Binance Holdings Ltd, along with its founder and former CEO Changpeng Zhao and senior executive Guangying Chen, has been named in a federal lawsuit for knowingly allowing transactions that enabled Hamas to support and carry out the Oct. 7 attack.

Month: November 2025

Spotify could be planning to take more out of your wallet soon

The post $566M Token Unlocks Could Set the Crypto Market Up for Price Swings appeared com. Key Insights: Token unlocks add $566 million of new supply and may create short-term crypto market pressure. HYPE, XPL, and JUP unlock land while prices are already weak across the market. Heavy unlock weeks often thin liquidity and make the crypto market move sharply. The crypto market is heading into a tricky week. More than $566 million in token unlocks will enter circulation. When new tokens enter the market, the total supply grows. If demand does not grow at the same speed, prices often fall for a short time. This is why traders watch unlock weeks very closely. Many tokens are already weak. HYPE is down 16. 7%, XPL is down 22. 1%, and JUP is down 6. 5% this week. New supply coming during a weak period can make price swings sharper than usual. This week’s unlocks are large enough to shake the market if buyers slow down. HYPE, XPL, and JUP Token Unlocks Bring Most of the New Supply In the latest crypto market news, Hyperliquid, Plasma, and Jupiter are the biggest unlocks of the week. Each unlock has a different reason, but the effect is the same: more tokens enter the market at once. Hyperliquid (HYPE) will unlock 9. 92 million tokens on Nov. 29, worth about $327 million. These tokens go to contributors. Even though some large buyers have been adding HYPE for weeks, the price still fell by 16. 7% in the past seven days. When a crypto token is already falling, and a large amount of new supply enters the market, the pressure often increases. If demand does not catch up, HYPE may find it hard to recover this week. Plasma (XPL) unlocks 88. 89 million tokens on November 25, worth about $17. 53 million. This unlock equals 4. 74% of its circulating supply. XPL is already down 22. 1% in the last.

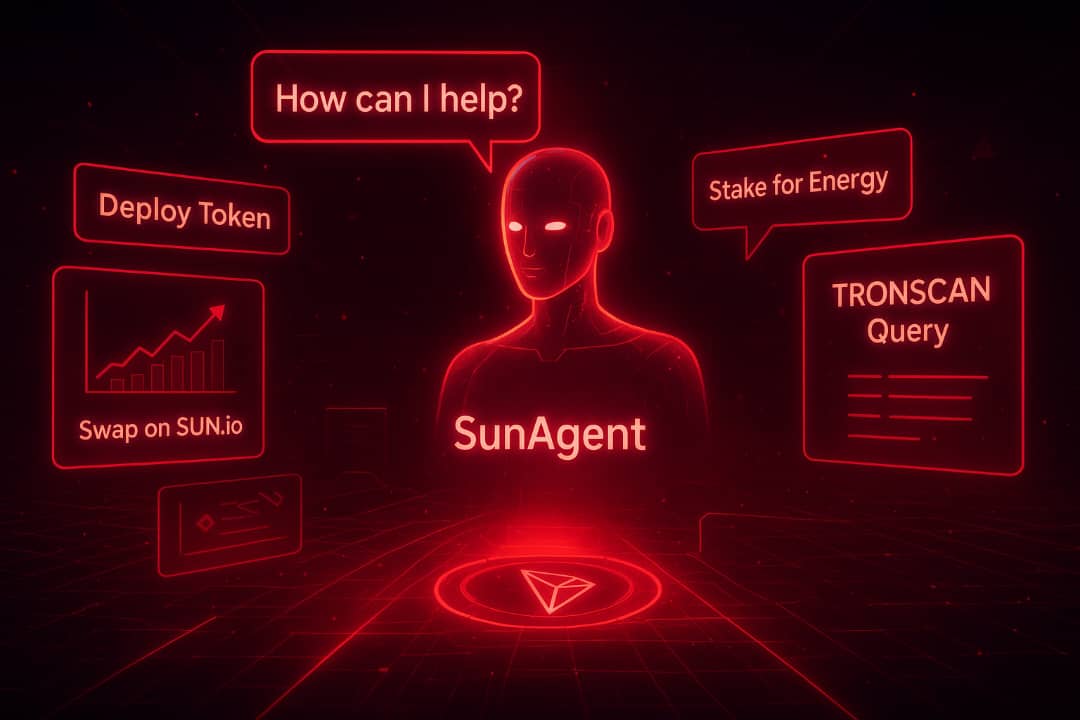

SunPump is pushing the TRON ecosystem into a new phase of usability. The platform has unveiled SunAgent, an AI-powered trading companion designed to simplify and accelerate how users interact with TRON’s on-chain environment. Built to understand natural, conversational dialogue, SunAgent removes the friction historically associated with blockchain navigation, and replaces it with an assistant that responds instantly, executes commands, and streamlines blockchain interactions into a simple chat window. The launch marks one of the biggest upgrades the TRON ecosystem has seen in 2025, signaling a future where trading, deploying, and managing digital assets may be as effortless as holding a The post SunPump Launches SunAgent, Bringing AI-Powered Trading to the TRON Blockchain appeared first.

The strategy bets on a measured rally into the year-end, rather than a record-breaking surge.

Crypto prices today are showing signs of recovery as easing fed rate expectations and renewed risk appetite lift major assets. The total crypto market capitalization has risen 2. 4% to $3. 1 trillion. Bitcoin traded at $88,590, up 1. 6% over the past.

The post Nasdaq Elliott Wave: Wave 4 support appeared com. Executive summary Trend bias: Wave 4 temporary correction. Key support level: 23, 854 22, 521. If correct, wave 5 could rally to 25, 950-27, 301. Back on October 7, we analyzed Nasdaq 100 (NDX) and the diverging RSI hinted of an incoming bearish reversal. Turns out, there was a relatively small reversal on October 10 at -3. 5% that was quickly retraced and led to new all-time highs. Then, beginning October 29, NDX began another decline of nearly -8. 9%. The structure of the decline hints that it is a corrective decline eventually leading to new all-time highs. Current Elliott Wave analysis Our Elliott wave analysis of the Nasdaq 100 (NDX) chart hints the rally that began in April has reached the end of its 3rd wave. The 3rd wave of an Elliott wave impulse pattern needs to subdivide in 5 waves and we can count those waves in place from the April 21 low labeled ((i))-((ii))-((iii))-((iv))-((v)). This suggests the correction from October 29 is wave 4 of a larger 5-wave impulse pattern. Wave 4 and wave 2 are cousin waves. they are similar, but tend to alternate in qualities. They should be similar in the depth of their corrections. Wave 2 of the impulse pattern (in April 2025) corrected -8% as a zigzag pattern. Wave 4, so far, has corrected about -8. 9%, similar to wave 2. Additionally, wave 4 has reached the 23. 6% Fibonacci retracement level of the distance of wave 3 (not pictured). This is common for wave 4 to correct between 23-50% of wave 3. Lastly, the decline from last week has reached horizontal support from the previous 4th wave symmetrical triangle pattern. As a result, the decline to the Friday, November 21 low, may be all or part of wave 4. When wave 5 begins, we anticipate a rally that may reach.

Warriors vs. Jazz: Steph Curry, Jimmy Butler and Gary Payton II overcome thin roster to snap losing streak.

Rio Ferdinand slammed Manchester United during their 1-0 defeat against Everton in the Premier League on Monday, November 24. He bemoaned their lack of urgency against the 10-man Toffees.

Photo credits: zverge / BigStock From January 2026, the Canadian government will lead a C$100 million (€61. 4 million) international research.