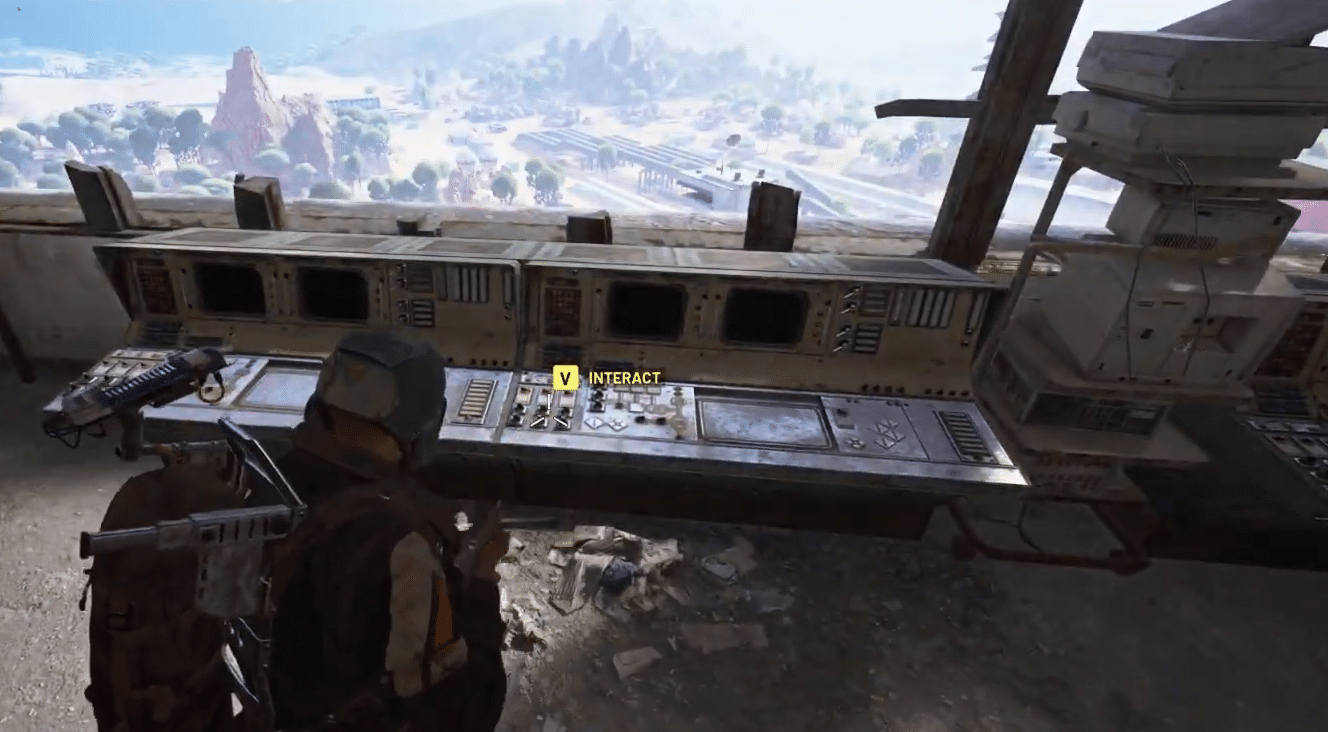

“Got the logs. and. There’s a lot to unpack here.” The post ARC Raiders Lost in Transmission Quest Guide appeared first on Games Fuze.

Category: technology

Evergy Selects Kigen’s Secure eSIM OS and eIM to Maximize Grid Reliability with Automated Failover Across Private and Public Networks Evergy, one of the largest investor-owned utilities in the Midwest United States serving 1. 7 million customers across Kansas and Missouri, has selected Kigen, the global leader in eSIM and iSIM technology, to strengthen grid resiliency. The post Evergy Selects Kigen To Strengthen Grid Resilience Across Private and Public Networks appeared first.

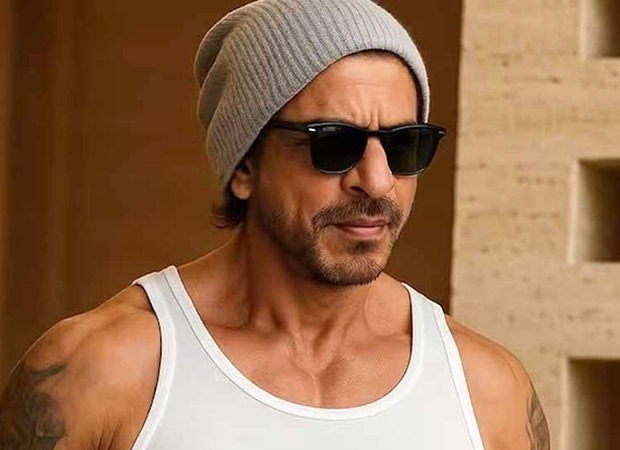

After a weekend packed with birthday celebrations marking his 60th milestone, Shah Rukh Khan is set to return to work with renewed vigour. The superstar, who celebrated his birthday with an intimate gathering at his Alibaug property and a special fan meet in Mumbai, will be back on set for his much-awaited action film King, starting November 5 at Yash Raj Studios, Andheri. Directed by Siddharth Anand, King marks Shah Rukh Khan’s first on-screen collaboration with his daughter Suhana Khan, alongside Abhishek Bachchan. The project, which began principal photography in June 2025, is generating buzz not only for its casting but also for its ambitious action sequences. A report by Mid-Day stated that the stunt unit has spent nearly three weeks rehearsing for a high-octane leg of filming-a hybrid chase-combat set piece that is set to push boundaries for Bollywood action. The upcoming 15-20 day schedule will centre around complex stunt choreography, combining hand-to-hand combat with tactical gunplay, wire-assisted jumps, and close-quarter grappling. Shah Rukh Khan, known for his commitment to roles, will reportedly perform several of these intricate action beats himself, with the team employing a custom-designed rig to ensure both safety and spectacular results. Director Siddharth Anand, who last teamed up with Shah Rukh for the record-smashing Pathaan in 2023, recently unveiled the film’s first look on November 2. The initial visuals introduced the audience to a transformed King Khan and gave a glimpse into the stylish, action-packed world that King promises. The film aims to wrap up its dramatic portions by the end of the year, with the remaining key action sequences and musical numbers scheduled for completion soon after. Also Read: Shah Rukh Khan opens up about his bond with Siddharth Anand: “He is a very aesthetic director”.

AEW head honcho Tony Khan is supposedly disinterested in using a 32-year-old New Japan Pro-Wrestling atlete due to rumors suggesting that the latter may be WWE-bound.

A former champion announced on social media today that he will be making his return on tomorrow night’s edition of WWE RAW.

The company is reportedly prepping smart displays and a new Siri to take on the likes of Amazon’s Echo and Google’s Nest Hub.

Luego del récord de participación establecido el año pasado, este domingo vuelve el Maratón de NYC. Muchas calles y entradas al Metro estarán cerradas.

BNM’s tokenization roadmap aims to focus on real-world use cases such as SME supply chain financing, Shariah-compliant Islamic products, green finance and 24/7 cross-border payments. Bank Negara Malaysia (BNM), the country’s central bank, has unveiled a three-year roadmap to explore and test asset tokenization across the financial sector. Under the initiative, BNM will launch proof-of-concept (POC) projects and live pilots through its Digital Asset Innovation Hub (DAIH), established earlier this year, the central bank announced on Friday. A key part of this roadmap is the creation of an Asset Tokenization Industry Working Group (IWG), which will coordinate industry-wide exploration, share knowledge and identify regulatory and legal challenges. Read more.

Publisher Vertigo Games and developer Maze Theory announced the Virtual reality stealth action game, Thief VR: Legacy of Shadow, will launch for PlayStation VR2, SteamVR, and Quest 2 and 3 on December 4. View a new gameplay trailer below: Read details on the game below: The City is a place of shadows, ruled by the powerful and feared by the oppressed. Its rooftops form a labyrinth above the narrow, twisting streets. The City Watch prowls relentlessly, enforcing the iron will of Baron Ulysses Northcrest, a tyrant who crushes rebellion before it can take root. You are Magpie, a cunning thief orphaned by Northcrest’s brutality and shaped by the streets, who steals as the only means to survive. That is, until you uncover something greater: a legendary artifact holding a legacy from the past. Use immersive virtual reality mechanics to steal, evade, and outsmart the forces controlling The City. Unravel its darkest secrets and expose a sinister conspiracy that looms over its very foundation. A life-long and avid gamer, William D’Angelo was first introduced to VGChartz in 2007. After years of supporting the site, he was brought on in 2010 as a junior analyst, working his way up to lead analyst in 2012 and taking over the hardware estimates in 2017. He has expanded his involvement in the gaming community by producing content on his own YouTube channel and Twitch channel. You can follow the author on Bluesky.Full Article – https://www.vgchartz.com/article/466155/thief-vr-legacy-of-shadow-launches-december-4-for-ps-vr2-steam-vr-and-quest-2-and-3/

On October 31, 2025, Final Fantasy XIV Live Letter 89 released, focused on patch 7. 4 part 1. Like other Live Letters, this was only in Japanese, with English text being on the slides the devs showed.