to The Accumulation Trend Score (ATS) by Glassnode. ATS measures the relative accumulation or distribution behavior across different wallet cohorts, accounting for both the size of entities and the volume of coins they have acquired over the past 15 days. A value near 1 suggests that participants in that cohort are actively accumulating. A value near 0 indicates that they are distributing holdings. Exchanges, miners, and certain other entities are excluded from the calculation. Whales holding over 10, 000 BTC have been consistent sellers since August, marking three months of sustained distribution. Meanwhile, wallets in the 1, 000-10, 000 BTC range remain neutral around a score of 0. 5, while all smaller cohorts (below 1, 000 BTC) are firmly in accumulation mode, according to Glassnode data. While in the first four months of the year, all cohorts were in deep distribution, which contributed to bitcoin’s 30% decline to $76,000 in April during the so-called tariff tantrum. This data highlights a clear divide between whales and the rest of the market participants and for now, it appears the whales are still steering the price action. Source:.

The post Chainlink Whales Accumulate 4M LINK: Bullish Signal? appeared com. Key Insights: Whales bought over 4 million LINK as price dropped from $17. 50 to nearly $14. Exchange reserves fell by 6 million LINK in one week, hinting at off-exchange accumulation. RSI near oversold and MACD still negative-momentum weak despite whale accumulation trend. Chainlink Whales Accumulate 4M LINK: Bullish Signal? Chainlink (LINK) holders have added over 4 million in the past two weeks, according to on-chain data. Wallets holding between 100, 000 and 1, 000, 000 LINK tokens increased their balances while the market price dropped. LINK is currently trading around $14. 40, down from above $17. 50 earlier in the same period. This activity has come during a broad market pullback. Ali reported, “Whales have accumulated more than 4 million Chainlink INK over the past two weeks! Exchange Balances Fall as Tokens Move Off Platforms During the same timeframe, the total amount of LINK held on centralized exchanges has decreased. Data from CryptoQuant shows reserves falling from around 146. 5 million to 140. 3 million tokens between October 31 and November 7. This drop of over 6 million tokens indicates reduced selling availability on exchanges. When large wallets accumulate while exchange balances decline, it can reflect a change in short-term supply dynamics. However, no direct outcome is confirmed by this alone. Momentum Indicators Still Show Weakness LINK has lost 16. 6% over the last 7 days, and is down 2. 68% in the last 24 hours. The recent price action continues to show a series of lower highs and lower lows on the daily chart, reflecting a bearish trend. The Relative Strength Index (RSI) is now near 32. 90, close to the oversold threshold of 30. This suggests that.