For years, the European Central Bank (ECB) has envisioned a public digital currency that would anchor Europe’s payment system in [.] The post Digital Euro Faces Uncertain Future as Brussels Rethinks Its Purpose appeared first on Coindoo.

Category: finance

Two-time NASCAR Cup Series champion Kyle Busch and his wife, Samantha, have filed a lawsuit against Pacific Life Insurance Company.

Parents used daughter’s credit since she was 12, then asked her to co-sign their mortgage. She sent them a bill instead.

Teradyne surges after Q3, outlook beat estimates driven by AI-related demand

The latest upswing follows growing market enthusiasm after reports confirmed that Pi Network has joined the ISO 20022 group, aligning [.] The post Pi Coin Surges Over 30% as Bulls React to Major Network Milestone appeared first on Coindoo.

The post Circle debuts public testnet of its payment-focused Arc chain Details appeared com. Key Takeaways What’s next for Arc as it rolls out public testnet? If the test is successful, the payment-focused chain could soon hit the public mainnet for everyone. Why is Arc’s progress important? It signals incoming shifts across the stablecoin payment ecosystem, and whether Ethereum will hold its ground remains to be seen. Circle, the issuer of the USDC stablecoin, is close to launching its Arc chain A global payment-focused L1 powered by digital dollars. In a statement on 28 October, the firm said that it had begun public testing for the chain alongside key design partners. The partners include top banks, insurers, and asset managers like BlackRock, HSBC, and Absa, among others. According to Circle CEO Jeremy Allaire, the partners have billions of users and handle trillions of dollars in assets across the globe. He claimed that Arc can seamlessly allow local markets and builders to connect to the global economy. Allaire called it the “economic OS of the internet,” and added, “This geographic diversity highlights a defining strength of Arc: its purpose-built to connect every local market to the global economy. In fact, BlackRock’s Global Head of Digital Assets, Robert Mitchnick, underscored FX and tokenization as key interests for them in the project. He said, “Exploring Arc will provide insight into how stablecoin-denominated settlement and onchain FX capabilities might enable more efficient capital markets and unlock additional utility for onchain assets. Google, Stripe, and Tether have similar plans. In fact, Tether-backed Plasma [XPL] is already live and handles about $6 billion of the stablecoin supply. It’s.

The post Trump Criticizes Fed Chair Powell Over Interest Rate Policy appeared com. Key Points: Trump criticizes Fed at APEC, jokes about Powell’s slow rate action. Possible future inflation, 4% growth for U. S., Trump says. Cryptocurrencies may react to potential Fed rate changes. On October 29, 2025, President Trump criticized Federal Reserve Chair Jerome Powell at the Asia-Pacific Economic Cooperation summit in South Korea, ridiculing the Fed’s interest rate policies. Trump’s remarks highlight ongoing tensions with the Fed, potentially influencing U. S. economic policies and affecting market confidence, particularly in interest-sensitive assets like cryptocurrencies. Trump Mocks Powell: Calls for Faster Rate Cuts President Trump, speaking at the Asia-Pacific Economic Cooperation summit, labeled Federal Reserve Chair Jerome Powell as “Jerome ‘Too Late’ Powell,” criticizing his handling of interest rate cuts. Trump’s comments drew laughter from the audience and indicated frustrations with the pace of monetary policy adjustments. Trump highlighted his insistence that the Federal Reserve keep interest rates low, notwithstanding inflation risks. He predicted that the U. S. economy will achieve 4% growth in early 2026, a rate significantly higher than the median economist forecasts. “Jerome ‘Too Late’ Powell” and ridiculing the Fed’s pace on interest rate cuts, reinforcing, “We will not let the Fed raise interest rates because they are worried about inflation three years from now.” Donald Trump, Former U. S. President Crypto Markets Watch Fed Moves on Rate Debate Did you know? In past instances, President Trump’s criticisms of the Federal Reserve have led to short-term market volatility and debates over the stability of the US dollar, indirectly fueling interest in cryptocurrencies as a store of value. Bitcoin (BTC) is currently priced at $113,069. 26, according to CoinMarketCap. The cryptocurrency has a market cap of 2. 25 trillion dollars, maintaining a market dominance of 59. 22%. With a max supply of 21 million and a circulating supply of 19. 94 million, BTC experienced a 0. 51% decrease in.

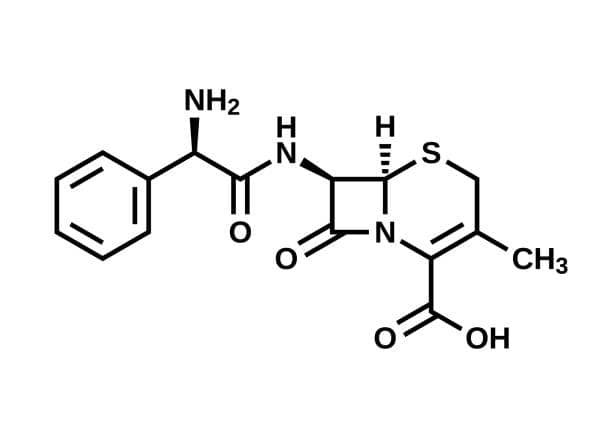

PARP Inhibitor Market Outlook Base Year: 2024 Forecasts Years: 2025-2035 The main aim of the report is to provide in-depth industry data to assist decision-makers make critical investment decisions and also identify potential changes and gaps in the PARP Inhibitor Market. To . Read more.