The best meme coins have flipped the crypto world upside down, showing how community power and cultural hype can fuel [.] The post Best Meme Coins With Big Rewards? MoonBull Attracts Whales After $550K Milestone While BZIL and La Culex Stay Strong appeared first on Coindoo.

Category: general

Feeding Florida is deploying more volunteers during the shutdown, but is seeking donations to help fill in relief to the needy. The post Feeding Florida is increasing relief efforts for those missing SNAP benefits during government shutdown appeared first on Florida Politics Campaigns & Elections. Lobbying & Government.

Jonathan Bailey is People magazine’s Sexiest Man Alive for 2025. The magazine’s pick was announced Monday night on “The Tonight Show Starring Jimmy Fallon.”.

Democratic National Committee Chair Ken Martin says he expects a big night for Democrats tonight during an interview with Joe Mathieu on “Balance of Power.” (Source: Bloomberg)

The post Phantom launches limit orders for Phantom Perps appeared com. Key Takeaways Phantom, a Solana-focused wallet app, has integrated limit orders for its Perps trading feature. Users can now set take profit and stop loss triggers directly on their perpetual futures positions. Phantom, a Solana-focused wallet app, today launched limit orders for Phantom Perps, a perpetual futures trading feature integrated into the mobile wallet for long and short positions. The new feature enables users to set take profit and stop loss triggers directly on perp positions for automated closures at target prices. Users can adjust stop-loss and take-profit levels using drag-and-drop on the perp chart for intuitive risk management. Phantom supports adding to existing perp positions to increase exposure while keeping leverage consistent, expanding the wallet’s capabilities beyond basic trading into advanced order management tools. Source:.

Disney has announced details on the upcoming 16th annual holiday television special, “CMA Country Christmas”, which is coming to our The post “CMA Country Christmas” Returning To ABC, Hulu & Disney+ appeared first on What’s On Disney Plus.

The post XRP Price in Limbo Despite Grayscale’s Bullish S-1 Amendment appeared com. Grayscale filed Amendment No. 2 for its XRP Trust ETF as regulated demand returns. Analysts say XRP price still trades inside liquidity sweeps and order blocks. Symmetrical 89-day cycles point to one more rejection before a breakout try. Grayscale Investments has put XRP back in front of institutional readers after submitting Amendment No. 2 to its Form S-1 for an XRP Trust ETF with the U. S. Securities and Exchange Commission on November 3. The updated filing names Grayscale Investments Sponsors, LLC as sponsor and Davis Polk & Wardwell LLP as counsel, signaling this is a serious push to get XRP into the same regulated lane that Bitcoin and Ethereum already use. If the SEC signs off, U. S. investors would be able to buy XRP exposure through the market structure they already trust, which usually increases depth and improves two-way liquidity. Related: XRP Price Prediction: ETF Speculation Builds Ahead Of Ripple’s $2. 5B Escrow Release The filing also lands at a moment when the XRP ecosystem is building real use cases. Ripple’s Swell conference in New York, set for November 12 to 14, is expected to feature tokenization, treasury, and regional settlement announcements, so Grayscale’s timing keeps XRP in the institutional conversation while those headlines drop. On top of that, corporate experiments such as VivoPower’s $5 million XRP-linked project in South Korea show that enterprises are starting to test XRPL for payments and asset rails, not only for trading. That strengthens the “XRP is infrastructure” narrative just as ETF issuers are circling. Technical Perspective: Liquidity Zones and Symmetrical Patterns Alongside the regulatory angle, market analysts tracking XRP’s intraday structure say this is still a liquidity-led market. Egrag Crypto’s recent analysis highlights liquidity sweeps and order-block formations within the current trading range, suggesting that institutional participants may be targeting liquidity above resistance before.

Los Angeles, CA, 2025-11-4 /EPR Network/ HDTV Supply, a leading USA-based manufacturer and distributor of professional audio-video equipment, has officially announced the launch of [read full press release.].

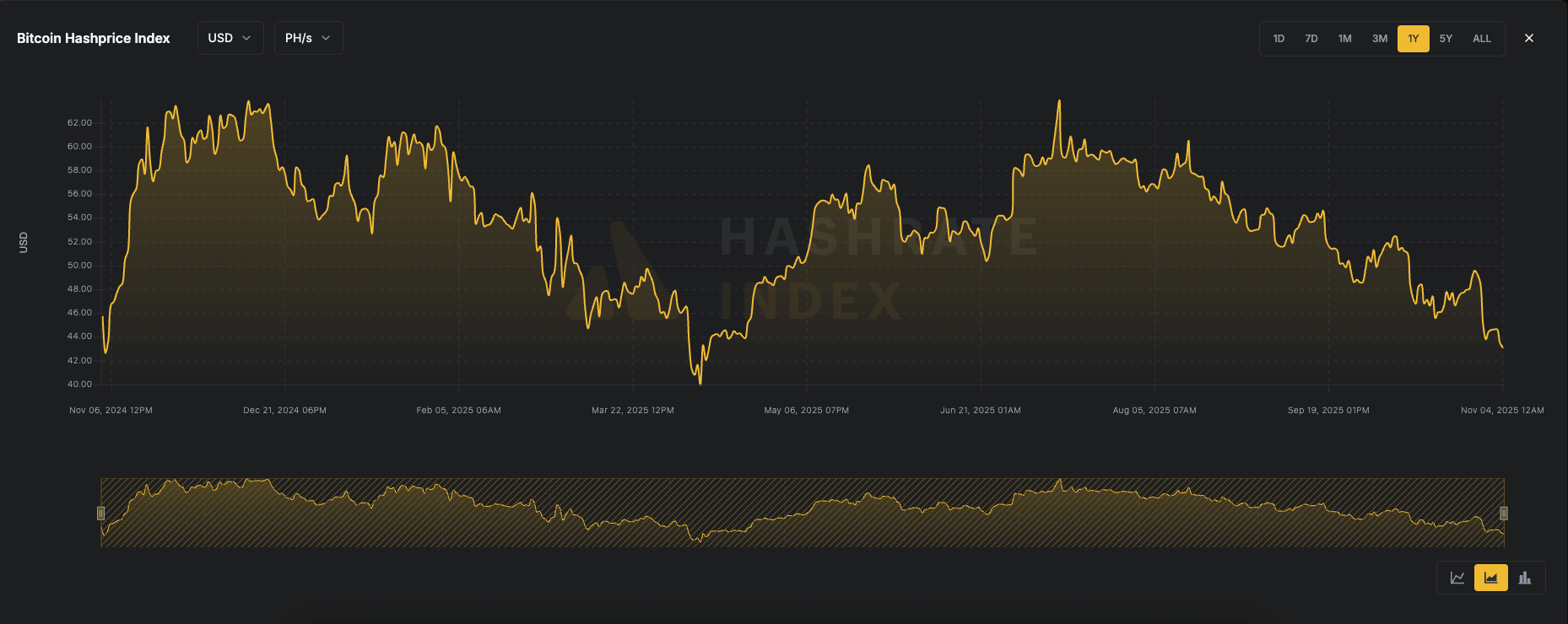

The post BTC Mining Profitability Slumps as Hashprice Falls to Multi-Month Low appeared com. Hashprice has plunged to its lowest level since April, when bitcoin was trading around $76,000, now sitting at $43. 1 per petahash/second (PH/s). Hashprice, a term coined by Luxor, refers to the expected value of one terahash per second (TH/s) of hashing power per day, representing how much a miner can earn from a specific amount of hashrate. It is influenced by bitcoin’s price, network difficulty, block subsidy and transaction fees. As bitcoin has corrected roughly 20% from its October all-time high to $104,000, and transaction fees remain at bear market levels, miner revenues have come under increasing pressure. According to mempool. space, processing a high-priority transaction currently costs about 4 sat/vB ($0. 58), while average transaction fees on an annual basis are at their lowest levels in years. Hash rate, the total computational power used by miners to secure the bitcoin network, remains just below all-time highs at over 1. 1 zettahashes per second (ZH/s). This has coincided with a recent difficulty adjustment reaching an all-time high of 156 trillion (T), up 6. 3%. The difficulty adjustment recalibrates roughly every two weeks to ensure that new blocks are mined approximately every ten minutes, maintaining network stability as mining power fluctuates. Declining bitcoin prices, low transaction fees and record-difficulty are all weighing on bitcoin mining profitability. As a result, bitcoin miners have pivoted to AI and high-performance computing (HPC) data center operations to secure more reliable revenue streams. By locking in longer-term contracts with data companies, miners can stabilize cash flow and reduce reliance on volatile bitcoin market conditions. Source:.

The post 5 clear signals that will prove if the Bitcoin bull run is still alive appeared com. Crypto Twitter is filled with claims that “everyone is buying Bitcoin”, from Michael Saylor and BlackRock to entire countries and even banks. Yet despite the accumulation narratives, Bitcoin’s price has slipped sharply, breaking below key levels as ETF flows turned negative. The contradiction between bullish headlines and falling prices emphasizes a crucial point: in markets driven by liquidity and marginal flow, who’s actually buying, and when, matters far more than who says they are. Bitcoin fell through $106,400 as spot ETF flows turned negative over four consecutive sessions. The shift came as BlackRock’s IBIT logged redemptions over the last four days, totaling $714. 8 million, removing a significant source of daily demand right as a widely watched cycle pivot gave way. According to Farside Investors, the outflows of $88. 1 million, $290. 9 million, $149. 3 million, and then $186. 5 million coincided with the breakdown. They forced selling by authorized participants who redeemed shares for underlying Bitcoin and offloaded them into the market. Thus, the net flow flipped. When creations slow and redemptions rise across the U. S. spot ETF complex, the daily bid that helped absorb volatility turns into a source of supply. Mid-October saw stretches of net outflows across digital asset funds as Bitcoin battled to stay above $106,400. While there were brief inflow days late in the month, the most recent run tilted back into the red, a pattern that aligns with the IBIT prints captured above. The mechanical impact matters because ETF flow translates into spot buys or sells, and the timing overlaps with a break of a level that many traders use to distinguish a late-cycle pullback from a trend resumption. Derivatives added pressure. The CME three-month futures premium has cooled to roughly 4 to 5 percent annualized over the back half of the year, curbing carry-trade incentives that pull.