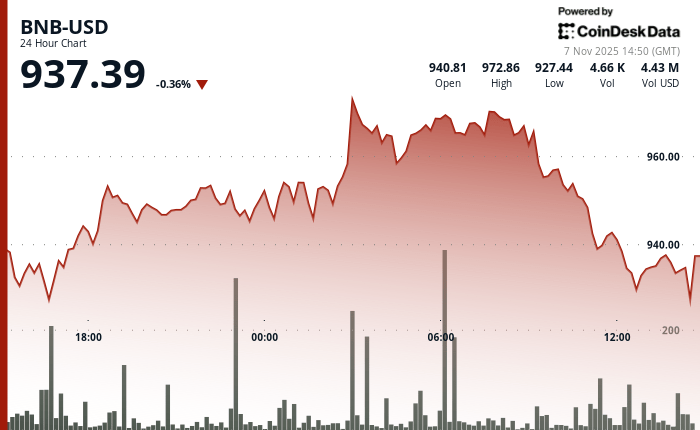

The post BNB Drops to Key Support Level Above $930 as Markets React to Liquidity Pressures appeared com. The native token of the BNB Chain, BNB, slipped slightly over the last 24-hour period, moving to $933 after briefly surging to $974, as broader crypto markets showed signs of stress tied to tightening financial conditions. The token’s price action played out in a narrow $46 range. Volume rose sharply during the morning’s move higher, 71% above the 24-hour average, but cooled into the close according to CoinDesk Research’s technical analysis data model. The rejection near $975 marked a technical ceiling, while BNB found support once again near $930. “BNB’s ability to hold support mirrors the broader strength we’re seeing on-chain,” Johnny B., the founder of BNBPad. ai, told CoinDesk in an emailed statement. “Despite the market headwinds, BNB Chain saw 82 million active addresses in October, a new all-time high, while DEX volumes neared $120 billion based on DeFiLlama.” BNB’s muted performance came along a wider market drawdown. 9% in the last 24 hours while bitcoin is struggling to remain above $100,000. A U. S. Treasury cash rebuild and falling bank reserves, down an estimated $500 billion since July, have drained capital from markets and made risk assets less attractive, according to a recent report from Citi. That has seen stocks fall as well, with the tech-heavy Nasdaq 100 seeing a 4. 7% decline this week, and the S&P 500 dropping by 2. 7%. In this environment, BNB’s ability to stay above its key $930 support level may reflect confidence in the network’s adoption and the performance of newer decentralized applications like Asper, even as the broader outlook dims. A break above $975 could reopen the path toward recent highs, but further downside in major assets could test buyers’ resolve. BNB remains tied to technical setups for now, but broader.

Category: general

Boomer Esiason offers Giants’ Graham Gano advice as he faces ugly ‘sewer pit’ of hate

With Stranger Things embarking on its final season, Millie Bobby Brown is leaving behind-the-scenes rumors in the Upside Down. While reuniting with co-star David Harbour at Thursday’s Season 5 premiere, the 2x Emmy nominee raved that she’s “so lucky” to have her onscreen dad in her life for nearly a decade since the Netflix show [.].

Nina Hoss enters a conversation about “Hedda” the way her character Eileen Lövborg enters that fateful party: She commands the space, is unapologetically present and utterly impossible to overlook. The German actress, who spent six years performing “Hedda Gabler” on stage in Berlin’s demanding repertoire system, now takes on Nia DaCosta’s bold reimagining of the [.].

The post Citibank Explains Reason for Bitcoin’s Continuing Declines, Warns! “The Declines Are a Serious Warning for the Giant Stock Exchange!” appeared com. October and November, known as the historically bullish months for Bitcoin (BTC) and altcoins, are not going as desired in 2025. A major collapse occurred in October following US President Donald Trump’s announcement of tariffs on China. While the collapse on October 11 was recorded as the largest liquidation event in history, the downward trend continued in the first week of November. While wondering whether the declines will continue, Citibank evaluated the declines in Bitcoin. Why Did Bitcoin Fall? Citi analysts said Bitcoin’s decline was due to a liquidity shortage, according to Coindesk. They also noted that Bitcoin’s decline and continued weakness are a warning for the Nasdaq. Citi cited the US Treasury Department’s liquidity-reducing measures and the decline in bank reserves as the reasons for Bitcoin’s weakness. However, it also predicted that Bitcoin and the Nasdaq would experience a combined recovery if liquidity recovered by the end of the year. Bitcoin’s Decline Is a Warning for Nasdaq! Citibank stated that Bitcoin fell due to a liquidity crunch and decoupled from the Nasdaq. Citi analysts noted that Bitcoin’s trading patterns have historically moved in close correlation with the Nasdaq 100 index. Nasdaq’s earnings, in particular, showed a marked improvement as BTC’s price moved above its 55-day moving average. However, Bitcoin has recently fallen below its 55-day moving average. With Bitcoin now trading below its 55-day moving average, the situation for the stock market is also worsening. Citi noted that while the Nasdaq remains relatively strong thanks to the AI craze, it faces a risk of decline due to weakness in Bitcoin, which is more sensitive to liquidity changes. However, Citibank added that there remains upside potential for both Bitcoin and stocks as liquidity shows signs of improvement. In this context, Citi analysts stated that the year-end Christmas Rally is not.

Danielle Poli, Assistant Portfolio Manager for Global Credit Strategy at Oaktree Capital Management, says investors are seeing systematic, rather systemic, problems in credit and there is a place in portfolios for both public and private credit. She speaks to Bloomberg’s Matt Miller on “Bloomberg Real Yield.” (Source: Bloomberg)

Veterans Day 2025 in South Florida: Ceremonies, patriotic music & a parade to honor military service

Communities across South Florida will gather at events that provide the opportunity to pause, reflect and say thanks to veterans while celebrating their courage and commitment.

Thank you, veterans By Rep. Dusty Johnson November 7, 2025 This coming Tuesday is an opportunity to thank the brave men and women who have served our country. South Dakota is home to more than 60, 000 veterans who served from World War II through today. Veterans Day is an important reminder to take time to [.].

India will take on Australia at The Gabba in Brisbane on Saturday, November 8 in the fifth and final T20I of the series.