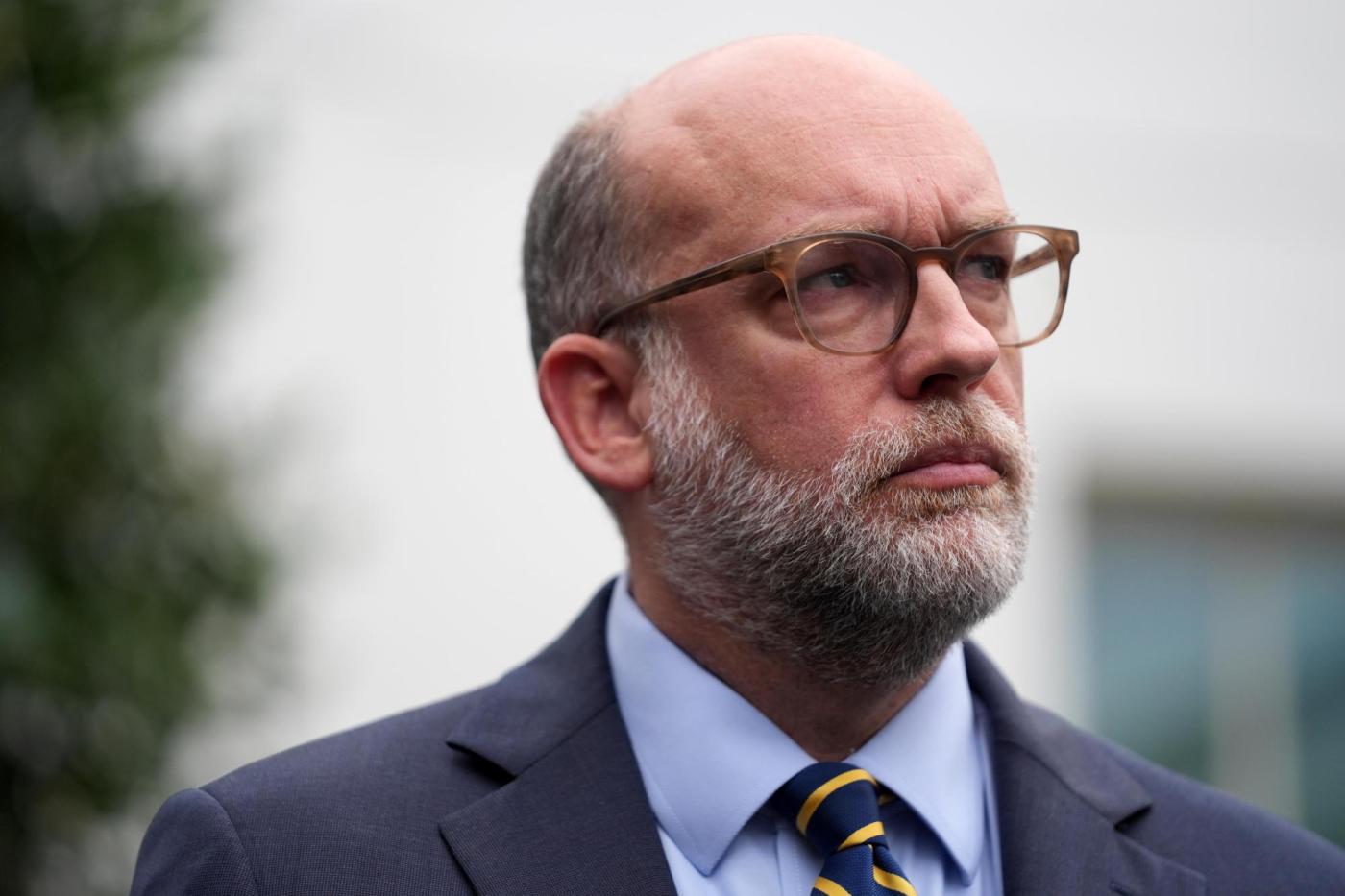

By KEN SWEET, AP Business Writer NEW YORK (AP) President Trump nominated Stuart Levenbach as the next director of the Consumer Financial Protection Bureau, using a legal maneuver to keep his budget director Russell Vought as acting director of the bureau while the Trump administration continues on its plan to shut down the consumer financial protection agency. Levenbach is currently an associate director inside the Office of Management and Budget, handling issues related to natural resources, energy, science and water issues. Levenbach’s resume shows significant experience dealing with science and natural resources issues, acting as chief of staff of the National Oceanic and Atmospheric Administration during Trump’s first term. Levenbach’s nomination is not meant to go through to confirmation, an administration official said, speaking on condition of anonymity to discuss personnel matters. Under the Vacancies Act, Vought can only act as acting director for 210 days, but now that Trump has nominated someone to the position, that clock has been suspended until the Senate approves or denies Levenbach’s confirmation as director. Vought is Levenbach’s boss. The CFPB has been nonfunctional much of the year. Many of its employees have been ordered not to work, and the only major work the bureau is doing is unwinding the regulations and rules it put into place during Trump’s first term and during the Biden administration. While in the acting director role, Vought has signaled that he wishes to dismantle, or vastly diminish, the bureau. The latest blow to the bureau came earlier this month, when the White House said it does not plan to withdraw any funds from the Federal Reserve, which is where the bureau gets its funding, to fund the bureau past Dec. 31. The White House and the Justice Department used a legal interpretation of the law that created the bureau, the Dodd-Frank Act, that the Fed must be profitable in order to fund the CFPB’s operations. Several judges have rejected this argument when it was brought up by companies, but it’s never been the position of the government until this year that the CFPB requires the Fed to be profitable to have operating funds. “Donald Trump’s sending the Senate a new nominee to lead the CFPB looks like nothing more than a front for Russ Vought to stay on as Acting Director indefinitely as he tries to illegally close down the agency,” said Sen. Elizabeth Warren, the top Democrat on the Senate Banking Committee, in a statement. The bureau was created after the 2008 financial crisis as part of the Dodd-Frank Act, a law passed to overhaul the financial system and require banks to hold more capital to avoid another financial crisis. The CFPB was created to be a independent advocate for consumers to help them avoid bad actors in the financial system.

https://www.pasadenastarnews.com/2025/11/19/trump-cfpb-nomination/

Trump nominates new CFPB director, but White House says agency is still closing

Be First to Comment