Los Angeles, CA, 2025-11-4 /EPR Network/ HDTV Supply, a leading USA-based manufacturer and distributor of professional audio-video equipment, has officially announced the launch of [read full press release.].

Month: November 2025

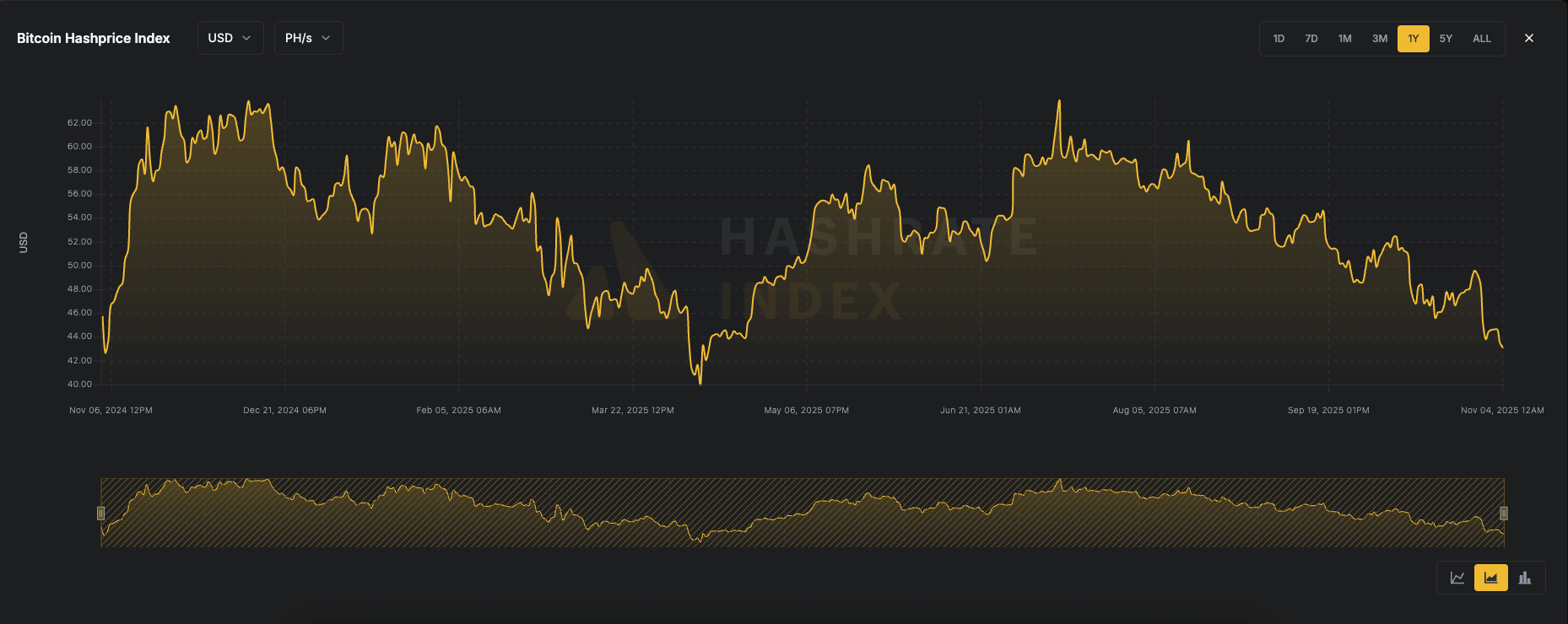

The post BTC Mining Profitability Slumps as Hashprice Falls to Multi-Month Low appeared com. Hashprice has plunged to its lowest level since April, when bitcoin was trading around $76,000, now sitting at $43. 1 per petahash/second (PH/s). Hashprice, a term coined by Luxor, refers to the expected value of one terahash per second (TH/s) of hashing power per day, representing how much a miner can earn from a specific amount of hashrate. It is influenced by bitcoin’s price, network difficulty, block subsidy and transaction fees. As bitcoin has corrected roughly 20% from its October all-time high to $104,000, and transaction fees remain at bear market levels, miner revenues have come under increasing pressure. According to mempool. space, processing a high-priority transaction currently costs about 4 sat/vB ($0. 58), while average transaction fees on an annual basis are at their lowest levels in years. Hash rate, the total computational power used by miners to secure the bitcoin network, remains just below all-time highs at over 1. 1 zettahashes per second (ZH/s). This has coincided with a recent difficulty adjustment reaching an all-time high of 156 trillion (T), up 6. 3%. The difficulty adjustment recalibrates roughly every two weeks to ensure that new blocks are mined approximately every ten minutes, maintaining network stability as mining power fluctuates. Declining bitcoin prices, low transaction fees and record-difficulty are all weighing on bitcoin mining profitability. As a result, bitcoin miners have pivoted to AI and high-performance computing (HPC) data center operations to secure more reliable revenue streams. By locking in longer-term contracts with data companies, miners can stabilize cash flow and reduce reliance on volatile bitcoin market conditions. Source:.

The post 5 clear signals that will prove if the Bitcoin bull run is still alive appeared com. Crypto Twitter is filled with claims that “everyone is buying Bitcoin”, from Michael Saylor and BlackRock to entire countries and even banks. Yet despite the accumulation narratives, Bitcoin’s price has slipped sharply, breaking below key levels as ETF flows turned negative. The contradiction between bullish headlines and falling prices emphasizes a crucial point: in markets driven by liquidity and marginal flow, who’s actually buying, and when, matters far more than who says they are. Bitcoin fell through $106,400 as spot ETF flows turned negative over four consecutive sessions. The shift came as BlackRock’s IBIT logged redemptions over the last four days, totaling $714. 8 million, removing a significant source of daily demand right as a widely watched cycle pivot gave way. According to Farside Investors, the outflows of $88. 1 million, $290. 9 million, $149. 3 million, and then $186. 5 million coincided with the breakdown. They forced selling by authorized participants who redeemed shares for underlying Bitcoin and offloaded them into the market. Thus, the net flow flipped. When creations slow and redemptions rise across the U. S. spot ETF complex, the daily bid that helped absorb volatility turns into a source of supply. Mid-October saw stretches of net outflows across digital asset funds as Bitcoin battled to stay above $106,400. While there were brief inflow days late in the month, the most recent run tilted back into the red, a pattern that aligns with the IBIT prints captured above. The mechanical impact matters because ETF flow translates into spot buys or sells, and the timing overlaps with a break of a level that many traders use to distinguish a late-cycle pullback from a trend resumption. Derivatives added pressure. The CME three-month futures premium has cooled to roughly 4 to 5 percent annualized over the back half of the year, curbing carry-trade incentives that pull.

Taylor Swift and Gigi Hadid enjoyed a girls night out in New York City on Monday. It came just a day after Swift’s fiancé, Travis Kelce’s, Chiefs lost to the Buffalo Bills 28-21.

Denny’s board of directors has unanimously approved the deal, which is expected to close in the first quarter of 2026.

This 2008 Ford Mustang Cobra Jet is #37 of 50 examples produced by Ford Racing for the model year and was delivered new to Jacky Jones Ford of Cleveland, Georgia. Painted white with a Cobra Jet livery, the car is powered by a 5. 4-liter DOHC V8 with a 2. 3-liter Eaton TVS supercharger, forged internals, Ford GT cylinder heads, and Ford Performance camshafts. The engine sends power to Goodyear Eagle drag slicks through a six-speed manual transmission and a Strange Engineering 9″ rear axle, and additional equipment includes 15″ Bogart Racing wheels, adjustable suspension, Strange Engineering disc brakes, an NHRA-certified roll cage, and racing harnesses This FR500CJ Cobra Jet is being offered by the selling dealer in Missouri with a Cobra Jet-branded shirt, jacket, and hat, a binder of literature, build documentation, and a bill of sale.

President Donald Trump warned Tuesday he will not allow federal food benefits to be paid until the government reopens in a hardened position that puts millions of low-income households directly in the political blast zone. Two federal courts only last week ruled that the administration must pay at least partial Supplemental Nutrition Assistance Program (SNAP) benefits during the ongoing government shutdown. SNAP supports roughly 42 million Americans, and the majority are children or people over 60. Taking to Truth Social on Tuesday, the president wrote: SNAP BENEFITS, which increased by Billions and Billions of Dollars (MANY FOLD!) during Crooked Joe.

The post VCs pour $5. 1B into crypto firms while Bitcoin’s ‘Uptober’ whiffed appeared com. October closed roughly 4% down for Bitcoin, yet venture funding hit $5. 1 billion in the same month, the second-strongest month since 2022. According to CryptoRank data, three mega-deals account for most of it, as October defied its own seasonal mythology. Bitcoin fell 3. 7% during a month traders have nicknamed “Uptober” for its historical winning streak, breaking a pattern that had held since 2019. Yet venture capitalists deployed $5. 1 billion into crypto startups during the same 31 days, marking the second-strongest monthly total since 2022 and the best VC performance of 2025 aside from March. The divergence between spot market weakness and venture market strength creates a puzzle, where either builders see something that traders have missed, or a handful of enormous checks have distorted the signal. The concentration tells most of the story. Three transactions account for roughly $2. 8 billion of October’s total of $5. 1 billion: Intercontinental Exchange’s (ICE) strategic investment of up to $2 billion in Polymarket, Tempo’s $500 million Series A round led by Stripe and Paradigm, and Kalshi’s $300 million Series D round. CryptoRank’s monthly data shows 180 disclosed funding rounds in October, indicating that the top three transactions account for 54% of the total capital deployed across fewer than 2% of deals. The median round size is likely in the single-digit millions. Removing Polymarket, Tempo, and Kalshi from the calculation would shift the narrative from “best month in years” to “steady but unspectacular continuation of 2024’s modest pace.” The “venture rebound” narrative depends heavily on whether people count a strategic acquisition play by the New York Stock Exchange’s parent company and two infrastructure bets as representative of broader builder confidence or as outliers that happened to close in the same reporting window. October 2025’s $5. 1 billion in crypto venture funding marked the second-highest monthly total since 2022, surpassing.

The Pokemon TCG Pocket Mega Rising meta has introduced some powerful new cards, and among them, Mega Ampharos ex has become a standout pick.

Prosecutors say a Border Patrol mechanic in Maine attempted to “wipe off” some scuff marks but did no actual repairs on an immigration agent’s SUV after he shot a woman in Brighton Park last month.