The University of Wisconsin Badgers (4-7, 2-6 Big Ten) wrapped up the final home game of the 2025 season with a matchup against the No. 21 Illinois Fighting Illini (7-4, 4-4). Following some early back-and-forth, the Badgers eventually ran away with it, winning 27-10 and recording their second ranked win of the season.. As the.

Month: November 2025

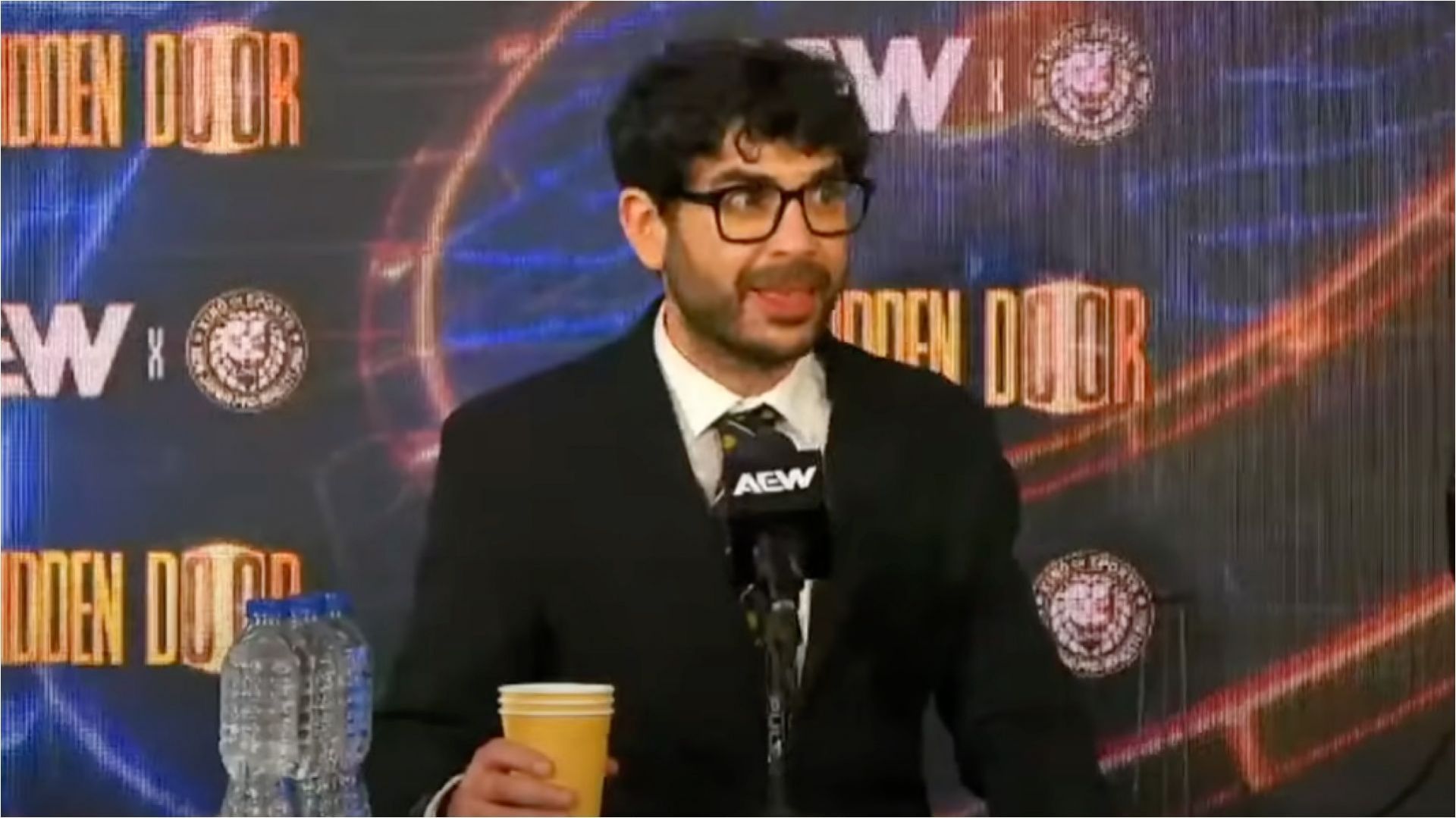

AEW Full Gear took place this weekend at the Prudential Center in Newark, New Jersey. Tony Khan booked a stacked card of matches for the show. For the most part, Full Gear lived up to the hype.

The post Best Crypto to Buy: New Cryptocurrency at $0. 035 Set to be a Bigger Millionaire-Maker Than Shiba Inu is already accelerating quickly at only $0. 035 in its blazing hot Phase 6 presale and over 95% of its current phase is already sold out. This positions MUTM as the best crypto to buy for early adopters seeking high-upside DeFi potential. Shiba Inu Weakens Further as Breakdown Validates Bearish Continuation Shiba Inu (SHIB) continues to move deeper inside its falling structure after breaking below the bottom of its triangular pattern, which further added to its bearish sentiment on the whole market. There is also very weak momentum here since each attempt to move higher is followed by an even faster decline to below its last peak, emphasizing strong selling pressure at all stages. SHIB is now inside its falling channel after breaking below its triangular bottom boundary level of 0. 0000085, which is being widely eyed as its new target point for further decline. At this point, most investors have started to shift their focus to Mutuum Finance after SHIB’s lack of strength to move higher, marking it as the best crypto to buy before 2026. MUTM Presale: Final Call for Potential Gains Mutuum Finance (MUTM) is quickly making its presence felt as one of the most highly anticipated DeFi initiatives of 2025. The project has been able to raise over $18. 9 million from 18, 140.

A former WWE star was reportedly present at AEW Full Gear 2025. This star was last seen on TV in 2024.

Syracuse delivers worst-ever performance against nation’s best back (PFF grades, snap counts)

Investor Panic Creates A +10% Yield Opportunity: SLRC

Former India selector Saba Karim backed TV umpire Chris Gaffaney over his decision to overturn the lbw decision against Senuran Muthusamy on Day 2 of the Guwahati Test.

The post Bitcoin Cycle Peak Still Ahead, According to New Price Projection appeared com. Bitcoin Many investors looking at Bitcoin’s latest pullback are bracing for a dramatic washout. But one crypto analyst argues the opposite: the downturn might already be close to exhausting itself and the next leg higher could begin from a level far above where most bears expect. Key Takeaways: Bitcoin is expected to stabilize higher than many traders fear, with the likeliest floor projected between $70K and $80K. The pullback is viewed as a normal pause within a larger bullish cycle, not the start of a prolonged market collapse. Long-term conviction remains strong, with expectations of significantly higher valuations over the coming years. Instead of warning about a crash into the $50,000s or lower, the analyst believes the market is shaping up for a controlled reset inside the higher price ranges. In his view, the biggest cluster of probabilities sits not in disaster territory but in an area that would still keep Bitcoin deep inside bullish long-term structure. A Statistical Approach to Price Floors His model visualizes the current correction as a probability curve rather than an emotional forecast. The curve peaks around the $70, 000-$80, 000 band, which he identifies as the most realistic zone for Bitcoin to finalize its bottom. Everything below that begins to show smaller and smaller likelihoods. The analyst’s curve continues to taper: a dip to $60,000-$70, 000 sits in the slim-chance category; $50,000-$60,000 drifts into unlikely territory; and anything under $50,000 is labeled borderline impossible statistically speaking. Under that framework, $70, 000 becomes the practical definition of the worst case rather than the catastrophic depths many fear. The Long-Term Mindset Interestingly, his outlook doesn’t come from someone trying to time every fluctuation. He openly states he doesn’t chase short-term entries or exits and considers Bitcoin a multi-year growth story rather than a trading instrument. He said he.

Get better internet all around your house for just $19. The post Amazon Pushes the TP-Link WiFi Extender to Peanuts as It Dumps Remaining Stock After 10K+ Sold Last Month appeared first on Kotaku.